Apps & Software

Latest about Apps & Software

-

-

App-based AI is out

App-based AI is outQira is Motorola and Lenovo’s big swing at hands-free, always-on AI

By Jay Bonggolto Published

-

Coming soon

Coming soonGoogle is gearing up to revive Snapseed on Android, and I couldn't be more excited

By Brady Snyder Published

-

CES 2026

CES 2026Meta adds a teleprompter and EMG handwriting to Ray-Ban Display, but it's also delaying international availability to prioritize the US market. Here's what this tells us about how the smart display glasses are doing.

By Brady Snyder Published

-

AI everywhere

AI everywhereYouTube Music is testing AI-generated backgrounds for lyric cards

By Brady Snyder Published

-

Visual mess

Visual messA major Wear OS 6 bug is ruining custom watch faces on Pixel and Galaxy Watches

By Jay Bonggolto Published

-

Looking inwards

Looking inwardsHow I learned to manage my emotions with Google's Journal app

By Namerah Saud Fatmi Published

-

2026 AI preview

2026 AI previewWhat I want to see from AI in 2026, from Samsung glasses to OpenAI hardware

By Brady Snyder Published

-

Explore Apps & Software

AI

-

-

2026 AI preview

2026 AI previewWhat I want to see from AI in 2026, from Samsung glasses to OpenAI hardware

By Brady Snyder Published

-

Remix in Google Messages

Remix in Google MessagesGoogle says goodbye to the Remix banana emoji in latest Messages app beta

By Brady Snyder Published

-

Smarter studying

Smarter studyingNotebookLM is now powered by Gemini 3 for better reasoning and multimodal understanding

By Brady Snyder Published

-

Rolling out

Rolling outGoogle's Gemini for Home rollout expands to Canada, with another language on the way

By Brady Snyder Published

-

Report card

Report cardThe state of AI in 2025: How Google, Apple, OpenAI, and others fared

By Brady Snyder Published

-

Re-evaluating

Re-evaluatingThe Assistant lives: Google says it will 'adjust' its timeline for its Gemini transition

By Nickolas Diaz Published

-

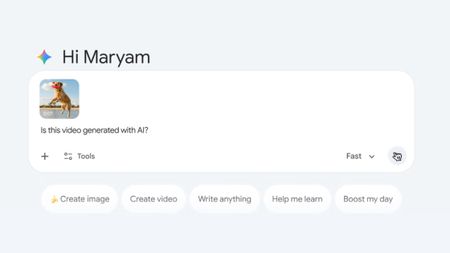

Deepfake detector

Deepfake detectorGemini can now tell you whether a video was generated with Google AI

By Brady Snyder Published

-

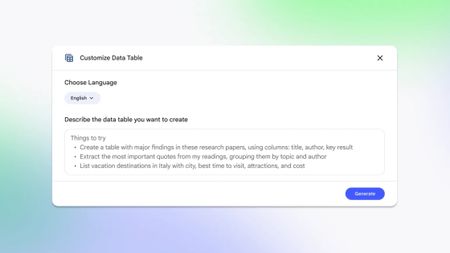

Easy exports

Easy exportsNotebookLM now turns your source material into tables ready for Google Sheets

By Brady Snyder Published

-

Extra context

Extra contextNotebookLM starts rolling out chat history on mobile and the web

By Brady Snyder Last updated

-

Android Auto

-

-

It might finally happen

It might finally happenAndroid Auto may finally let you cast media from your phone

By Sanuj Bhatia Published

-

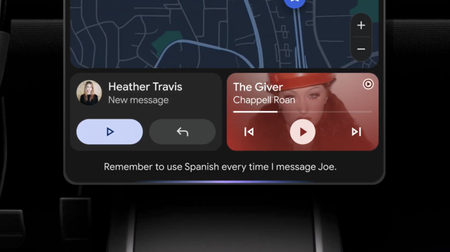

Gemini-fied

Gemini-fiedGemini transforms Android Auto with new AI features for a smarter drive

By Nandika Ravi Published

-

Bye, Assistant!

Bye, Assistant!Gemini for Android Auto is starting to replace Google Assistant

By Brady Snyder Published

-

Eyes on the Road

Eyes on the RoadGoogle starts quietly rolling out an essential button on Android Auto

By Nickolas Diaz Published

-

game over

game overGoogle may be pulling the plug on Android Auto’s in-car mini-games

By Jay Bonggolto Published

-

Alternative?

Alternative?Samsung's alleged 'Auto DeX' leak is an Android Auto variant you might see

By Nickolas Diaz Published

-

Share songs n ride

Share songs n rideAndroid users can now "Jam" together with this new Spotify feature

By Vishnu Sarangapurkar Published

-

Coming soon

Coming soonI tried Android Auto with Gemini at Google I/O, here's how it went

By Brady Snyder Last updated

-

It's getting hot

It's getting hotAndroid Auto's UI for climate control support might look like this

By Nickolas Diaz Published

-

Android OS

-

-

Apps stop crashing

Apps stop crashingGoogle starts rolling out Android 16 QPR3 Beta 1.1 is rolling out with an important fix

By Sanuj Bhatia Published

-

Be different

Be differentAndroid 2025 scorecard: Major changes and challenges leading to an exciting future for the OS

By Harish Jonnalagadda Published

-

Feel the Magic

Feel the MagicMore Android phones could feel the Magic Cue as this leak spots early signs

By Nickolas Diaz Published

-

It's here!

It's here!Android 16 QPR3 Beta 1 quietly upgrades Pixel phones where it counts

By Jay Bonggolto Published

-

Take back your homescreen

Take back your homescreenAndroid 16 Beta lets Pixel users finally ditch the 'At a Glance' widget from their home screen

By Jay Bonggolto Published

-

Look to the stars

Look to the starsLeak claims Google wants to make your Android satellite connections easy

By Nickolas Diaz Published

-

Motion Assist

Motion AssistHere's why you might have to wait for Android 17 to use Motion Cues

By Brady Snyder Published

-

Emergency SOS

Emergency SOSAndroid's Emergency Live Video shares crucial visual info with first responders

By Brady Snyder Published

-

Alternative

AlternativeNew details about Android's NameDrop alternative surface with bright animations

By Nickolas Diaz Published

-

Gmail

-

-

A long-awaited feature

A long-awaited featureGmail might finally let you switch to a new address without starting over

By Sanuj Bhatia Published

-

Get a preview

Get a previewGmail gives Android users a window into email attachments with this update

By Nickolas Diaz Published

-

Sleigh Bells ring...

Sleigh Bells ring...Google brings a unified 'Purchases' tab to Gmail ahead of the holiday rush

By Nickolas Diaz Published

-

new UX style

new UX styleGmail's new Material 3 Expressive design is secretly hitting some inboxes

By Jay Bonggolto Published

-

Quick reply

Quick replyGmail will now let you react to emails with emojis

By Brady Snyder Published

-

Mail upgrades

Mail upgradesGmail's new search results prioritize relevant emails over recent ones

By Brady Snyder Published

-

Gone phishing

Gone phishingGmail could start rejecting suspicious emails even before they reach your inbox

By Steven Shaw Published

-

How to recover lost Google contacts for Android

By Mick Symons Last updated

-

7 best Gmail for Android tips and tricks

By Harish Jonnalagadda Published

-

Google Assistant

-

-

Bye, Assistant

Bye, AssistantGoogle Assistant could shut down for Android Auto in March 2026

By Brady Snyder Published

-

New look!

New look!Google's song search evolves with a modern Gemini-inspired UI on Android

By Nandika Ravi Published

-

New look!

New look!Google's voice and song search gets a major overhaul on Android after years

By Nandika Ravi Published

-

Stay in the know

Stay in the knowGoogle introduces new tools to help users fight against evolving phishing scams effectively

By Nandika Ravi Published

-

Google Outage

Google OutageGoogle, Gmail, and Meet hit by widespread outage, causing login issues

By Nandika Ravi Published

-

New voices

New voicesGoogle is spicing up its voice list on Search, according to a new leak

By Nandika Ravi Published

-

New Google AI plans

New Google AI plansNew Google AI Pro and $249/month Ultra subscription announced at I/O

By Vishnu Sarangapurkar Published

-

Easy-peesy

Easy-peesyGoogle app on iOS gets a new feature that will 'Simplify' text online

By Nandika Ravi Published

-

Bye

ByeGoogle officially killed Driving Mode after stripping most of its features in 2024

By Brady Snyder Published

-

Google Maps

-

-

Better battery life

Better battery lifeHow to enable and use Google Maps power saving mode

By Brady Snyder Published

-

Let's go there

Let's go thereGoogle Maps gets a major upgrade with Gemini for smooth navigation on Android and iOS

By Nickolas Diaz Published

-

Let's go there

Let's go thereGoogle Maps gets a Gemini boost to help you navigate the roads like a pro

By Nickolas Diaz Published

-

Double Rainbow

Double RainbowHere's what the redesigned Google Photos and Maps icons look like

By Nickolas Diaz Published

-

Real-time lane intelligence

Real-time lane intelligenceGoogle Maps and Polestar fix the worst part of highway driving

By Jay Bonggolto Published

-

ETA at a glance

ETA at a glanceGoogle Maps is adding a nifty chip to show how long it'll take you to get home

By Sanuj Bhatia Published

-

Assistant is out

Assistant is outYour next Google Maps navigation could be planned by Gemini

By Jay Bonggolto Published

-

Smoother EV driving

Smoother EV drivingRivian partners with Google Maps for enhanced EV navigation experience

By Vishnu Sarangapurkar Published

-

Save from Screenshots

Save from ScreenshotsGoogle Maps for iOS simplifies saving locations from screenshots

By Vishnu Sarangapurkar Published

-

Google Pay

-

-

No more drain

No more drainAndroid’s next update is finally addressing your phone’s biggest battery hogs

By Jay Bonggolto Published

-

On Time

On TimeGoogle Wallet is helping Android users effortlessly catch their plane or train

By Nickolas Diaz Published

-

Quick Taps

Quick TapsGoogle Pay's fresh updates will unlock better shopping rewards for Chrome users

By Nickolas Diaz Published

-

Pay Your Way

Pay Your WayAndroid users get another option to pay later with Klarna on Google Pay

By Nickolas Diaz Published

-

Easier access

Easier accessGoogle Wallet brings digital ID support to UK, more US states

By Nandika Ravi Published

-

Now arriving at...

Now arriving at...Google Wallet brings real-time train status alerts to Android, and teases I/O 2025

By Nickolas Diaz Published

-

Next stop is...

Next stop is...Londoners can join the Google Pay 'Tube Challenge' for badges and city lore

By Nickolas Diaz Published

-

How to add vaccine cards and medical info to Google Wallet

By Michael L Hicks Published

-

How to send and request money using GPay

By Jerry Hildenbrand Published

-

Google Play Store

-

-

A downgrade to downgrading

A downgrade to downgradingGoogle just made uninstalling system app updates more complicated

By Sanuj Bhatia Published

-

Free cash

Free cashHere's when Google Play Store users will get an automatic cash settlement payout

By Brady Snyder Published

-

You win!

You win!Focus Friend and Pokémon TCG Pocket shine in Google Play's Best of 2025 awards

By Nickolas Diaz Published

-

Find it faster

Find it fasterGoogle Play enhances search with new 'Where to watch' streaming feature

By Sanuj Bhatia Published

-

No more sifting

No more siftingGoogle's upcoming review search feature might soon help you save time on the Play Store

By Jay Bonggolto Published

-

Gift cards go green

Gift cards go greenYou can now send Starbucks and Disney gift cards straight from Google Play

By Jay Bonggolto Published

-

Epic v. Google

Epic v. GoogleGoogle and Epic's settlement proposal could finally end the multi-year Play Store dispute

By Brady Snyder Published

-

Ditch the scroll

Ditch the scrollPlay Store’s new AI summaries could help you spot the best apps faster

By Jay Bonggolto Published

-

Age checks go live

Age checks go liveGoogle Play users must now verify their age to keep downloading certain apps

By Sanuj Bhatia Published

-

Meta

-

-

CES 2026

CES 2026Meta adds a teleprompter and EMG handwriting to Ray-Ban Display, but it's also delaying international availability to prioritize the US market. Here's what this tells us about how the smart display glasses are doing.

By Brady Snyder Published

-

Game-changer

Game-changerMeta's new smart glasses update enhances your holiday listening experience

By Nandika Ravi Published

-

Meta Neural Band

Meta Neural BandMeta Ray-Ban Display glasses will get virtual handwriting, IG Reels support in 2026

By Brady Snyder Published

-

It's yours

It's yoursInstagram hands you the keys to control 'Your Algorithm' in Reels, plans to expand

By Nickolas Diaz Published

-

Delayed

DelayedMeta reportedly pushes the release of new mixed-reality glasses to 2027

By Brady Snyder Published

-

Early deals

Early dealsMeta reveals its Black Friday offers early with Ray-Ban Meta and Meta Quest 3S deals

By Brady Snyder Published

-

Trade-in deals

Trade-in dealsMeta is piloting a trade-in program for Ray-Ban and Oakley smart glasses — here's how it works

By Brady Snyder Published

-

Shakeup

ShakeupMeta's chief AI scientist is leaving the company after 12 years to create a startup

By Brady Snyder Published

-

Ruled in favor

Ruled in favorMeta cleared of monopoly claims as judge highlights competition with TikTok

By Nickolas Diaz Published

-

Spotify

-

-

Preservation or piracy?

Preservation or piracy?The internet grabbed 300TB of Spotify songs and the implications are massive

By Brady Snyder Published

-

Down, down, down!

Down, down, down!Spotify's recent outage leaves users locked out — but now it's back up and running

By Nandika Ravi Published

-

You're the captain, now

You're the captain, nowSpotify’s ‘Prompted Playlists’ lets you take more control of its algorithm

By Nickolas Diaz Published

-

Wrap it up!

Wrap it up!Explore Spotify Wrapped 2025: A year in music, top albums, and your unique listening age

By Nandika Ravi Published

-

Pricey!

Pricey!Spotify might raise prices again for US users in early 2026

By Nandika Ravi Published

-

Easy switching

Easy switchingSpotify is making it easier to switch with in-app TuneMyMusic playlist transfers

By Brady Snyder Published

-

Pay up

Pay upSpotify lossless lands in India, and there's the inevitable price hike: it's 40% costlier than Apple Music, and I'm now paying 3x as much as my previous plan

By Harish Jonnalagadda Published

-

Spotify sharing

Spotify sharingAndroid users can now share their favorite Spotify songs through WhatsApp Status

By Brady Snyder Published

-

Put you on repeat...

Put you on repeat...Spotify can now tell which songs Android users are addicted to

By Nickolas Diaz Published

-

-

-

Where are you?

Where are you?X's new 'transparent' location labels for accounts have people questioning everything

By Nickolas Diaz Published

-

Partial outage

Partial outageFacing trouble logging into X? You're not alone — here’s the scoop!

By Nandika Ravi Published

-

Twitter is down

Twitter is downIt wasn't just you — X (Twitter) resolved a major outage today

By Brady Snyder Last updated

-

Whistleblower calls out Twitter for spambots and mishandling user data

By Derrek Lee Published

-

What is free speech?

By Jerry Hildenbrand Published

-

Twitter makes it easier to search for Communities on the web

By Derrek Lee Published

-

Massive Twitter outage ends after about 90 minutes

By Michael L Hicks Published

-

House committee summons Meta, Alphabet, Twitter and Reddit over Capitol riot

By Jay Bonggolto Published

-

Twitter wants to turn the Explore page into yet another TikTok clone

By Michael L Hicks Published

-

Wear OS

-

-

Visual mess

Visual messA major Wear OS 6 bug is ruining custom watch faces on Pixel and Galaxy Watches

By Jay Bonggolto Published

-

Wearables Weekly

Wearables WeeklyWhat I expect and want to see from Android smartwatches in 2026

By Michael L Hicks Published

-

Wearables Weekly

Wearables WeeklyWear OS in 2025: How Pixel, Galaxy, and OnePlus smartwatches fared against our expectations

By Michael L Hicks Published

-

You're green!

You're green!Androidify for Wear OS: turn yourself into an Android bot for your Pixel Watch

By Nickolas Diaz Published

-

Google Weather is down

Google Weather is downGoogle Weather is broken on older Wear OS watches, but a fix is coming

By Jay Bonggolto Published

-

Wear this

Wear thisBest Wear OS watch

By Michael L Hicks Last updated

-

AOD upgrades

AOD upgradesGoogle Pixel Watch update adds always-on display support for more Clock features

By Brady Snyder Published

-

UI boost!

UI boost!Galaxy Watch 5 and Pro users await One UI 8 Watch update after beta concludes

By Brady Snyder Published

-

Watch 5 + Watch 5 Pro

Watch 5 + Watch 5 ProOne UI 8 Watch update expected soon for Galaxy Watch 5 and 5 Pro users

By Brady Snyder Published

-

Youtube

-

-

AI everywhere

AI everywhereYouTube Music is testing AI-generated backgrounds for lyric cards

By Brady Snyder Published

-

Ending soon

Ending soonYouTube won't share streaming data with Billboard in 2026 — what it means for you

By Brady Snyder Published

-

Like it or not

Like it or notYouTube Shorts starts a 'dislike' test to help make sense of the confusing process

By Nickolas Diaz Published

-

Premium Holidays

Premium HolidaysYouTube Premium hands out huge discounts so you can get a Pixel 10

By Nickolas Diaz Published

-

The safety paradox

The safety paradoxYouTube cut off: Australian teens are losing logins under new age law

By Jay Bonggolto Published

-

AI everywhere

AI everywhereYouTube might soon let you tweak your suggested content with AI prompts

By Sanuj Bhatia Published

-

DM feature is back

DM feature is backYouTube revives in-app direct messaging in surprise test

By Jay Bonggolto Published

-

Targeted tracks

Targeted tracksYouTube Music might finally fix its biggest playlist headache for a long time

By Jay Bonggolto Published

-

Piling on

Piling onWhy YouTube is not working for users of Opera GX with Ad blockers

By Nickolas Diaz Published

-

More about Apps & Software

-

-

2026 AI preview

2026 AI previewWhat I want to see from AI in 2026, from Samsung glasses to OpenAI hardware

By Brady Snyder Published

-

Photos hit the big screen

Photos hit the big screenGoogle Photos is coming to Samsung TVs, but not in the way you'd think

By Sanuj Bhatia Published

-

Best of 2025

Best of 2025Android Central's Best of 2025: Apps and Services

By Shruti Shekar Published

-