Apps & Software

Latest about Apps & Software

-

-

A Rework

A ReworkGoogle Photos' fresh look is here, but may not be for your Android

By Nickolas Diaz Published

-

Safari Reigns Supreme

Safari Reigns SupremeChrome on Android needs to copy this one iOS 26 and iPadOS 26 feature

By Nirave Gondhia Published

-

DMs on Threads

DMs on ThreadsThreads ups its game with DMs, distancing itself from Instagram's shadow

By Nandika Ravi Published

-

No more sneaky stingrays

No more sneaky stingraysAndroid 16 can tip you off if someone is snooping on you using 'stingray' devices

By Jay Bonggolto Published

-

Ask Jerry: Who are the 3 billion Android users?

By Jerry Hildenbrand Published

-

Study Guides & More

Study Guides & MoreGemini empowers Google Classroom educators with new AI tools

By Nickolas Diaz Published

-

One UI 8 beta

One UI 8 betaOne UI 8 Beta rolls into the Galaxy S25 series and Galaxy Watches

By Vishnu Sarangapurkar Published

-

Explore Apps & Software

AI

-

-

Study Guides & More

Study Guides & MoreGemini empowers Google Classroom educators with new AI tools

By Nickolas Diaz Published

-

AI Byte

AI ByteThe NotebookLM app for Android keeps making me want to go back to the website

By Brady Snyder Published

-

A Change

A ChangeGemini blazes past the old Assistant with this useful setting change

By Nickolas Diaz Published

-

Gemini for the win

Gemini for the winGoogle Workspace gets a much needed boost with Gemini's new smarts

By Nandika Ravi Published

-

Quicker, Convenient

Quicker, ConvenientAI Mode in Chrome could gain a neat shortcut for quicker interactions like Gemini

By Nickolas Diaz Published

-

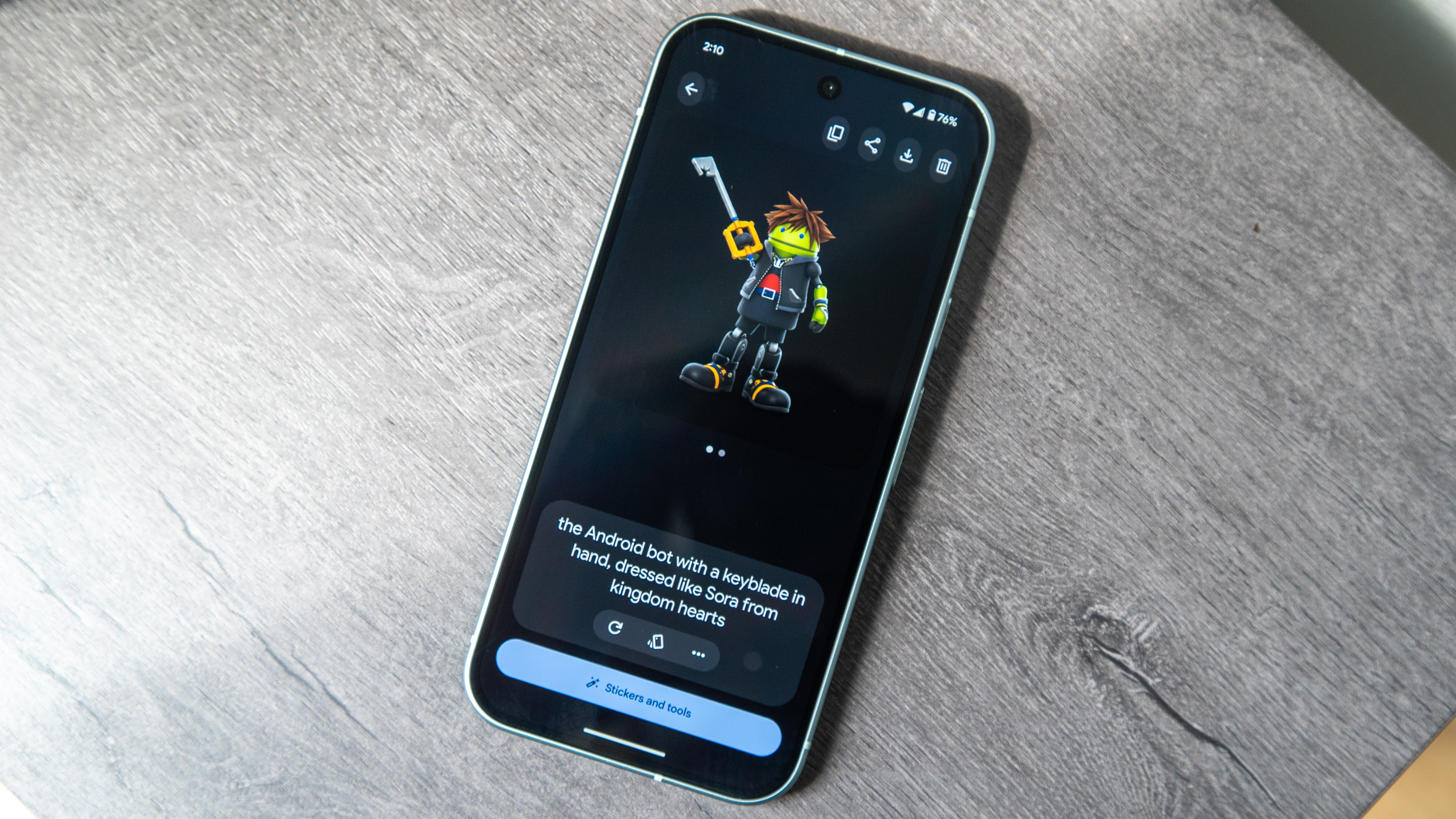

AI creations

AI creationsHow to create custom AI stickers on a Google Pixel phone

By Brady Snyder Published

-

Gemini CLI

Gemini CLIGemini is heading to your command line as an open-source AI agent

By Brady Snyder Published

-

Generate with Veo 3

Generate with Veo 3Google’s new Veo 3 could land on YouTube Shorts this summer

By Nickolas Diaz Published

-

New AI models

New AI modelsGemini 2.5 Pro and Flash are stable and hitting the Gemini app for Android now

By Brady Snyder Published

-

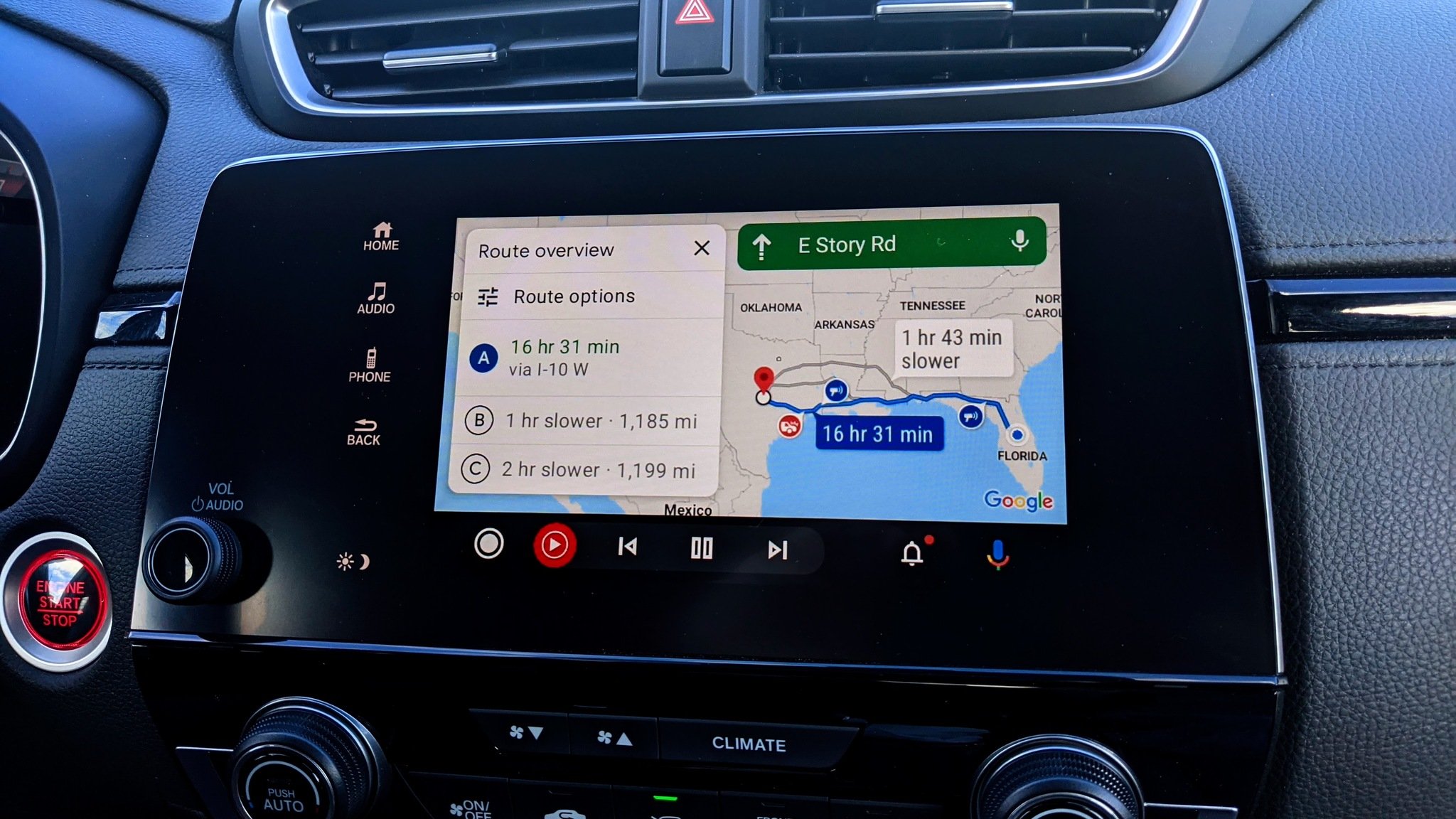

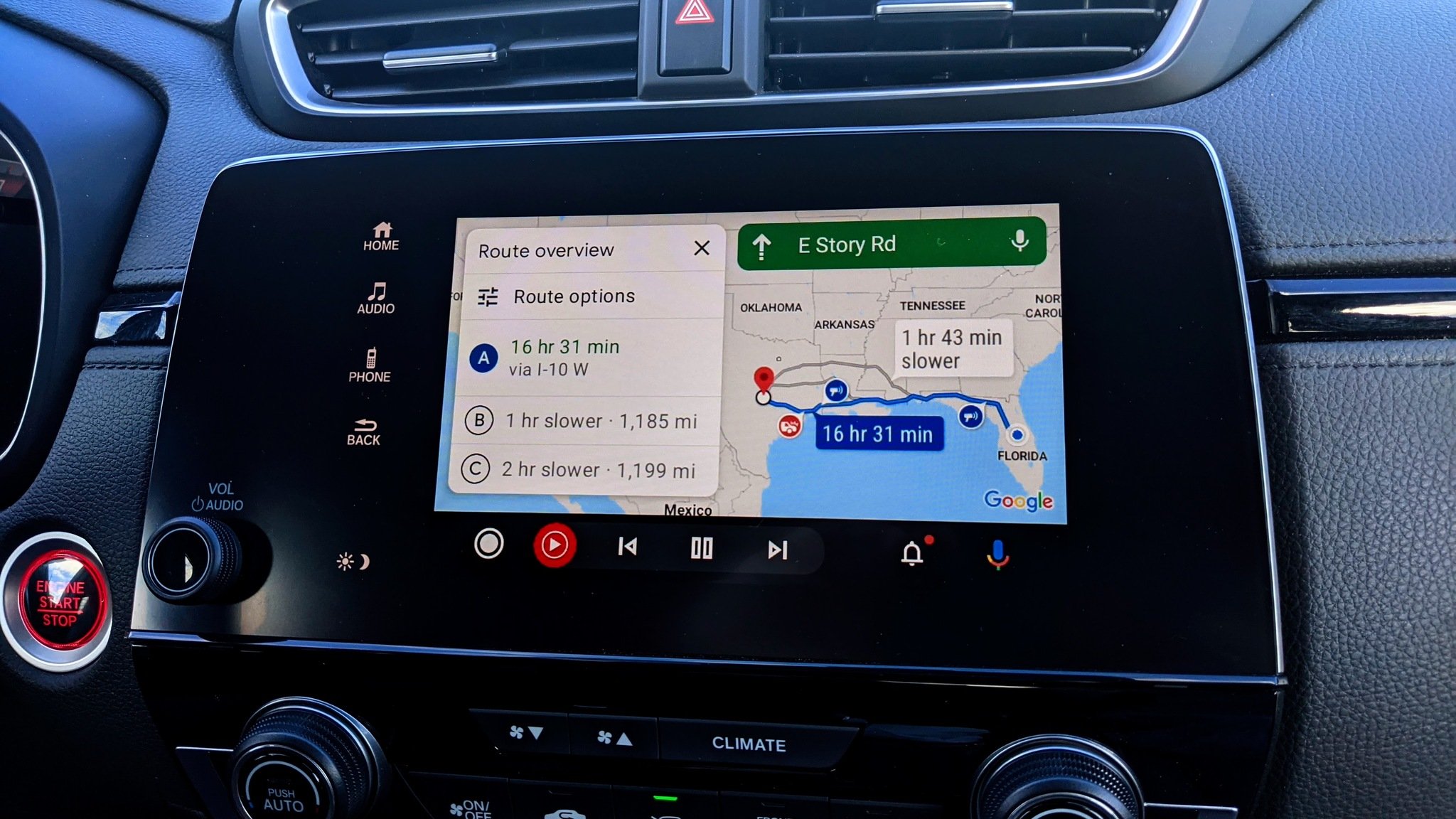

Android Auto

-

-

Coming soon

Coming soonI tried Android Auto with Gemini at Google I/O, here's how it went

By Brady Snyder Last updated

-

It's getting hot

It's getting hotAndroid Auto's UI for climate control support might look like this

By Nickolas Diaz Published

-

Might not happen

Might not happenLatest Android Auto v14.2 seemingly dashes hopes of smart glasses navigation

By Nickolas Diaz Published

-

Truly Sci-fi

Truly Sci-fiAndroid Auto might let you navigate the road with smart glasses

By Nickolas Diaz Published

-

Gettin' Chilly

Gettin' ChillyAndroid Auto's next update could bring controls for a more comfortable car ride

By Nickolas Diaz Published

-

Rough around the Edges

Rough around the EdgesThis could be how Gemini works with Android Auto, but it needs more time

By Nickolas Diaz Published

-

Finding the best route...

Finding the best route...Android Auto users report issues with TomTom GO, but devs say a fix is coming

By Nickolas Diaz Published

-

Can I get a ride?

Can I get a ride?Gemini is hitching a ride on Android Auto to your car

By Nickolas Diaz Published

-

drive safely

drive safelyThis Android Auto update cuts down on distractions when you're driving

By Jay Bonggolto Published

-

Android OS

-

-

No more sneaky stingrays

No more sneaky stingraysAndroid 16 can tip you off if someone is snooping on you using 'stingray' devices

By Jay Bonggolto Published

-

Ask Jerry: Who are the 3 billion Android users?

By Jerry Hildenbrand Published

-

One UI 8 beta

One UI 8 betaOne UI 8 Beta rolls into the Galaxy S25 series and Galaxy Watches

By Vishnu Sarangapurkar Published

-

Another Beta patch

Another Beta patchAndroid 16 QPR1 Beta 2.1 starts rolling out to Pixels with some bug fixes

By Nandika Ravi Published

-

Lossless finally!

Lossless finally!Spotify may finally launch lossless audio after years of delays

By Vishnu Sarangapurkar Published

-

New features

New featuresThree-year-old Nothing Phone 1 gets new features with the latest June security patch

By Vishnu Sarangapurkar Published

-

Bug fixes

Bug fixesSamsung rolls out June security update for Galaxy S25 and more

By Vishnu Sarangapurkar Published

-

Video Analysis

Video AnalysisGoogle app could level up with this powerful AI feature for Android users

By Vishnu Sarangapurkar Published

-

Early access

Early accessHow to install the One UI 8 beta

By Brady Snyder Published

-

Gmail

-

-

new UX style

new UX styleGmail's new Material 3 Expressive design is secretly hitting some inboxes

By Jay Bonggolto Published

-

Quick reply

Quick replyGmail will now let you react to emails with emojis

By Brady Snyder Published

-

Mail upgrades

Mail upgradesGmail's new search results prioritize relevant emails over recent ones

By Brady Snyder Published

-

Gone phishing

Gone phishingGmail could start rejecting suspicious emails even before they reach your inbox

By Steven Shaw Published

-

How to recover lost Google contacts for Android

By Mick Symons Last updated

-

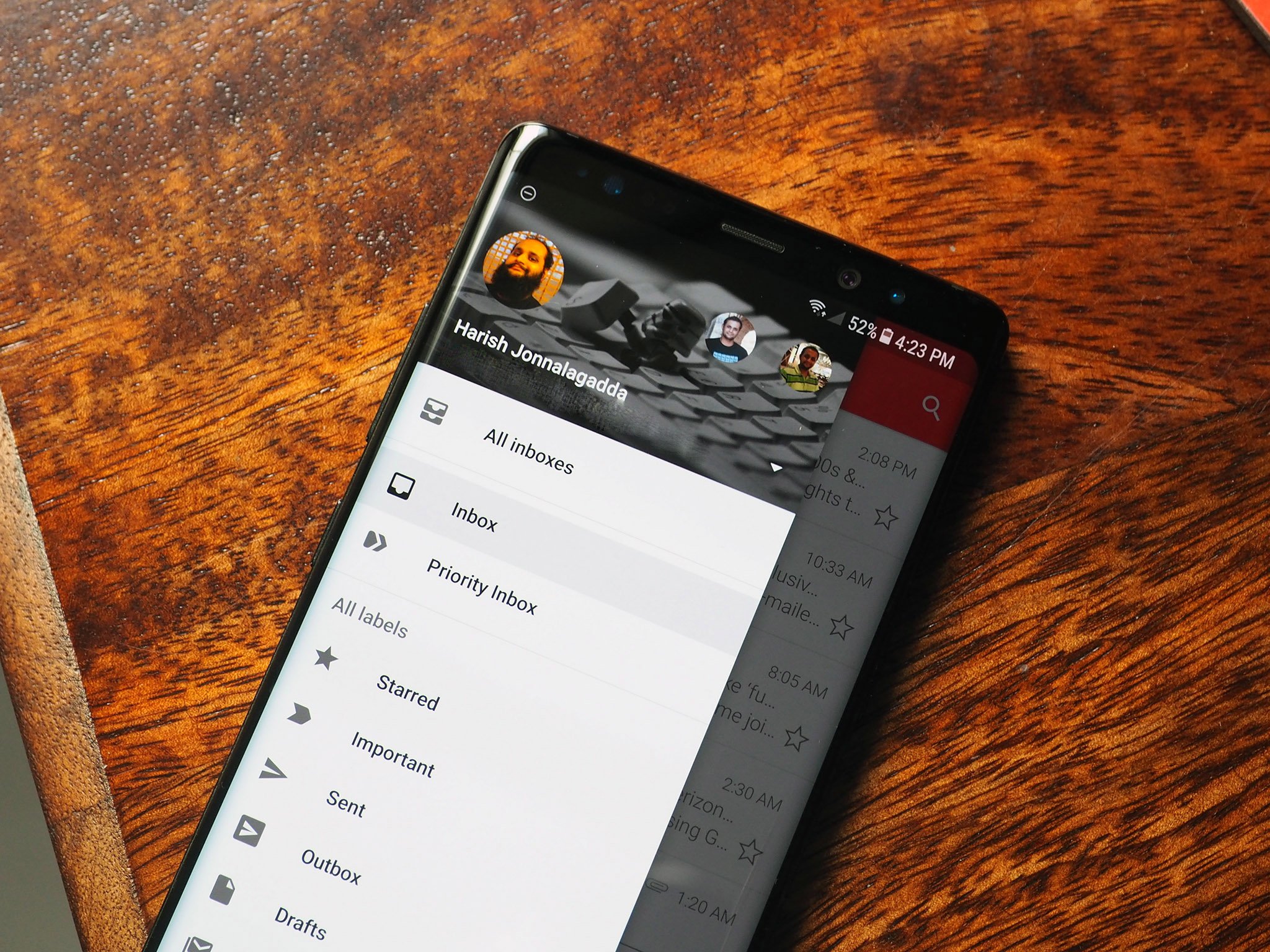

7 best Gmail for Android tips and tricks

By Harish Jonnalagadda Published

-

How to set up out of office replies in Gmail

By Jeramy Johnson Published

-

How to download all of your Gmail attachments at once

By Namerah Saud Fatmi Published

-

Google is restoring one of Gmail's useful features on the web

By Jay Bonggolto Published

-

Google Assistant

-

-

New voices

New voicesGoogle is spicing up its voice list on Search, according to a new leak

By Nandika Ravi Published

-

New Google AI plans

New Google AI plansNew Google AI Pro and $249/month Ultra subscription announced at I/O

By Vishnu Sarangapurkar Published

-

Easy-peesy

Easy-peesyGoogle app on iOS gets a new feature that will 'Simplify' text online

By Nandika Ravi Published

-

Bye

ByeGoogle officially killed Driving Mode after stripping most of its features in 2024

By Brady Snyder Published

-

Google Vs DOJ

Google Vs DOJGoogle disagrees with US judge's ruling, says it could impact users at large

By Nandika Ravi Published

-

AI Mode gets Gemini-ed

AI Mode gets Gemini-edGoogle's AI Mode gets Gemini's multimodal powers making it a visual search expert

By Nandika Ravi Published

-

Gotta catch 'em all!

Gotta catch 'em all!Google just turned your Search into a Pokédex for Easter

By Nandika Ravi Published

-

Spring cleaning

Spring cleaningGoogle is dialing back more Assistant features on Android and Nest devices

By Jay Bonggolto Published

-

Google Assistant

Google AssistantGoogle Assistant explained: Tricks, devices, and latest updates

By Michael L Hicks Last updated

-

Google Maps

-

-

Save from Screenshots

Save from ScreenshotsGoogle Maps for iOS simplifies saving locations from screenshots

By Vishnu Sarangapurkar Published

-

Fake reviews

Fake reviewsGoogle Maps doubles down on preventing fake reviews

By Nandika Ravi Published

-

now looking sharp

now looking sharpGoogle Maps is giving your ETA screen a glow-up on Android

By Jay Bonggolto Published

-

Too soon?

Too soon?Google Maps taps Gemini for an 'Ask about place' chip with directions and more

By Nickolas Diaz Published

-

More deets

More deetsGoogle Maps might predict more than just the traffic for you soon

By Nandika Ravi Published

-

Executive order

Executive orderGoogle Maps to rename 'Gulf of Mexico' to 'Gulf of America' following Trump executive order

By Nandika Ravi Published

-

Enhanced navigation

Enhanced navigationAbsolutely game-changing Google Maps update will cut down on wrong turns

By Michael L Hicks Published

-

Faster route my a**

Faster route my a**Is anyone else sick of this unreliable Google Maps tool?

By Michael L Hicks Published

-

Earth Day

Earth DayHow to find eco-friendly routes and EV charging stops in Google Maps

By Michael L Hicks Last updated

-

Google Pay

-

-

Pay Your Way

Pay Your WayAndroid users get another option to pay later with Klarna on Google Pay

By Nickolas Diaz Published

-

Easier access

Easier accessGoogle Wallet brings digital ID support to UK, more US states

By Nandika Ravi Published

-

Now arriving at...

Now arriving at...Google Wallet brings real-time train status alerts to Android, and teases I/O 2025

By Nickolas Diaz Published

-

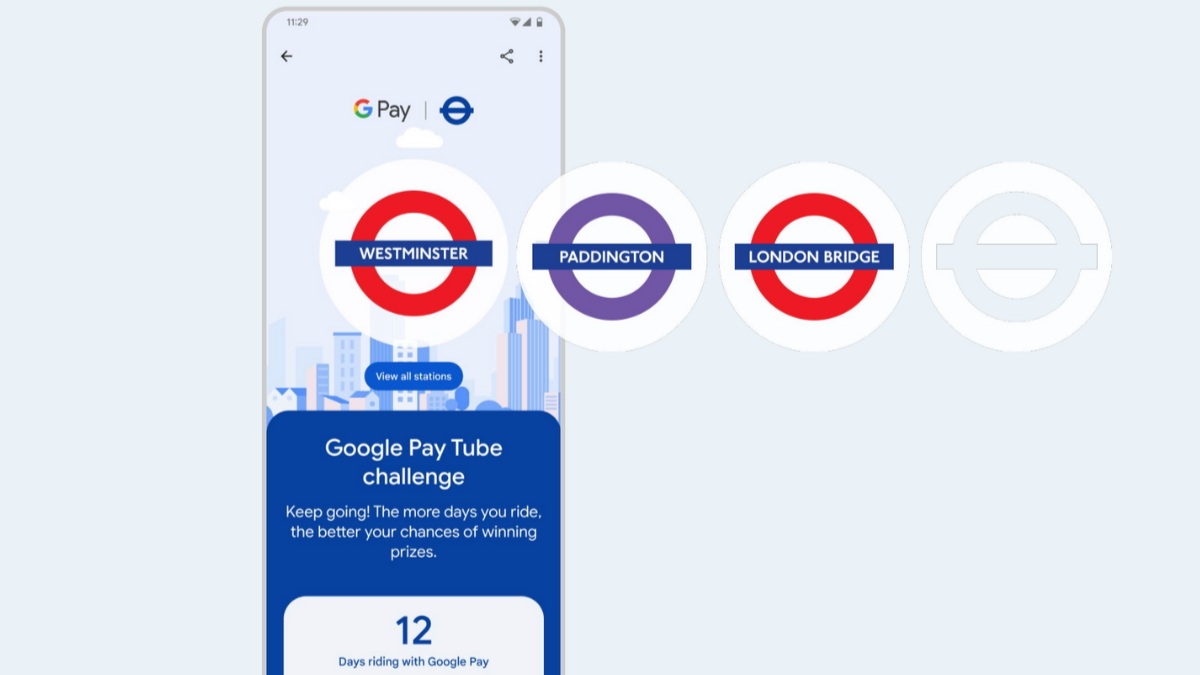

Next stop is...

Next stop is...Londoners can join the Google Pay 'Tube Challenge' for badges and city lore

By Nickolas Diaz Published

-

How to add vaccine cards and medical info to Google Wallet

By Michael L Hicks Published

-

How to send and request money using GPay

By Jerry Hildenbrand Published

-

Google Pay: How it works, where it's available, and how it compares to Wallet

By Mark Knapp Published

-

Google Pay may add crypto cards to attract its 'Next Billion Users'

By Michael L Hicks Published

-

Google Pay shouldn't be so terrible in 2022

By Joe Maring Published

-

Google Play Store

-

-

no more oops moments

no more oops momentsGoogle Play Store’s new swipe gesture is here to save you from accidental buys

By Jay Bonggolto Published

-

Apps A Plenty

Apps A PlentyMajor Google Play Store update grabs your attention with 'browse pages' and more

By Nickolas Diaz Published

-

Gone for good!

Gone for good!Google Play Store just lost a ton of apps, but this is actually a good thing

By Nandika Ravi Published

-

Safe space

Safe spaceGoogle Play Store will get more tools to protect users from scammy apps

By Nandika Ravi Published

-

Another bug?

Another bug?Play Store update 'bugs' several Android users with recurring notifications

By Nandika Ravi Published

-

Keep up

Keep upHow to update Android apps on your phone

By Christine Persaud Published

-

The more you know

The more you knowGoogle Play Services: What is it, and how does it keep your Android phone safe?

By Namerah Saud Fatmi Last updated

-

App management

App managementUninstalling Android apps on other devices is about to become a lot easier

By Michael L Hicks Published

-

Google Play: Everything you need to know

By Michael L Hicks Published

-

Meta

-

-

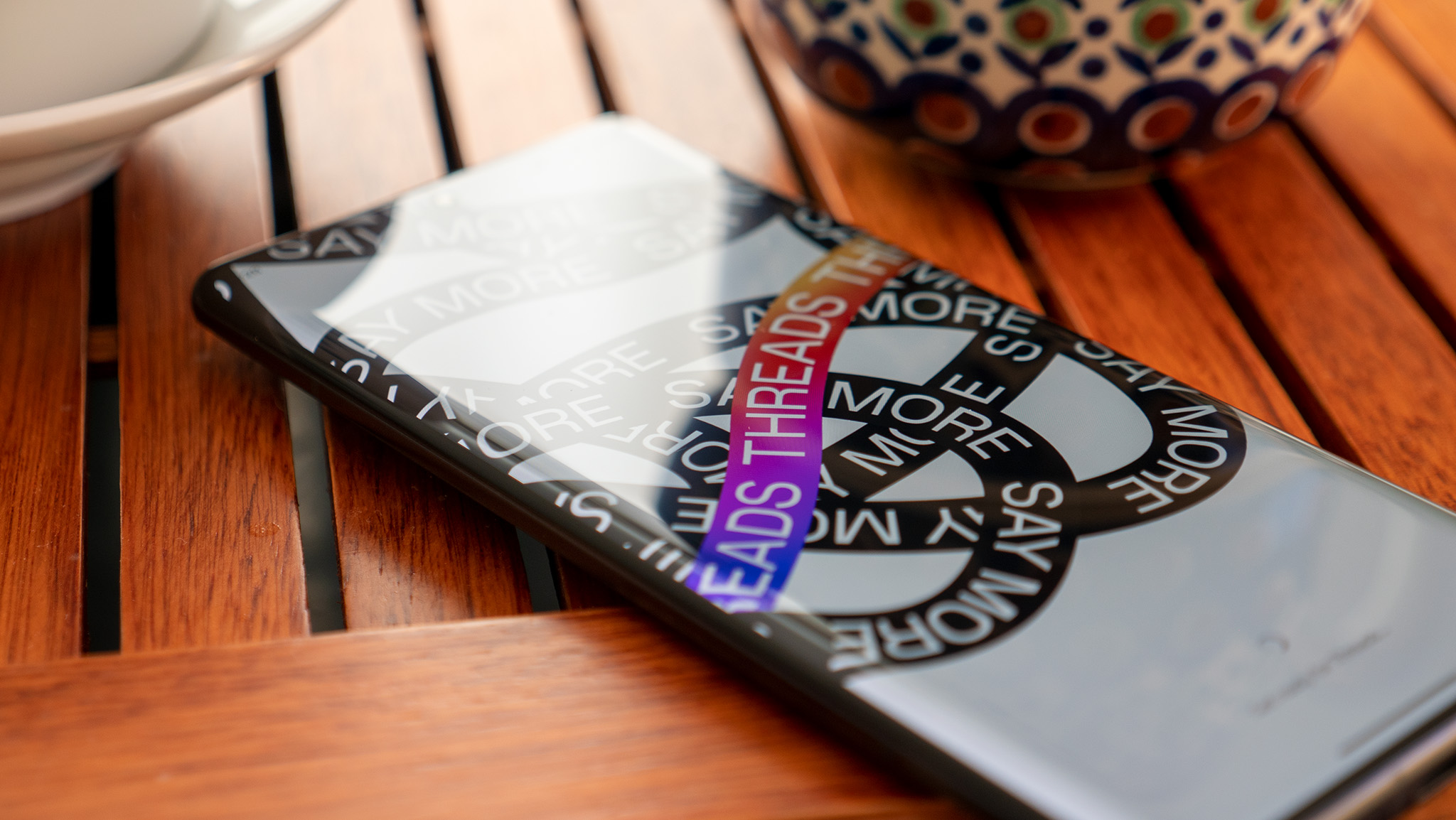

DMs on Threads

DMs on ThreadsThreads ups its game with DMs, distancing itself from Instagram's shadow

By Nandika Ravi Published

-

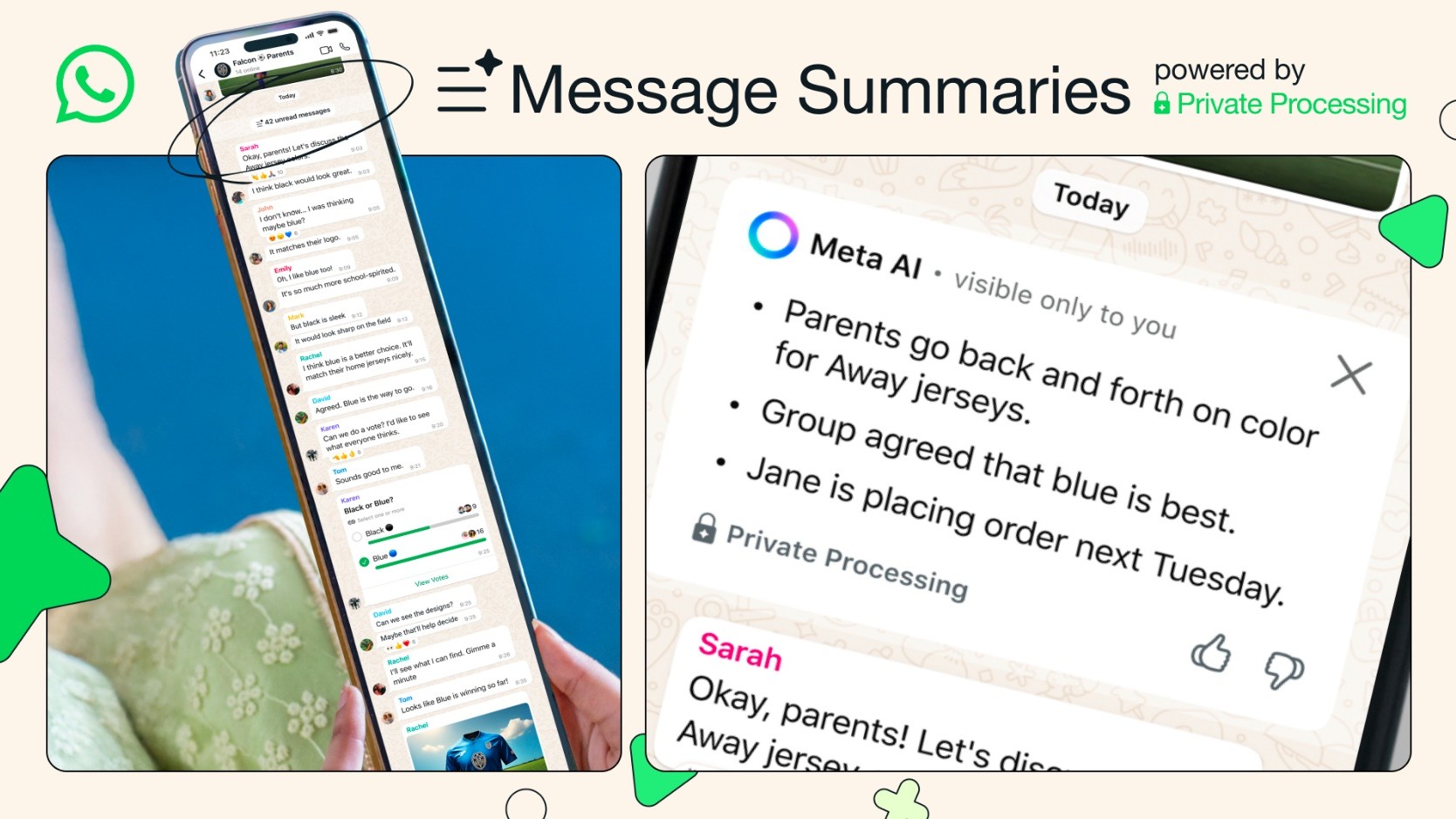

35 Unread Messages

35 Unread MessagesWhatsApp gives users 'Message Summaries' for when those texts pile up

By Nickolas Diaz Published

-

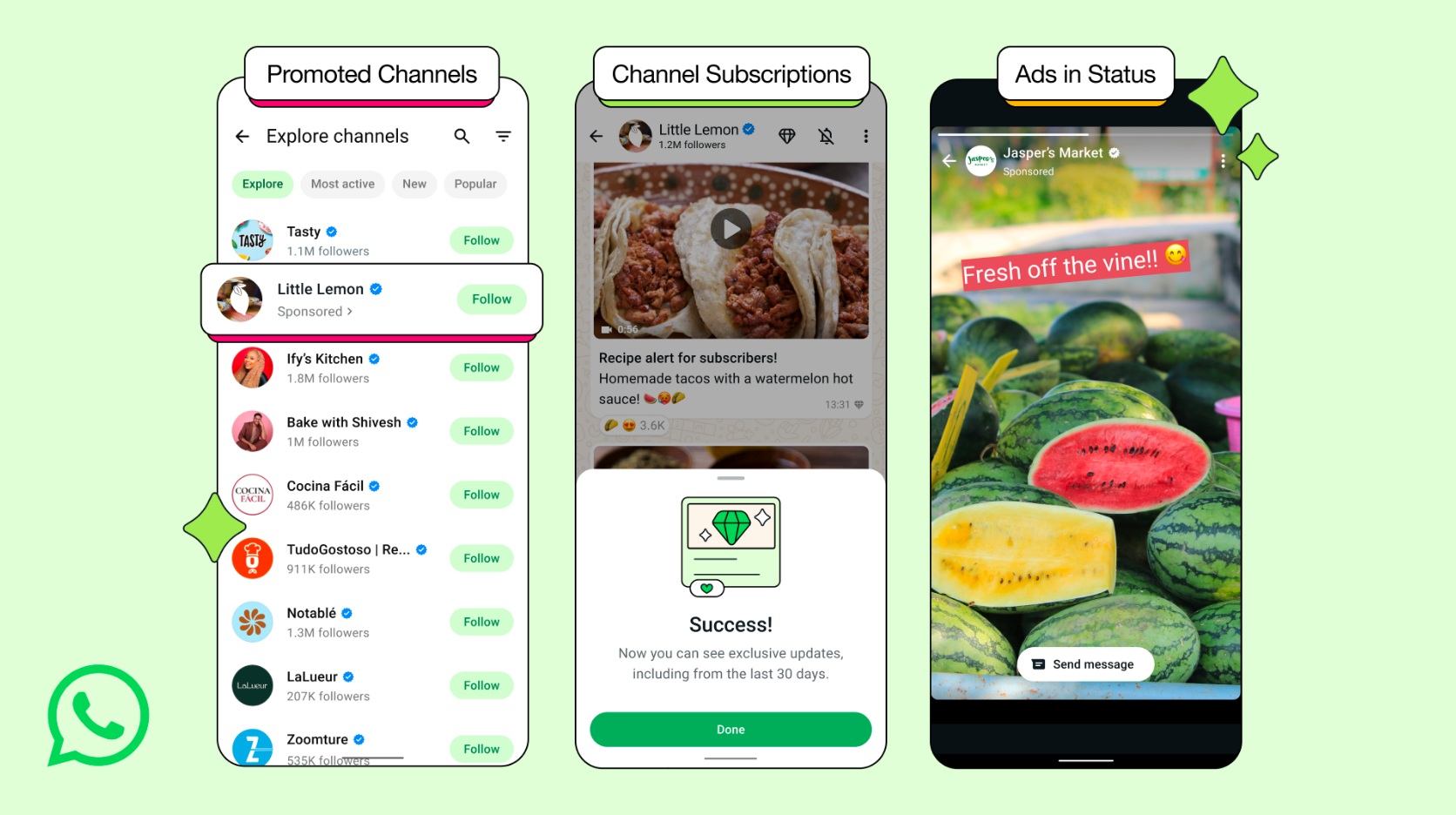

Making Moves

Making MovesWhatsApp unlocks new revenue streams, rolls out paid subscriptions, and more

By Nickolas Diaz Published

-

No more app switching as Threads begins testing DMs in some regions

By Vishnu Sarangapurkar Published

-

Sigh, finally!

Sigh, finally!Better late than never? WhatsApp finally arrives on iPad for more seamless messaging

By Vishnu Sarangapurkar Published

-

Insta-3D

Insta-3DMeta beats Android XR to the punch by making Instagram scrolling spatial

By Nickolas Diaz Published

-

Secret Reels club

Secret Reels clubInstagram is trying out password-locked Reels, and The Weeknd is first to test it

By Jay Bonggolto Published

-

Blend goes wider

Blend goes widerInstagram's latest Blend Direct Messages feature is seeing a wider rollout

By Vishnu Sarangapurkar Published

-

Earnings

EarningsMeta's Q1 2025 earnings show major AI priority shift, Ray-Ban success

By Michael L Hicks Published

-

Spotify

-

-

Skip the sync struggle

Skip the sync struggleSpotify just made it super easy to grab your favorite tracks on Wear OS

By Jay Bonggolto Published

-

Spotlight on Canada

Spotlight on CanadaCanadian artists thrive as Spotify hits record $10 Billion payout to music industry

By Nandika Ravi Published

-

DJ, play...

DJ, play...Spotify's DJ takes song requests for music that fits what you want

By Nickolas Diaz Published

-

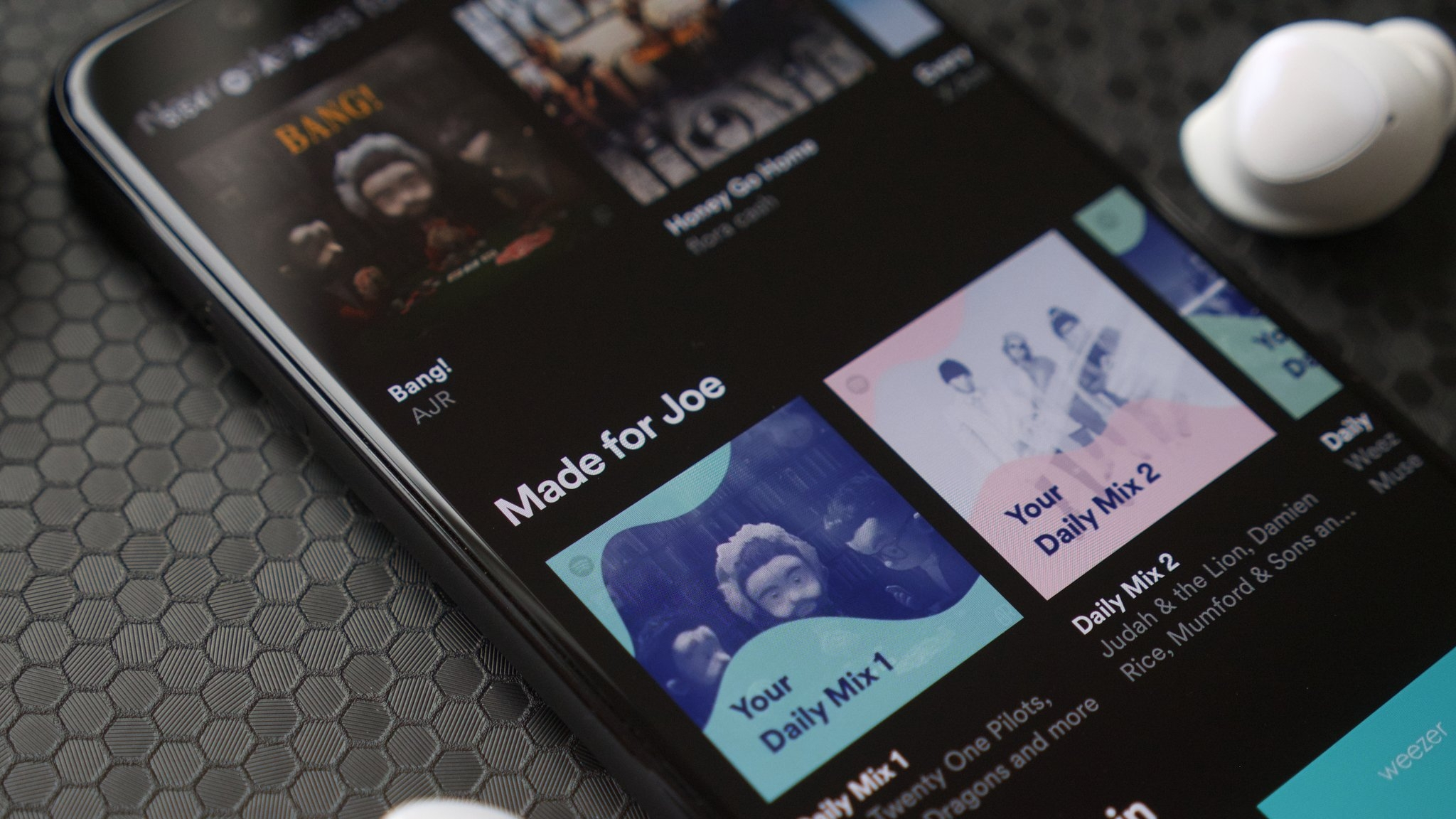

Up next...

Up next...Spotify users get more control over their music with 'Queue' updates and more

By Nickolas Diaz Published

-

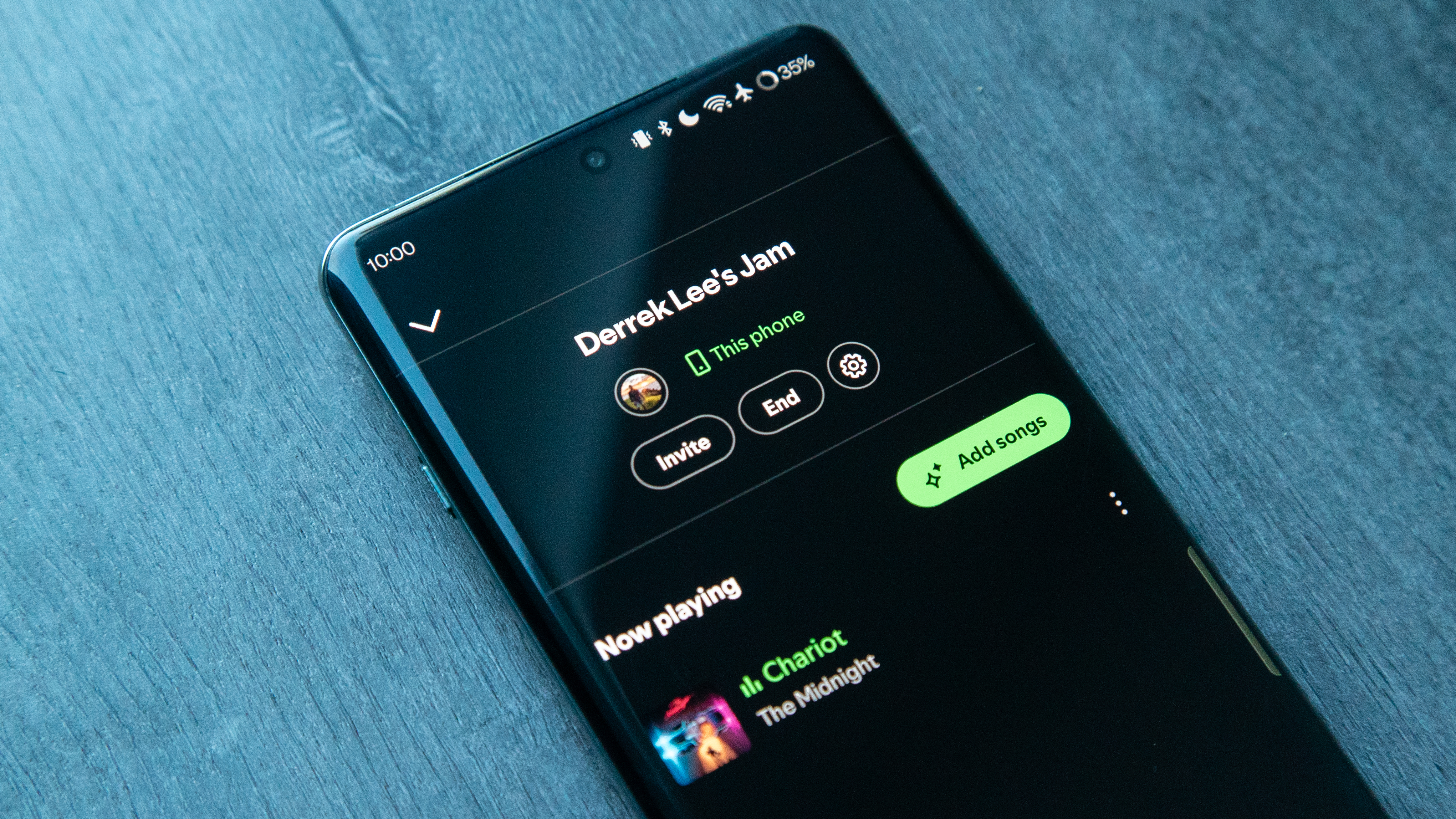

Gadget Weekly

Gadget WeeklyI wish Spotify would augment Jam sessions with features like comments and reactions

By Namerah Saud Fatmi Published

-

Free until it isn't

Free until it isn'tSpotify takes the fight to Audible with 200,000 'free' audiobooks, but there's a catch

By Michael L Hicks Published

-

Spotify announces employee layoffs amid organizational restructuring

By Derrek Lee Published

-

Spotify update brings support for the Android 13 media player

By Vishnu Sarangapurkar Published

-

Spotify Wrapped 2022 gets unwrapped with new 'Listening Personality' types

By Derrek Lee Published

-

-

-

Twitter is down

Twitter is downIt wasn't just you — X (Twitter) resolved a major outage today

By Brady Snyder Last updated

-

Whistleblower calls out Twitter for spambots and mishandling user data

By Derrek Lee Published

-

What is free speech?

By Jerry Hildenbrand Published

-

Twitter makes it easier to search for Communities on the web

By Derrek Lee Published

-

Massive Twitter outage ends after about 90 minutes

By Michael L Hicks Published

-

House committee summons Meta, Alphabet, Twitter and Reddit over Capitol riot

By Jay Bonggolto Published

-

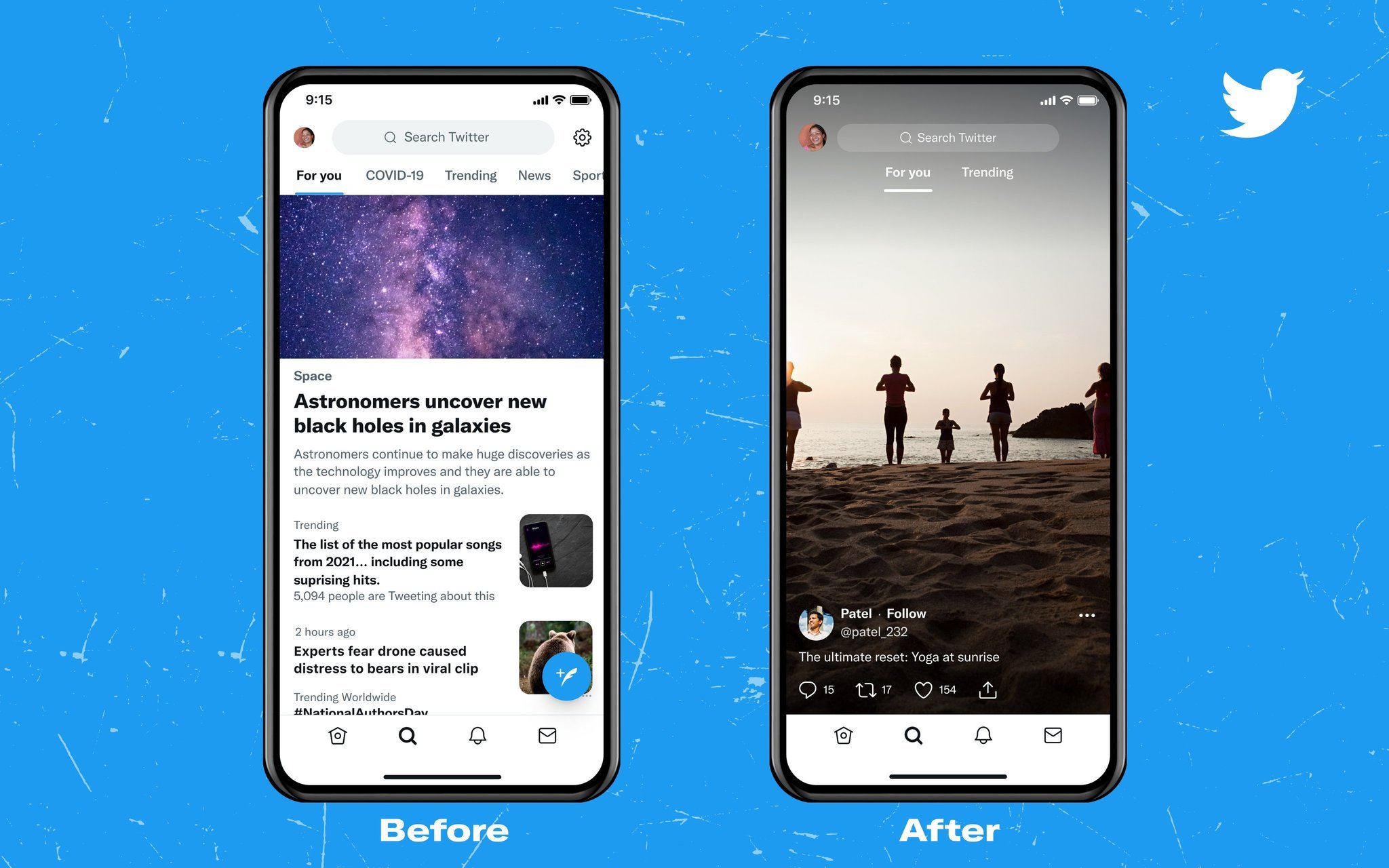

Twitter wants to turn the Explore page into yet another TikTok clone

By Michael L Hicks Published

-

How to remove a follower on Twitter without blocking them

By Keegan Prosser Published

-

Twitter had the best reaction to Fleets still being up on shutdown day

By Derrek Lee Last updated

-

Wear OS

-

-

Wear OS Weekly

Wear OS WeeklyWill last-gen Galaxy and Pixel Watches die this year...and should they?

By Michael L Hicks Published

-

Early warning

Early warningThis new Android feature brings earthquake alerts right to your wrist

By Nickolas Diaz Last updated

-

Healthier habits

Healthier habitsAndroid users can now make healthier decisions as One UI 8 beta lands on Galaxy watches

By Vishnu Sarangapurkar Published

-

Wear OS Weekly

Wear OS WeeklyWatchOS 26 and Wear OS 6 take different approaches to the same problems

By Michael L Hicks Published

-

Hidden depths

Hidden depthsCool Pixel Watch features keep trickling in from the Wear OS 6 dev code

By Michael L Hicks Published

-

Wear this

Wear thisBest Wear OS watch 2025

By Michael L Hicks Last updated

-

Android vet, watch newbie

Android vet, watch newbieHMD Global is reportedly making a Wear OS watch with a camera

By Michael L Hicks Published

-

Finally

FinallyGoogle patches an annoying Wear OS authentication bug affecting Wallet

By Brady Snyder Published

-

Future of Wear OS

Future of Wear OSWear OS 6: Material 3 Expressive, One UI 8 Watch, Gemini, & more

By Michael L Hicks Last updated

-

Youtube

-

-

Online Safety

Online SafetyYouTube ups minimum age for live streaming to boost child safety

By Nickolas Diaz Published

-

AI Highlights

AI HighlightsYouTube tests its own take on AI Overviews with Premium users in search

By Nickolas Diaz Published

-

Sending songs

Sending songsYouTube Music is borrowing this handy feature from Spotify and Apple Music

By Brady Snyder Published

-

Slowdown

SlowdownYouTube allegedly slowing down videos to get you to ditch that ad blocker

By Nickolas Diaz Published

-

YouTube down

YouTube downYouTube seems to be experiencing a widespread outage

By Nandika Ravi Published

-

superfan leaderboard

superfan leaderboardYouTube is testing a leaderboard to show off top live stream fans

By Jay Bonggolto Published

-

Become your own DJ

Become your own DJYouTube Music

By Christine Persaud Published

-

'love it' button

'love it' buttonYouTube is making playlist listening a bit more democratic

By Jay Bonggolto Published

-

Thumbs down

Thumbs downYouTube is putting Shorts front and center on TVs, and users aren't happy

By Brady Snyder Published

-

More about Apps & Software

-

-

One UI 8 beta

One UI 8 betaOne UI 8 Beta rolls into the Galaxy S25 series and Galaxy Watches

By Vishnu Sarangapurkar Published

-

AI Byte

AI ByteThe NotebookLM app for Android keeps making me want to go back to the website

By Brady Snyder Published

-

Android & Chill

Android & ChillMillions will be scammed on Prime Day. Don't be one of them

By Jerry Hildenbrand Published

-