Apps & Software

Latest about Apps & Software

-

-

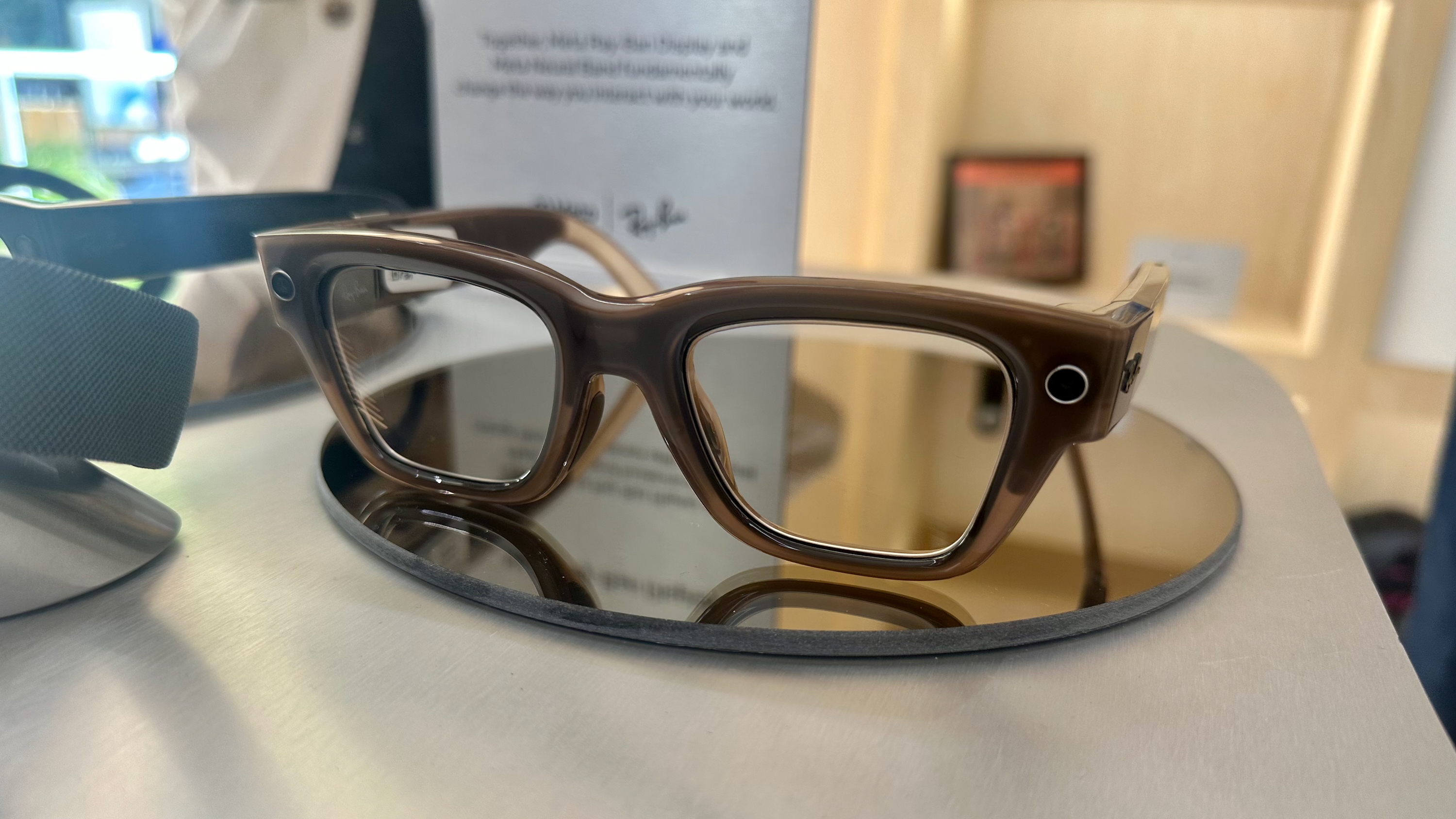

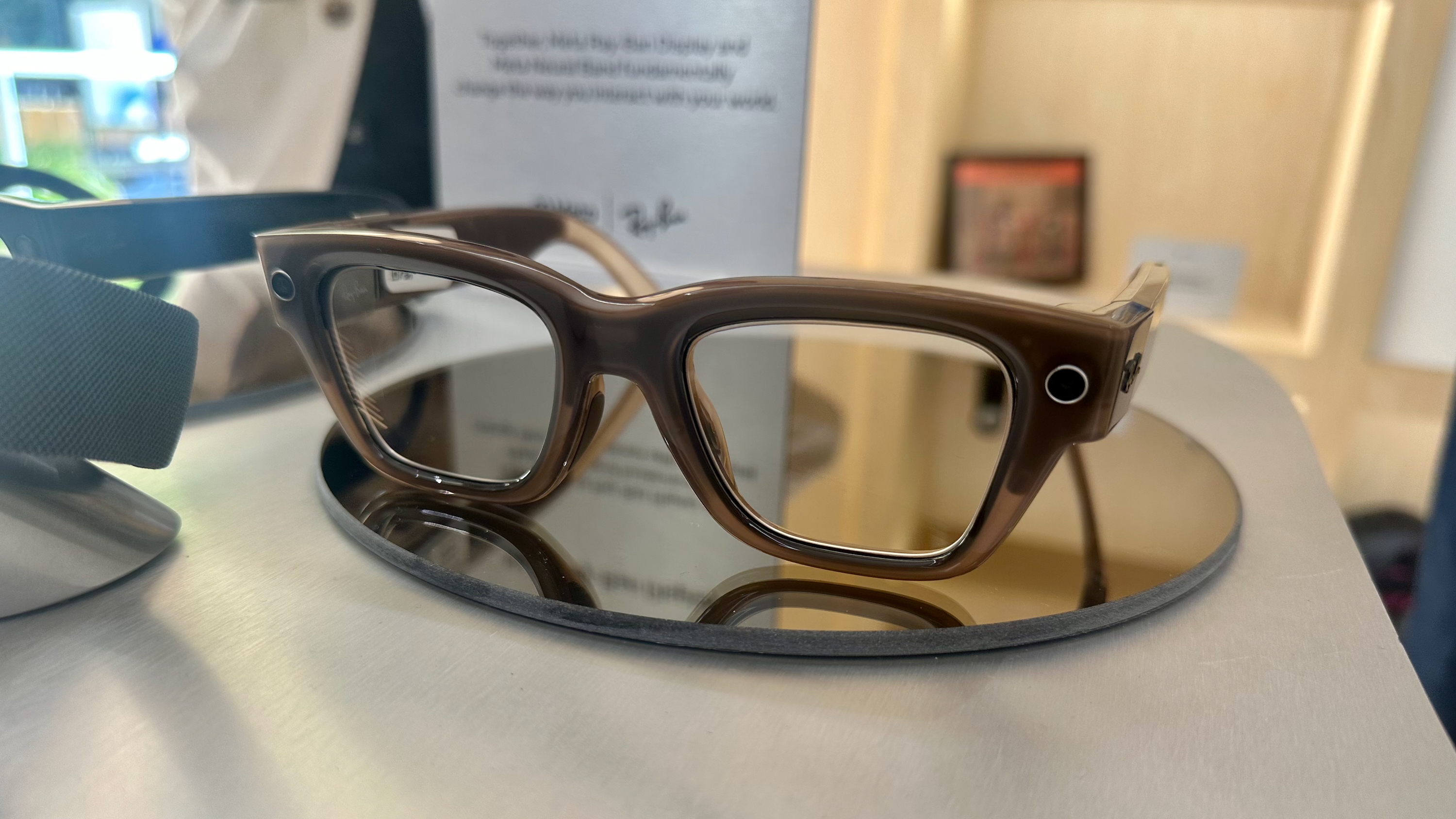

Ray-Ban or Oakley?

Ray-Ban or Oakley?Ray-Ban Meta (Gen 2) vs. Oakley Meta Vanguard: Chic meets sporty

By Brady Snyder Published

-

Usability over style

Usability over styleGoogle Clock update ditches wallpaper chaos for a cleaner alarm screen

By Jay Bonggolto Published

-

Meet Pomelli

Meet PomelliGoogle's Pomelli AI is here to be your new marketing department

By Jay Bonggolto Published

-

Google Beam + USO

Google Beam + USOGoogle Beam will use AI to bring 3D video calls to military families

By Brady Snyder Published

-

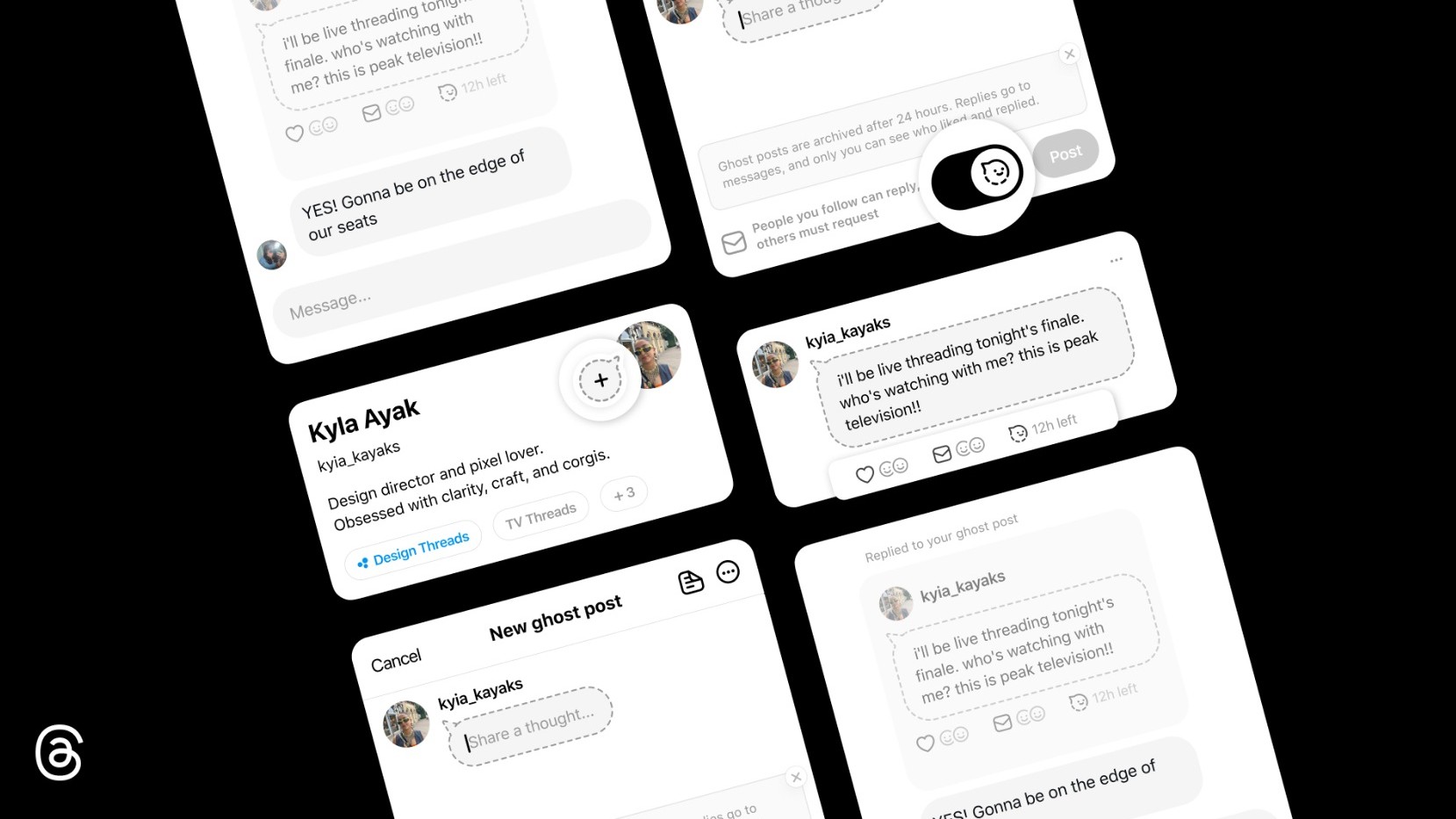

For the wild ones

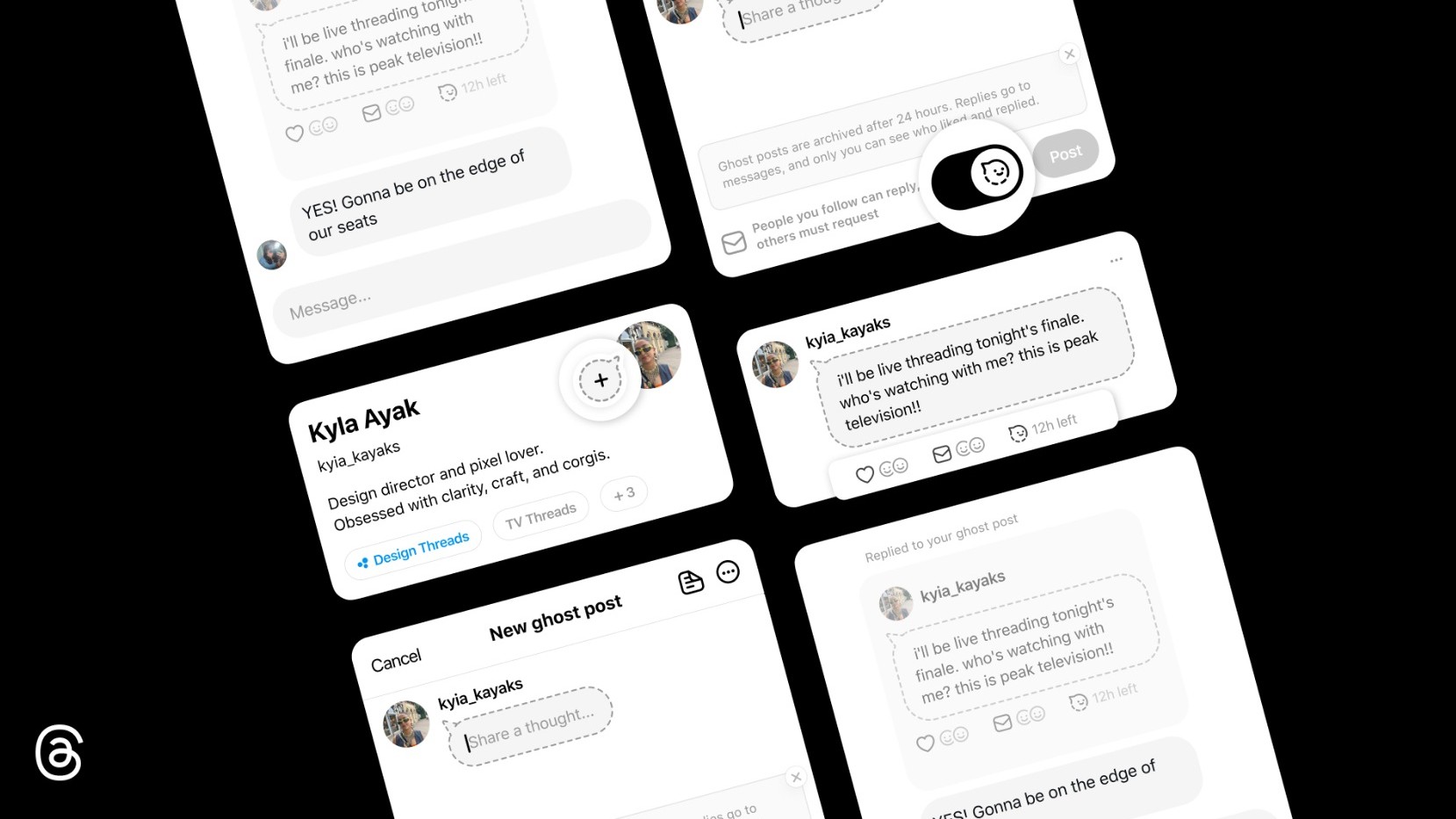

For the wild onesThreads adds vanishing 'ghost posts' on a timer for those one-off hot takes

By Nickolas Diaz Published

-

Try it yourself!

Try it yourself!Meta Ray-Ban Display demos are popping up at an unexpected spot

By Brady Snyder Published

-

Milestone

MilestoneYouTube Music paid out a record $8 billion to the music industry in a year

By Brady Snyder Published

-

Explore Apps & Software

AI

-

-

Google Beam + USO

Google Beam + USOGoogle Beam will use AI to bring 3D video calls to military families

By Brady Snyder Published

-

Google AI + MLB

Google AI + MLBHow Google Cloud and Gemini are powering Fox coverage of the MLB World Series

By Brady Snyder Published

-

Coming soon

Coming soonAndroid users will soon get to experience OpenAI's viral Sora app

By Brady Snyder Published

-

Android & Chill

Android & ChillGoogle says its new carbon capture initiative unlocks 'a critical technology pathway to enable a clean, affordable, reliable energy future,' but are initiatives like this a savior or a smokescreen as AI becomes more power-hungry?

By Jerry Hildenbrand Published

-

Only Treats

Only TreatsGemini's October drop brings powerful AI upgrades to your work and home

By Nickolas Diaz Published

-

Ultimate Guide

Ultimate GuideAI in Motion: The Road to AI and the Future of Mobile

By AC Staff Published

-

IDC X AC

IDC X ACExclusive: The road to AI — How it will transform our relationship with technology

By Shruti Shekar Published

-

Suunto My plan

Suunto My planCan the Suunto Coach replace your trainer with AI? I tested it to find out

By Brady Snyder Published

-

Tell a story

Tell a storyGoogle's powerful Veo steps up its creativity in 3.1 version update for 'realism'

By Nickolas Diaz Published

-

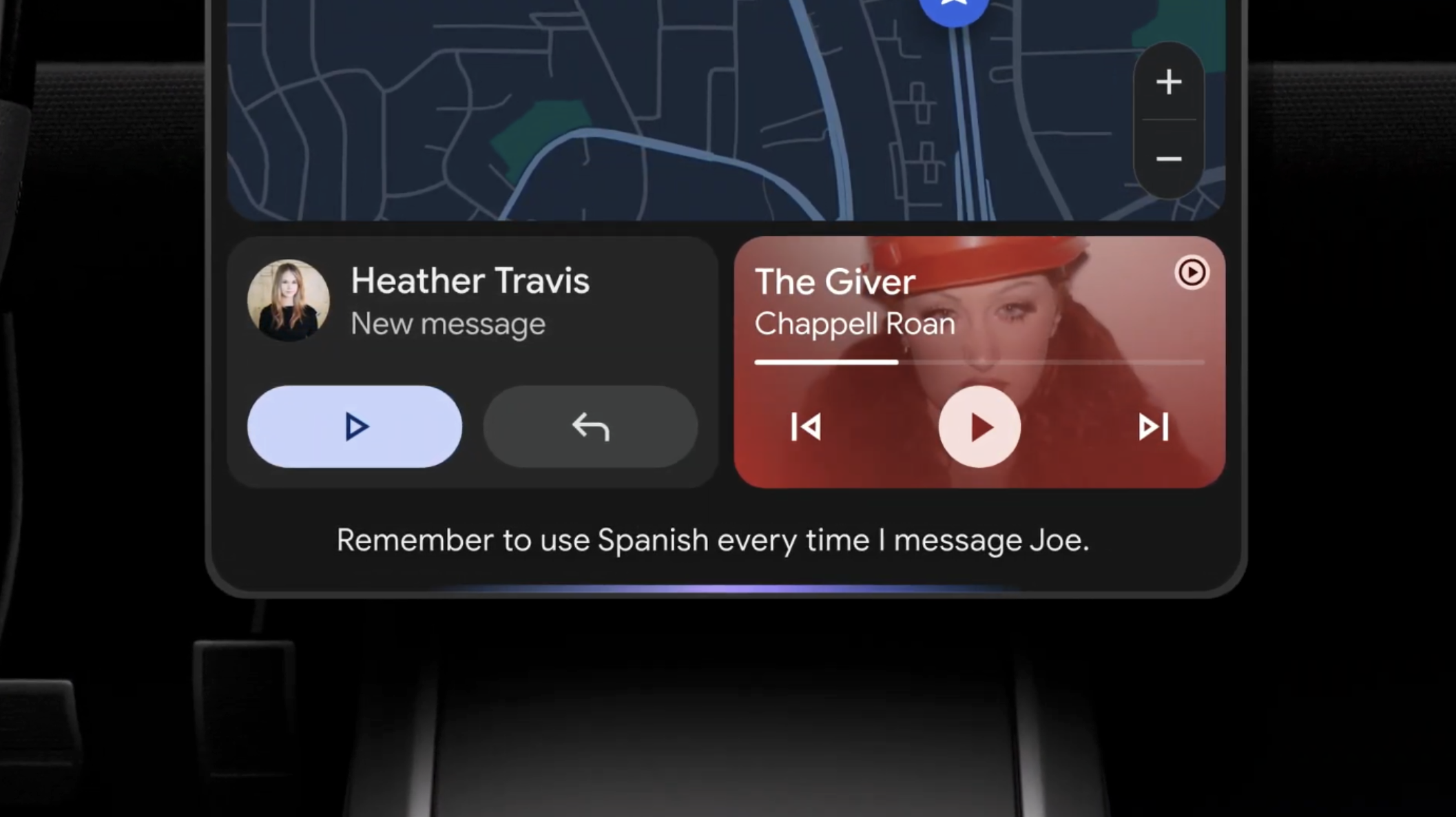

Android Auto

-

-

Eyes on the Road

Eyes on the RoadGoogle starts quietly rolling out an essential button on Android Auto

By Nickolas Diaz Published

-

game over

game overGoogle may be pulling the plug on Android Auto’s in-car mini-games

By Jay Bonggolto Published

-

Alternative?

Alternative?Samsung's alleged 'Auto DeX' leak is an Android Auto variant you might see

By Nickolas Diaz Published

-

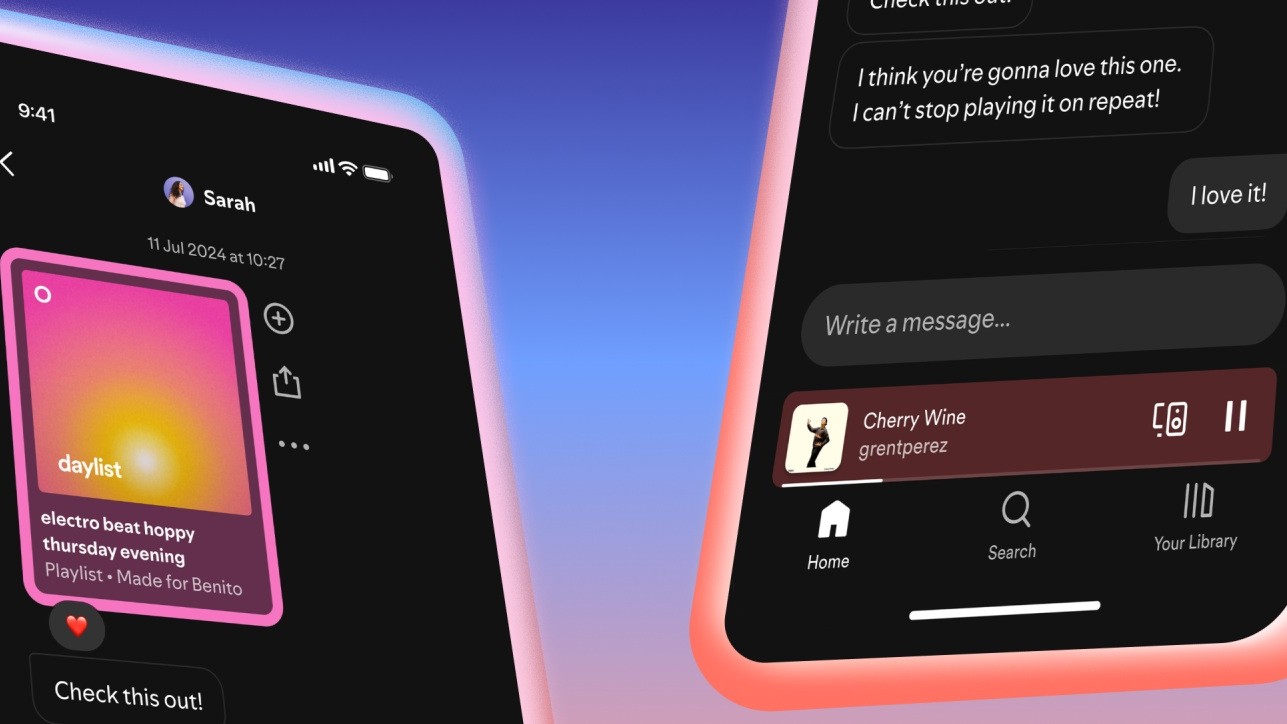

Share songs n ride

Share songs n rideAndroid users can now "Jam" together with this new Spotify feature

By Vishnu Sarangapurkar Published

-

Coming soon

Coming soonI tried Android Auto with Gemini at Google I/O, here's how it went

By Brady Snyder Last updated

-

It's getting hot

It's getting hotAndroid Auto's UI for climate control support might look like this

By Nickolas Diaz Published

-

Might not happen

Might not happenLatest Android Auto v14.2 seemingly dashes hopes of smart glasses navigation

By Nickolas Diaz Published

-

Truly Sci-fi

Truly Sci-fiAndroid Auto might let you navigate the road with smart glasses

By Nickolas Diaz Published

-

Gettin' Chilly

Gettin' ChillyAndroid Auto's next update could bring controls for a more comfortable car ride

By Nickolas Diaz Published

-

Android OS

-

-

Simple switching

Simple switchingThis Apple framework will make ditching your iPhone for an Android even easier

By Brady Snyder Published

-

Android 16

Android 16The Samsung Galaxy S21 FE's last major Android upgrade is reaching users

By Brady Snyder Published

-

GenAI is here to stay!

GenAI is here to stay!GenAI is emerging, and it could make the phone's form factor feel irrelevant

By Nandika Ravi Published

-

Solved

SolvedGoogle rolls out Android 16 Beta 3.1 to fix bootloop issues for Pixel users

By Nickolas Diaz Published

-

Beta gets better

Beta gets betterThe latest Android 16 QPR2 beta makes it easier to add app shortcuts to home screen

By Sanuj Bhatia Published

-

Spruced up!

Spruced up!Galaxy S23 FE sees major One UI 8 update: Customize your lock screen and more

By Nandika Ravi Published

-

Your phone your rules

Your phone your rulesLineageOS 23 brings Android 16 to over 100 devices despite Google’s holdups

By Jay Bonggolto Published

-

Live Search

Live SearchGoogle Search goes "Live" with this new feature that we didn't know we needed

By Nandika Ravi Published

-

Put a party hat on my dog!

Put a party hat on my dog!Google expands exclusive Pixel 10 feature to Android users in the US

By Nandika Ravi Published

-

Gmail

-

-

Sleigh Bells ring...

Sleigh Bells ring...Google brings a unified 'Purchases' tab to Gmail ahead of the holiday rush

By Nickolas Diaz Published

-

new UX style

new UX styleGmail's new Material 3 Expressive design is secretly hitting some inboxes

By Jay Bonggolto Published

-

Quick reply

Quick replyGmail will now let you react to emails with emojis

By Brady Snyder Published

-

Mail upgrades

Mail upgradesGmail's new search results prioritize relevant emails over recent ones

By Brady Snyder Published

-

Gone phishing

Gone phishingGmail could start rejecting suspicious emails even before they reach your inbox

By Steven Shaw Published

-

How to recover lost Google contacts for Android

By Mick Symons Last updated

-

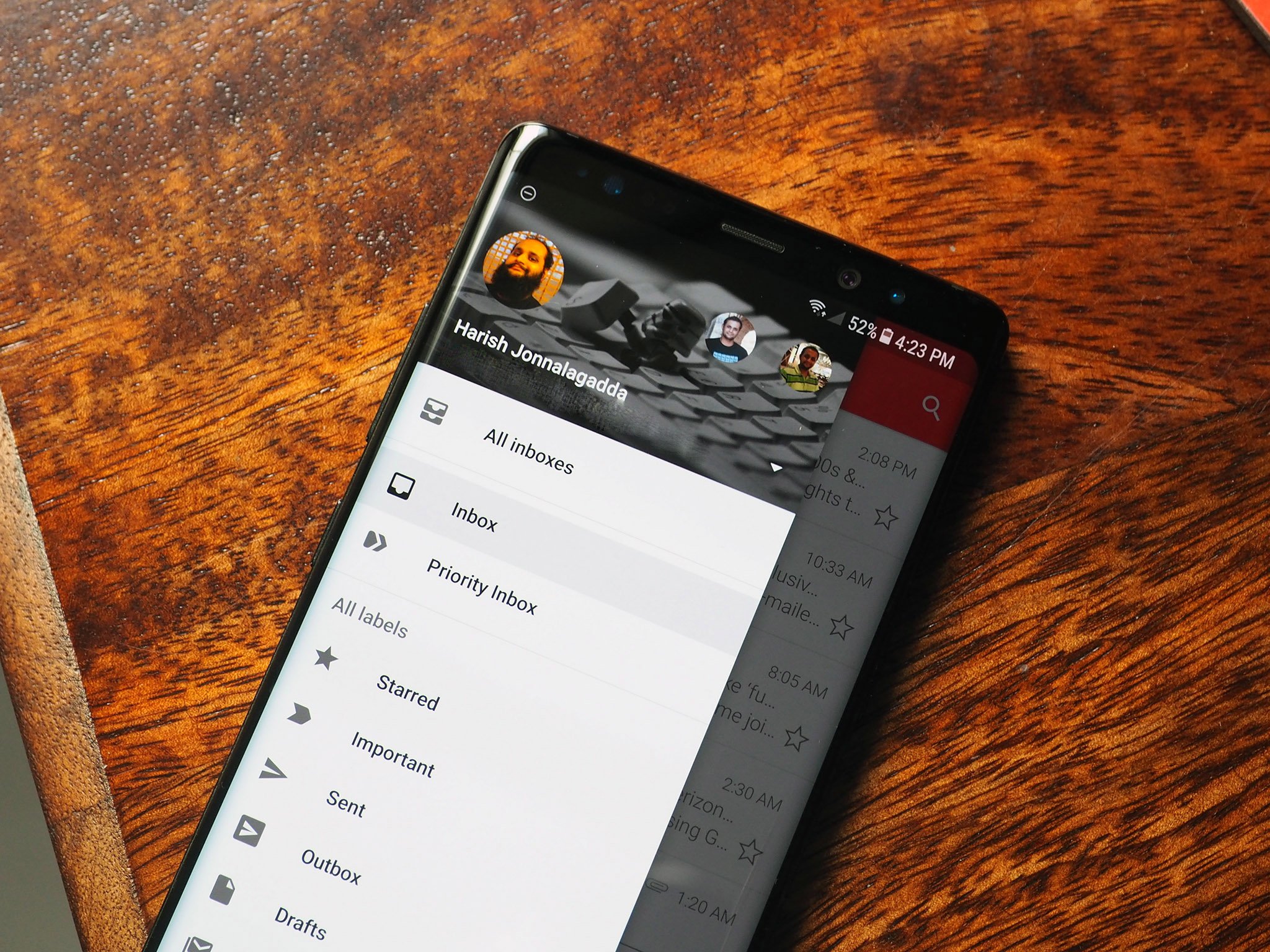

7 best Gmail for Android tips and tricks

By Harish Jonnalagadda Published

-

How to set up out of office replies in Gmail

By Jeramy Johnson Published

-

How to download all of your Gmail attachments at once

By Namerah Saud Fatmi Published

-

Google Assistant

-

-

Stay in the know

Stay in the knowGoogle introduces new tools to help users fight against evolving phishing scams effectively

By Nandika Ravi Published

-

Google Outage

Google OutageGoogle, Gmail, and Meet hit by widespread outage, causing login issues

By Nandika Ravi Published

-

New voices

New voicesGoogle is spicing up its voice list on Search, according to a new leak

By Nandika Ravi Published

-

New Google AI plans

New Google AI plansNew Google AI Pro and $249/month Ultra subscription announced at I/O

By Vishnu Sarangapurkar Published

-

Easy-peesy

Easy-peesyGoogle app on iOS gets a new feature that will 'Simplify' text online

By Nandika Ravi Published

-

Bye

ByeGoogle officially killed Driving Mode after stripping most of its features in 2024

By Brady Snyder Published

-

Google Vs DOJ

Google Vs DOJGoogle disagrees with US judge's ruling, says it could impact users at large

By Nandika Ravi Published

-

AI Mode gets Gemini-ed

AI Mode gets Gemini-edGoogle's AI Mode gets Gemini's multimodal powers making it a visual search expert

By Nandika Ravi Published

-

Gotta catch 'em all!

Gotta catch 'em all!Google just turned your Search into a Pokédex for Easter

By Nandika Ravi Published

-

Google Maps

-

-

ETA at a glance

ETA at a glanceGoogle Maps is adding a nifty chip to show how long it'll take you to get home

By Sanuj Bhatia Published

-

Assistant is out

Assistant is outYour next Google Maps navigation could be planned by Gemini

By Jay Bonggolto Published

-

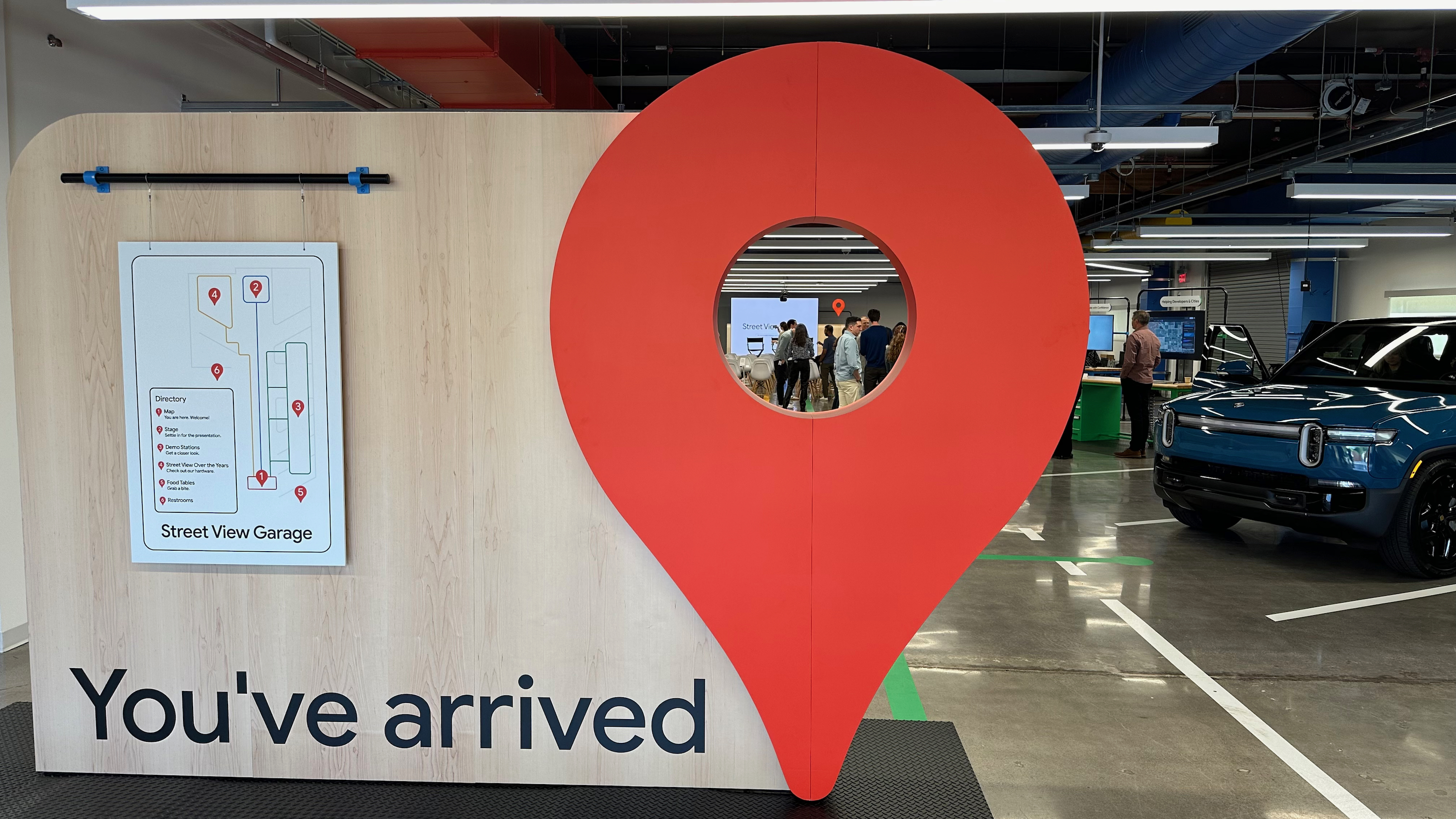

Smoother EV driving

Smoother EV drivingRivian partners with Google Maps for enhanced EV navigation experience

By Vishnu Sarangapurkar Published

-

Save from Screenshots

Save from ScreenshotsGoogle Maps for iOS simplifies saving locations from screenshots

By Vishnu Sarangapurkar Published

-

Fake reviews

Fake reviewsGoogle Maps doubles down on preventing fake reviews

By Nandika Ravi Published

-

now looking sharp

now looking sharpGoogle Maps is giving your ETA screen a glow-up on Android

By Jay Bonggolto Published

-

Too soon?

Too soon?Google Maps taps Gemini for an 'Ask about place' chip with directions and more

By Nickolas Diaz Published

-

More deets

More deetsGoogle Maps might predict more than just the traffic for you soon

By Nandika Ravi Published

-

Executive order

Executive orderGoogle Maps to rename 'Gulf of Mexico' to 'Gulf of America' following Trump executive order

By Nandika Ravi Published

-

Google Pay

-

-

On Time

On TimeGoogle Wallet is helping Android users effortlessly catch their plane or train

By Nickolas Diaz Published

-

Quick Taps

Quick TapsGoogle Pay's fresh updates will unlock better shopping rewards for Chrome users

By Nickolas Diaz Published

-

Pay Your Way

Pay Your WayAndroid users get another option to pay later with Klarna on Google Pay

By Nickolas Diaz Published

-

Easier access

Easier accessGoogle Wallet brings digital ID support to UK, more US states

By Nandika Ravi Published

-

Now arriving at...

Now arriving at...Google Wallet brings real-time train status alerts to Android, and teases I/O 2025

By Nickolas Diaz Published

-

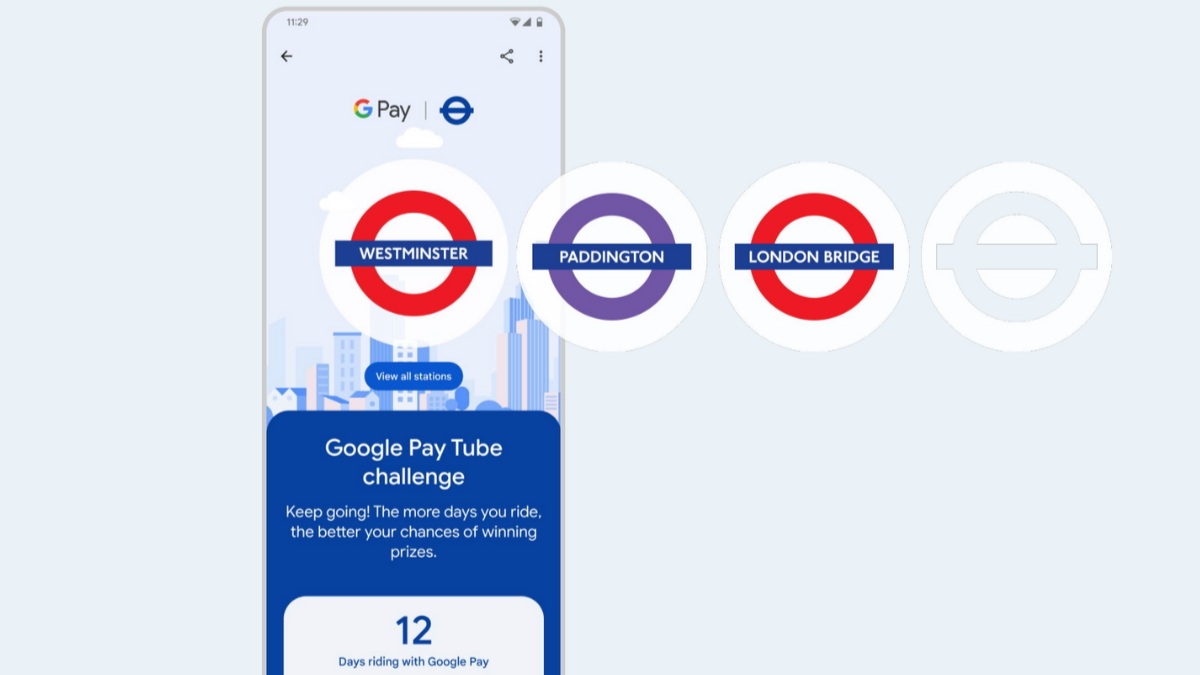

Next stop is...

Next stop is...Londoners can join the Google Pay 'Tube Challenge' for badges and city lore

By Nickolas Diaz Published

-

How to add vaccine cards and medical info to Google Wallet

By Michael L Hicks Published

-

How to send and request money using GPay

By Jerry Hildenbrand Published

-

Google Pay: How it works, where it's available, and how it compares to Wallet

By Mark Knapp Published

-

Google Play Store

-

-

The Order Stands

The Order StandsUS Supreme Court upholds Google Play Store changes amid ongoing Epic Games lawsuit

By Nickolas Diaz Published

-

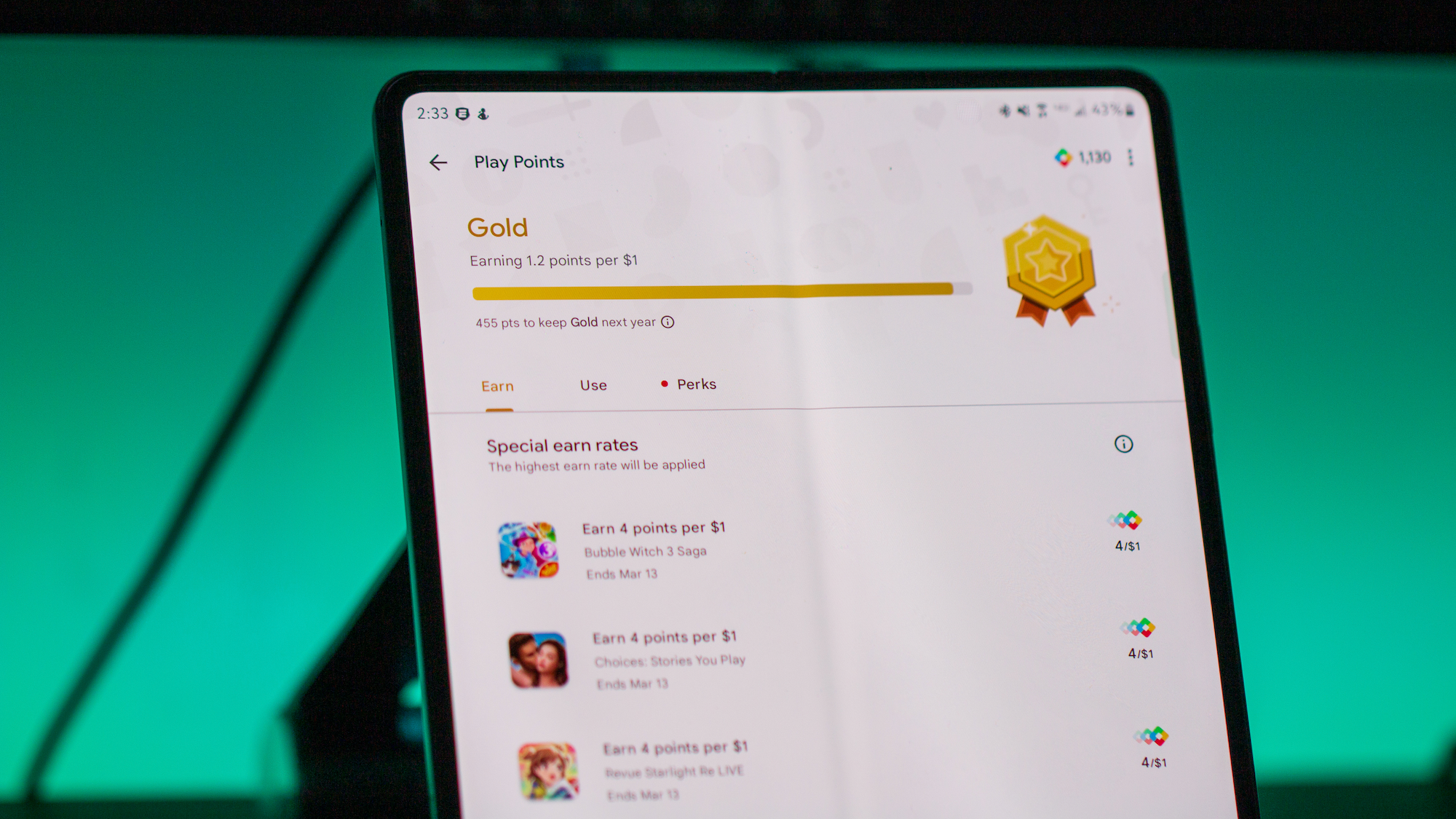

More games, more prizes

More games, more prizesAndroid users can unlock new rewards with Google's revamped Play Points

By Nickolas Diaz Published

-

race against time

race against timeGoogle is scrambling for an emergency hold after Epic’s court victory

By Jay Bonggolto Published

-

Victory

VictoryEpic Games for Android will be available on Google Store following court ruling

By Nickolas Diaz Published

-

no more oops moments

no more oops momentsGoogle Play Store’s new swipe gesture is here to save you from accidental buys

By Jay Bonggolto Published

-

Apps A Plenty

Apps A PlentyMajor Google Play Store update grabs your attention with 'browse pages' and more

By Nickolas Diaz Published

-

Gone for good!

Gone for good!Google Play Store just lost a ton of apps, but this is actually a good thing

By Nandika Ravi Published

-

Safe space

Safe spaceGoogle Play Store will get more tools to protect users from scammy apps

By Nandika Ravi Published

-

Another bug?

Another bug?Play Store update 'bugs' several Android users with recurring notifications

By Nandika Ravi Published

-

Meta

-

-

Ray-Ban or Oakley?

Ray-Ban or Oakley?Ray-Ban Meta (Gen 2) vs. Oakley Meta Vanguard: Chic meets sporty

By Brady Snyder Published

-

For the wild ones

For the wild onesThreads adds vanishing 'ghost posts' on a timer for those one-off hot takes

By Nickolas Diaz Published

-

Try it yourself!

Try it yourself!Meta Ray-Ban Display demos are popping up at an unexpected spot

By Brady Snyder Published

-

Rewind your Reels

Rewind your ReelsInstagram is finally adding a YouTube-like watch history for Reels

By Sanuj Bhatia Published

-

More Protections

More ProtectionsMeta preps AI Safety update for teens that lets parents breathe easier

By Nickolas Diaz Published

-

Threads levels up

Threads levels upThreads is rolling out group chats and expands messaging to the EU

By Jay Bonggolto Published

-

Reels first

Reels firstInstagram tests a 'Home' tab with short-form content before anything else

By Nickolas Diaz Published

-

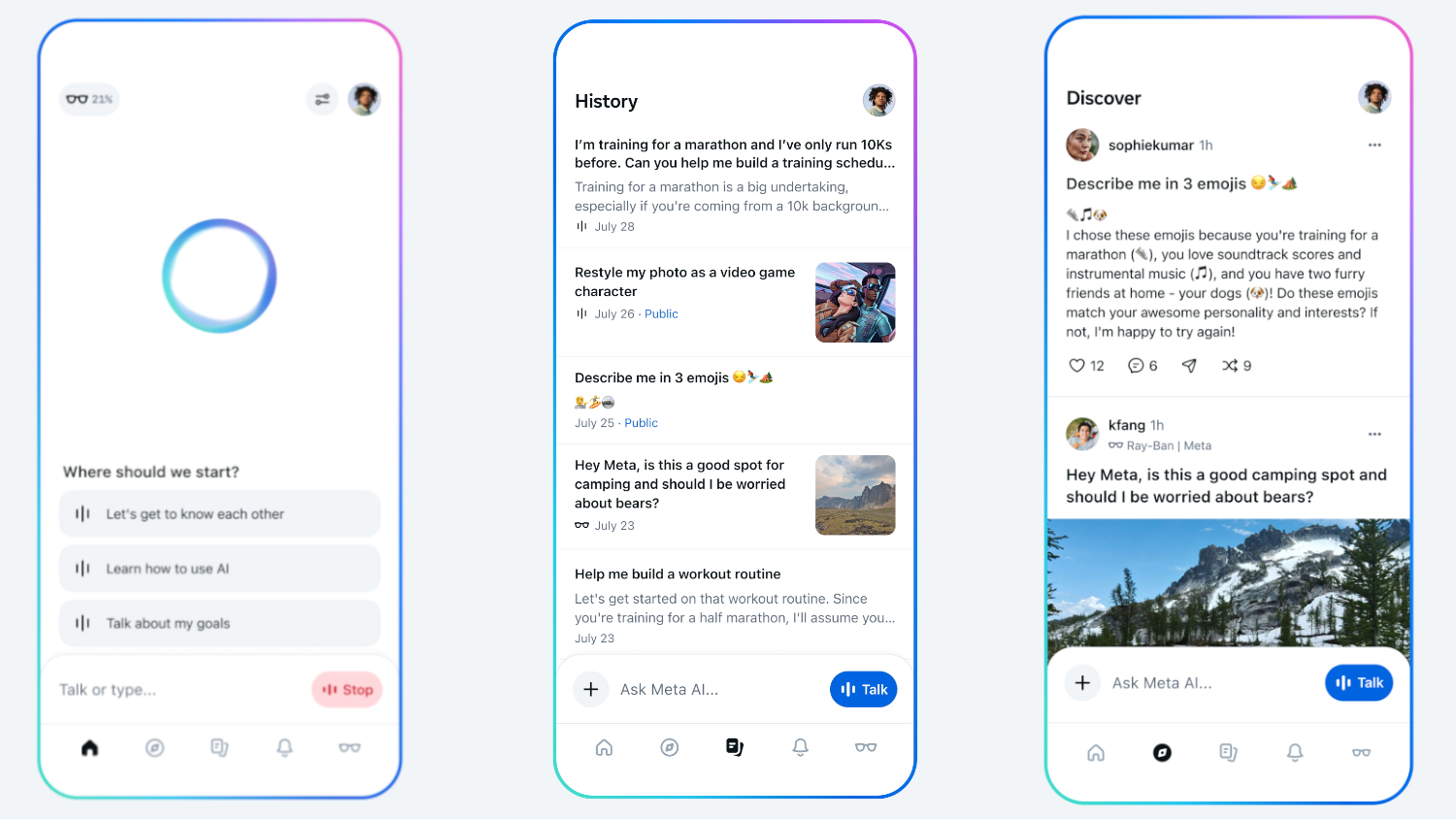

Meta AI app has a new 'Vibes' feed, full of AI-generated videos you can remix

By Nickolas Diaz Published

-

IDC x AC

IDC x ACExclusive: Meta's new smart glasses are great and everyone should be worried

By Jitesh Ubrani Published

-

Spotify

-

-

Rocky Music

Rocky MusicSpotify's having major issues on Samsung and Google phones—this is why

By Nickolas Diaz Published

-

Got a request?

Got a request?Spotify's AI DJ takes requests in a new way on Android with prompts to get you started

By Nickolas Diaz Published

-

Step into lossless

Step into losslessHow to enable Spotify Lossless audio on your smartphone

By Tshaka Armstrong Published

-

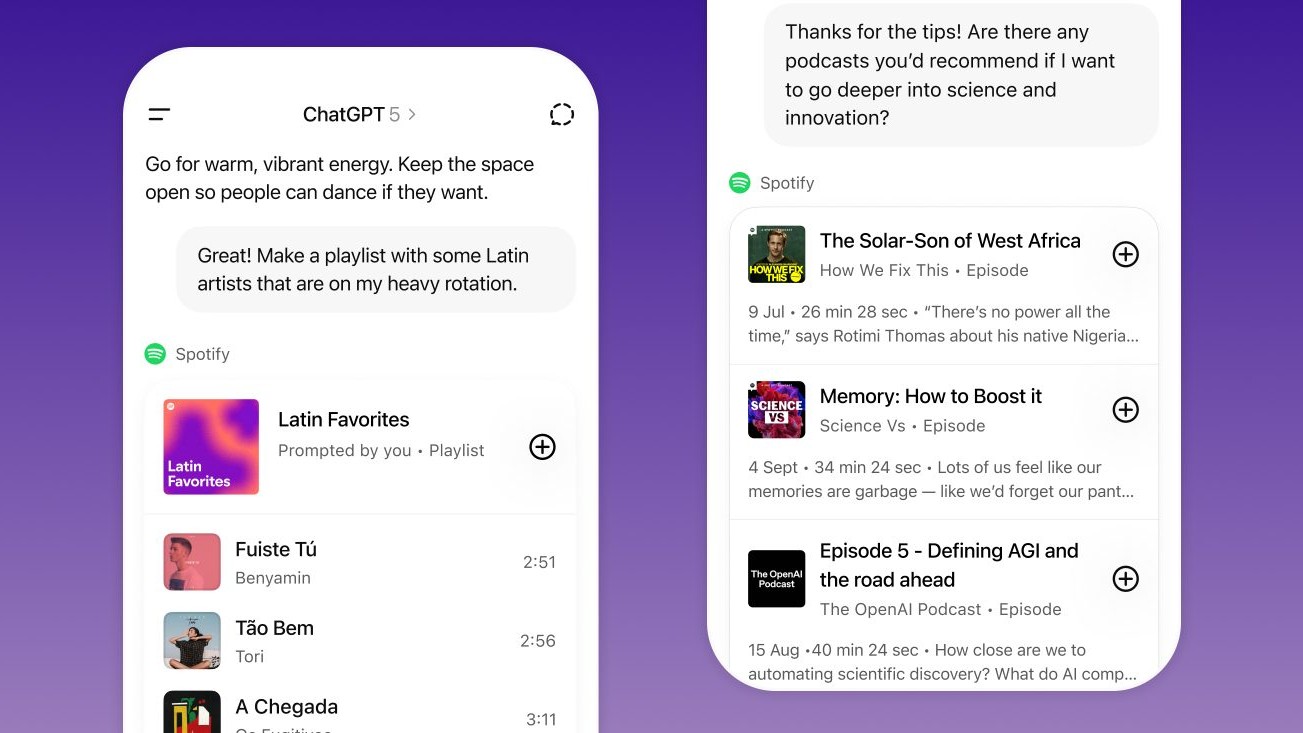

Just ask ChatGPT

Just ask ChatGPTSpotify in ChatGPT lets Android create entire playlists without lifting a finger

By Nickolas Diaz Published

-

Leadership shuffle

Leadership shuffleSpotify's top leadership changes hands as Ek exits CEO role

By Jay Bonggolto Published

-

Musically Upgraded

Musically UpgradedSpotify just gave free users a major upgrade, and it's rolling out now

By Nickolas Diaz Published

-

No sound lost

No sound lostSpotify 'Lossless Listening' lets Premium subscribers hear every refined note

By Nickolas Diaz Published

-

Talk about Music

Talk about MusicSpotify gets its own DMs for music-lovers sharing tracks and podcasts

By Nickolas Diaz Published

-

Increased to Innovate

Increased to InnovateSpotify prices are going up for Premium subscribers in these regions

By Nickolas Diaz Published

-

-

-

Twitter is down

Twitter is downIt wasn't just you — X (Twitter) resolved a major outage today

By Brady Snyder Last updated

-

Whistleblower calls out Twitter for spambots and mishandling user data

By Derrek Lee Published

-

What is free speech?

By Jerry Hildenbrand Published

-

Twitter makes it easier to search for Communities on the web

By Derrek Lee Published

-

Massive Twitter outage ends after about 90 minutes

By Michael L Hicks Published

-

House committee summons Meta, Alphabet, Twitter and Reddit over Capitol riot

By Jay Bonggolto Published

-

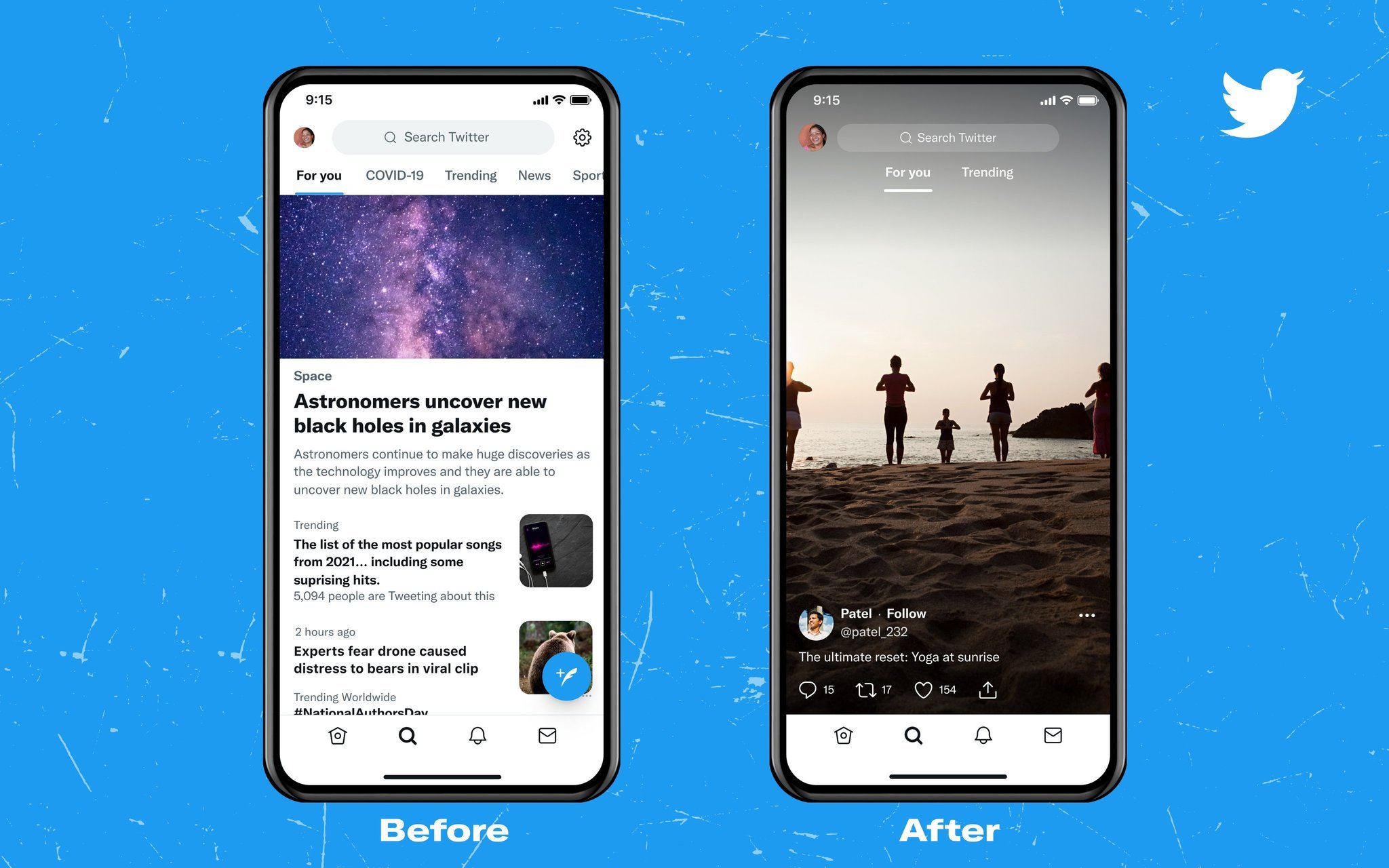

Twitter wants to turn the Explore page into yet another TikTok clone

By Michael L Hicks Published

-

How to remove a follower on Twitter without blocking them

By Keegan Prosser Published

-

Twitter had the best reaction to Fleets still being up on shutdown day

By Derrek Lee Last updated

-

Wear OS

-

-

Wear OS Weekly

Wear OS WeeklyWear OS 6 is one of the best parts of the Pixel Watch 4

By Michael L Hicks Published

-

Pixel Weather takes over

Pixel Weather takes overGoogle is phasing out the Wear OS Weather app, but for something better

By Sanuj Bhatia Published

-

Future of Wear OS

Future of Wear OSWear OS 6: One UI 8 Watch, Material 3 Expressive, Gemini, & more

By Michael L Hicks Last updated

-

Wear this

Wear thisBest Wear OS watch 2025

By Michael L Hicks Last updated

-

Wear OS Weekly

Wear OS WeeklyCustom watch faces for the Galaxy Watch 8 and Pixel Watch 4 are fantastic — Here's where to find them

By Michael L Hicks Published

-

Fun faces

Fun facesFacer officially returns to the Samsung Galaxy Watch 8 in massive update

By Michael L Hicks Published

-

Gemini on your Watch

Gemini on your WatchGoogle brings the might of Gemini AI to your Pixel Watch

By Vishnu Sarangapurkar Published

-

Wear OS Weekly

Wear OS WeeklyWill last-gen Galaxy and Pixel Watches die this year...and should they?

By Michael L Hicks Published

-

Early warning

Early warningThis new Android feature brings earthquake alerts right to your wrist

By Nickolas Diaz Last updated

-

Youtube

-

-

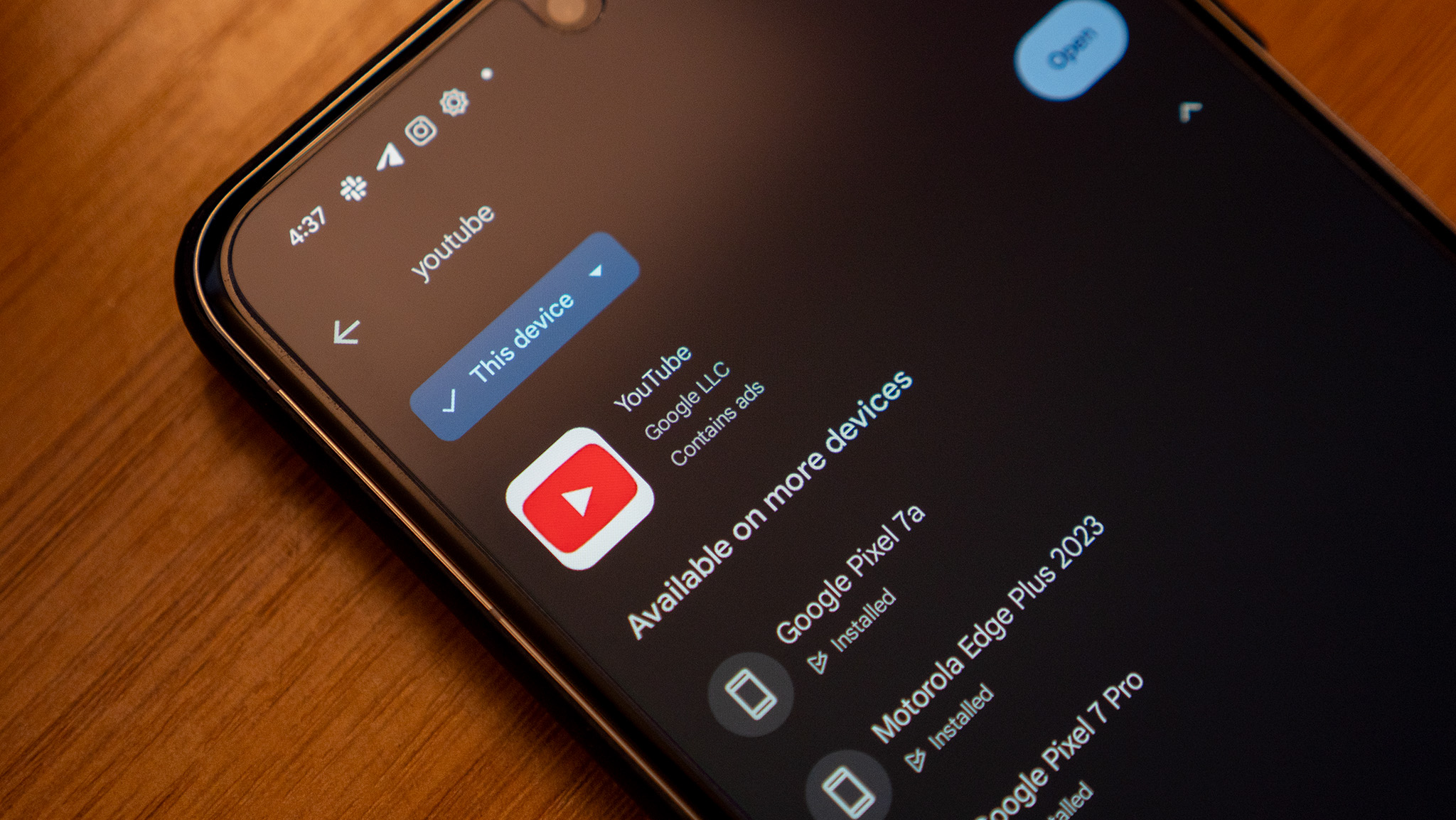

Milestone

MilestoneYouTube Music paid out a record $8 billion to the music industry in a year

By Brady Snyder Published

-

Less obtrusive player

Less obtrusive playerYouTube unveils major overhaul of its video player for Android and iOS users

By Jay Bonggolto Published

-

In Moderation

In ModerationYouTube's new timer stops you from doom scrolling into procrastination

By Nickolas Diaz Published

-

Much improved

Much improvedLike Android, YouTube gets more 'expressive' as an overhauled video player rolls out

By Nickolas Diaz Published

-

breaking language barrier

breaking language barrierYouTube Music breaks the language barrier with real-time lyrics translation

By Jay Bonggolto Published

-

Love it or hate it

Love it or hate itYouTube is testing bold mobile UI changes, and users are split

By Jay Bonggolto Published

-

Videos in the Lab

Videos in the LabAndroid users will now be able to test an unreleased YouTube AI feature

By Nickolas Diaz Published

-

AI vs. AI

AI vs. AIYouTube is giving creators more tools to tackle AI deepfakes

By Sanuj Bhatia Published

-

language barrier no more

language barrier no moreYouTube's new trick automatically re-dubs any video into your native tongue

By Jay Bonggolto Published

-

More about Apps & Software

-

-

Milestone

MilestoneYouTube Music paid out a record $8 billion to the music industry in a year

By Brady Snyder Published

-

Small touches matter

Small touches matterChrome for Android just got its long-awaited dose of Google’s latest redesign

By Jay Bonggolto Published

-

Google AI + MLB

Google AI + MLBHow Google Cloud and Gemini are powering Fox coverage of the MLB World Series

By Brady Snyder Published

-