Apps & Software

Latest about Apps & Software

-

-

Editor's Desk

Editor's DeskA month with Fitbit's new AI-driven health coach and how the reimagined app is inching closer to becoming my go-to fitness app

By Derrek Lee Published

-

A downgrade to downgrading

A downgrade to downgradingGoogle just made uninstalling system app updates more complicated

By Sanuj Bhatia Published

-

Google Weather is down

Google Weather is downGoogle Weather is broken on older Wear OS watches, but a fix is coming

By Jay Bonggolto Published

-

Better Understanding

Better UnderstandingThis is everything in Google Translate's three big updates rolling out for Android

By Nickolas Diaz Published

-

Get on the dance floor

Get on the dance floorGoogle's 'Disco' experiment is an AI browser that turns your tabs into mini apps

By Nickolas Diaz Published

-

Wear this

Wear thisBest Wear OS watch

By Michael L Hicks Last updated

-

The $1 billion pivot

The $1 billion pivotDisney invests $1 billion in OpenAI to put Mickey Mouse inside your text prompts

By Jay Bonggolto Published

-

Explore Apps & Software

AI

-

-

Editor's Desk

Editor's DeskA month with Fitbit's new AI-driven health coach and how the reimagined app is inching closer to becoming my go-to fitness app

By Derrek Lee Published

-

Get on the dance floor

Get on the dance floorGoogle's 'Disco' experiment is an AI browser that turns your tabs into mini apps

By Nickolas Diaz Published

-

Google Home

Google HomeGemini for Home's early access program will now let anyone in within 24 hours

By Brady Snyder Published

-

Meta prompting

Meta promptingA Google DeepMind engineer just shared the secret to making the perfect Gemini prompt

By Brady Snyder Published

-

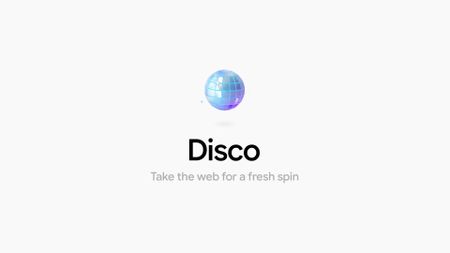

Mixboard

MixboardGoogle's AI idea board now generates presentations with Nano Banana Pro

By Brady Snyder Published

-

Betting on Google

Betting on GoogleI've tested Gemini 3, and it proves Google has what it takes to win the AI race

By Brady Snyder Published

-

Gemini, plus ads

Gemini, plus adsAmid rumors, Google assures Gemini users: 'no ads planned for the app'

By Nickolas Diaz Published

-

Upgraded AI model

Upgraded AI modelGemini 3 Deep Think is Google's 'most advanced reasoning feature' — and it's available now

By Brady Snyder Published

-

AI IDE

AI IDEGoogle Antigravity's rate limits are changing amid 'incredible' demand

By Brady Snyder Published

-

Android Auto

-

-

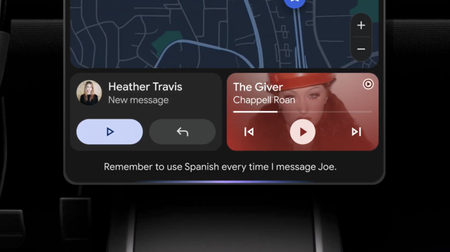

Gemini-fied

Gemini-fiedGemini transforms Android Auto with new AI features for a smarter drive

By Nandika Ravi Published

-

Bye, Assistant!

Bye, Assistant!Gemini for Android Auto is starting to replace Google Assistant

By Brady Snyder Published

-

Eyes on the Road

Eyes on the RoadGoogle starts quietly rolling out an essential button on Android Auto

By Nickolas Diaz Published

-

game over

game overGoogle may be pulling the plug on Android Auto’s in-car mini-games

By Jay Bonggolto Published

-

Alternative?

Alternative?Samsung's alleged 'Auto DeX' leak is an Android Auto variant you might see

By Nickolas Diaz Published

-

Share songs n ride

Share songs n rideAndroid users can now "Jam" together with this new Spotify feature

By Vishnu Sarangapurkar Published

-

Coming soon

Coming soonI tried Android Auto with Gemini at Google I/O, here's how it went

By Brady Snyder Last updated

-

It's getting hot

It's getting hotAndroid Auto's UI for climate control support might look like this

By Nickolas Diaz Published

-

Might not happen

Might not happenLatest Android Auto v14.2 seemingly dashes hopes of smart glasses navigation

By Nickolas Diaz Published

-

Android OS

-

-

Emergency SOS

Emergency SOSAndroid's Emergency Live Video shares crucial visual info with first responders

By Brady Snyder Published

-

Alternative

AlternativeNew details about Android's NameDrop alternative surface with bright animations

By Nickolas Diaz Published

-

New modes

New modesHow Android's new 'Transiting Mode' could change settings for public transit users automatically

By Brady Snyder Published

-

Dark mode on

Dark mode onGemini's refresh: Unveiling the new 'My Stuff' folder for seamless user navigation

By Nandika Ravi Published

-

Revamp

RevampGemini's web redesign introduces 'My Stuff' folder for a streamlined user experience

By Nandika Ravi Published

-

In-call safety arrives

In-call safety arrivesAndroid now warns before you open banking apps during risky calls

By Sanuj Bhatia Published

-

The big shift

The big shiftAndroid 16 finally fights notification overload and lets you kill ugly icons

By Jay Bonggolto Published

-

Unwrap the December drop: Google brings fresh updates for Android users

By Nandika Ravi Published

-

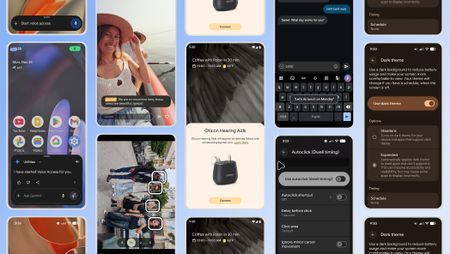

More inviting

More invitingFrom Expressive to Accessible, Google's winter Android update makes the OS easy for all

By Nickolas Diaz Published

-

Gmail

-

-

Get a preview

Get a previewGmail gives Android users a window into email attachments with this update

By Nickolas Diaz Published

-

Sleigh Bells ring...

Sleigh Bells ring...Google brings a unified 'Purchases' tab to Gmail ahead of the holiday rush

By Nickolas Diaz Published

-

new UX style

new UX styleGmail's new Material 3 Expressive design is secretly hitting some inboxes

By Jay Bonggolto Published

-

Quick reply

Quick replyGmail will now let you react to emails with emojis

By Brady Snyder Published

-

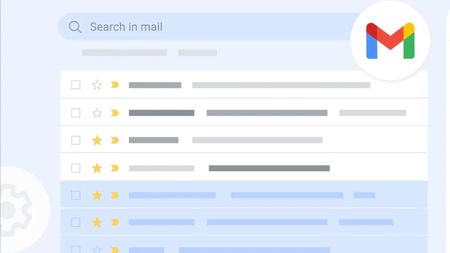

Mail upgrades

Mail upgradesGmail's new search results prioritize relevant emails over recent ones

By Brady Snyder Published

-

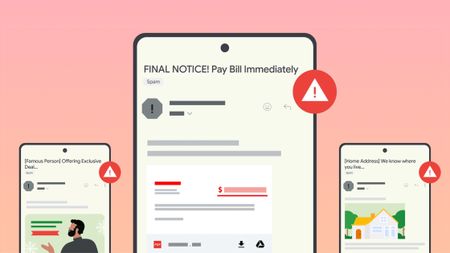

Gone phishing

Gone phishingGmail could start rejecting suspicious emails even before they reach your inbox

By Steven Shaw Published

-

How to recover lost Google contacts for Android

By Mick Symons Last updated

-

7 best Gmail for Android tips and tricks

By Harish Jonnalagadda Published

-

How to set up out of office replies in Gmail

By Jeramy Johnson Published

-

Google Assistant

-

-

Bye, Assistant

Bye, AssistantGoogle Assistant could shut down for Android Auto in March 2026

By Brady Snyder Published

-

New look!

New look!Google's song search evolves with a modern Gemini-inspired UI on Android

By Nandika Ravi Published

-

New look!

New look!Google's voice and song search gets a major overhaul on Android after years

By Nandika Ravi Published

-

Stay in the know

Stay in the knowGoogle introduces new tools to help users fight against evolving phishing scams effectively

By Nandika Ravi Published

-

Google Outage

Google OutageGoogle, Gmail, and Meet hit by widespread outage, causing login issues

By Nandika Ravi Published

-

New voices

New voicesGoogle is spicing up its voice list on Search, according to a new leak

By Nandika Ravi Published

-

New Google AI plans

New Google AI plansNew Google AI Pro and $249/month Ultra subscription announced at I/O

By Vishnu Sarangapurkar Published

-

Easy-peesy

Easy-peesyGoogle app on iOS gets a new feature that will 'Simplify' text online

By Nandika Ravi Published

-

Bye

ByeGoogle officially killed Driving Mode after stripping most of its features in 2024

By Brady Snyder Published

-

Google Maps

-

-

Let's go there

Let's go thereGoogle Maps gets a major upgrade with Gemini for smooth navigation on Android and iOS

By Nickolas Diaz Published

-

Let's go there

Let's go thereGoogle Maps gets a Gemini boost to help you navigate the roads like a pro

By Nickolas Diaz Published

-

Double Rainbow

Double RainbowHere's what the redesigned Google Photos and Maps icons look like

By Nickolas Diaz Published

-

Real-time lane intelligence

Real-time lane intelligenceGoogle Maps and Polestar fix the worst part of highway driving

By Jay Bonggolto Published

-

ETA at a glance

ETA at a glanceGoogle Maps is adding a nifty chip to show how long it'll take you to get home

By Sanuj Bhatia Published

-

Assistant is out

Assistant is outYour next Google Maps navigation could be planned by Gemini

By Jay Bonggolto Published

-

Smoother EV driving

Smoother EV drivingRivian partners with Google Maps for enhanced EV navigation experience

By Vishnu Sarangapurkar Published

-

Save from Screenshots

Save from ScreenshotsGoogle Maps for iOS simplifies saving locations from screenshots

By Vishnu Sarangapurkar Published

-

Fake reviews

Fake reviewsGoogle Maps doubles down on preventing fake reviews

By Nandika Ravi Published

-

Google Pay

-

-

No more drain

No more drainAndroid’s next update is finally addressing your phone’s biggest battery hogs

By Jay Bonggolto Published

-

On Time

On TimeGoogle Wallet is helping Android users effortlessly catch their plane or train

By Nickolas Diaz Published

-

Quick Taps

Quick TapsGoogle Pay's fresh updates will unlock better shopping rewards for Chrome users

By Nickolas Diaz Published

-

Pay Your Way

Pay Your WayAndroid users get another option to pay later with Klarna on Google Pay

By Nickolas Diaz Published

-

Easier access

Easier accessGoogle Wallet brings digital ID support to UK, more US states

By Nandika Ravi Published

-

Now arriving at...

Now arriving at...Google Wallet brings real-time train status alerts to Android, and teases I/O 2025

By Nickolas Diaz Published

-

Next stop is...

Next stop is...Londoners can join the Google Pay 'Tube Challenge' for badges and city lore

By Nickolas Diaz Published

-

How to add vaccine cards and medical info to Google Wallet

By Michael L Hicks Published

-

How to send and request money using GPay

By Jerry Hildenbrand Published

-

Google Play Store

-

-

A downgrade to downgrading

A downgrade to downgradingGoogle just made uninstalling system app updates more complicated

By Sanuj Bhatia Published

-

Free cash

Free cashHere's when Google Play Store users will get an automatic cash settlement payout

By Brady Snyder Published

-

You win!

You win!Focus Friend and Pokémon TCG Pocket shine in Google Play's Best of 2025 awards

By Nickolas Diaz Published

-

Find it faster

Find it fasterGoogle Play enhances search with new 'Where to watch' streaming feature

By Sanuj Bhatia Published

-

No more sifting

No more siftingGoogle's upcoming review search feature might soon help you save time on the Play Store

By Jay Bonggolto Published

-

Gift cards go green

Gift cards go greenYou can now send Starbucks and Disney gift cards straight from Google Play

By Jay Bonggolto Published

-

Epic v. Google

Epic v. GoogleGoogle and Epic's settlement proposal could finally end the multi-year Play Store dispute

By Brady Snyder Published

-

Ditch the scroll

Ditch the scrollPlay Store’s new AI summaries could help you spot the best apps faster

By Jay Bonggolto Published

-

Age checks go live

Age checks go liveGoogle Play users must now verify their age to keep downloading certain apps

By Sanuj Bhatia Published

-

Meta

-

-

It's yours

It's yoursInstagram hands you the keys to control 'Your Algorithm' in Reels, plans to expand

By Nickolas Diaz Published

-

Delayed

DelayedMeta reportedly pushes the release of new mixed-reality glasses to 2027

By Brady Snyder Published

-

Early deals

Early dealsMeta reveals its Black Friday offers early with Ray-Ban Meta and Meta Quest 3S deals

By Brady Snyder Published

-

Trade-in deals

Trade-in dealsMeta is piloting a trade-in program for Ray-Ban and Oakley smart glasses — here's how it works

By Brady Snyder Published

-

Shakeup

ShakeupMeta's chief AI scientist is leaving the company after 12 years to create a startup

By Brady Snyder Published

-

Ruled in favor

Ruled in favorMeta cleared of monopoly claims as judge highlights competition with TikTok

By Nickolas Diaz Published

-

Not so fast

Not so fastGot a $100 off code from Meta that didn't work? You're not alone — here's what happened

By Brady Snyder Published

-

One inbox for all

One inbox for allYou might soon message non-WhatsApp users — here’s how Meta plans to pull it off

By Jay Bonggolto Published

-

Finally!

Finally!Meta boosts older smart glasses with new Garmin and Strava features for fitness enthusiasts

By Brady Snyder Published

-

Spotify

-

-

You're the captain, now

You're the captain, nowSpotify’s ‘Prompted Playlists’ lets you take more control of its algorithm

By Nickolas Diaz Published

-

Wrap it up!

Wrap it up!Explore Spotify Wrapped 2025: A year in music, top albums, and your unique listening age

By Nandika Ravi Published

-

Pricey!

Pricey!Spotify might raise prices again for US users in early 2026

By Nandika Ravi Published

-

Easy switching

Easy switchingSpotify is making it easier to switch with in-app TuneMyMusic playlist transfers

By Brady Snyder Published

-

Pay up

Pay upSpotify lossless lands in India, and there's the inevitable price hike: it's 40% costlier than Apple Music, and I'm now paying 3x as much as my previous plan

By Harish Jonnalagadda Published

-

Spotify sharing

Spotify sharingAndroid users can now share their favorite Spotify songs through WhatsApp Status

By Brady Snyder Published

-

Put you on repeat...

Put you on repeat...Spotify can now tell which songs Android users are addicted to

By Nickolas Diaz Published

-

Rocky Music

Rocky MusicSpotify's having major issues on Samsung and Google phones—this is why

By Nickolas Diaz Published

-

Got a request?

Got a request?Spotify's AI DJ takes requests in a new way on Android with prompts to get you started

By Nickolas Diaz Published

-

-

-

Where are you?

Where are you?X's new 'transparent' location labels for accounts have people questioning everything

By Nickolas Diaz Published

-

Partial outage

Partial outageFacing trouble logging into X? You're not alone — here’s the scoop!

By Nandika Ravi Published

-

Twitter is down

Twitter is downIt wasn't just you — X (Twitter) resolved a major outage today

By Brady Snyder Last updated

-

Whistleblower calls out Twitter for spambots and mishandling user data

By Derrek Lee Published

-

What is free speech?

By Jerry Hildenbrand Published

-

Twitter makes it easier to search for Communities on the web

By Derrek Lee Published

-

Massive Twitter outage ends after about 90 minutes

By Michael L Hicks Published

-

House committee summons Meta, Alphabet, Twitter and Reddit over Capitol riot

By Jay Bonggolto Published

-

Twitter wants to turn the Explore page into yet another TikTok clone

By Michael L Hicks Published

-

Wear OS

-

-

Google Weather is down

Google Weather is downGoogle Weather is broken on older Wear OS watches, but a fix is coming

By Jay Bonggolto Published

-

Wear this

Wear thisBest Wear OS watch

By Michael L Hicks Last updated

-

AOD upgrades

AOD upgradesGoogle Pixel Watch update adds always-on display support for more Clock features

By Brady Snyder Published

-

UI boost!

UI boost!Galaxy Watch 5 and Pro users await One UI 8 Watch update after beta concludes

By Brady Snyder Published

-

Watch 5 + Watch 5 Pro

Watch 5 + Watch 5 ProOne UI 8 Watch update expected soon for Galaxy Watch 5 and 5 Pro users

By Brady Snyder Published

-

News Weekly

News WeeklyNews Weekly: Early look at the OnePlus 15R, Wear OS 6 lands on older Galaxy watches, Android Auto gets Gemini's tricks, and more

By Nandika Ravi Published

-

Wear OS Weekly

Wear OS WeeklyWear OS 6 is one of the best parts of the Pixel Watch 4

By Michael L Hicks Published

-

Pixel Weather takes over

Pixel Weather takes overGoogle is phasing out the Wear OS Weather app, but for something better

By Sanuj Bhatia Published

-

Future of Wear OS

Future of Wear OSWear OS 6: One UI 8 Watch, Material 3 Expressive, Gemini, & more

By Michael L Hicks Last updated

-

Youtube

-

-

The safety paradox

The safety paradoxYouTube cut off: Australian teens are losing logins under new age law

By Jay Bonggolto Published

-

AI everywhere

AI everywhereYouTube might soon let you tweak your suggested content with AI prompts

By Sanuj Bhatia Published

-

DM feature is back

DM feature is backYouTube revives in-app direct messaging in surprise test

By Jay Bonggolto Published

-

Targeted tracks

Targeted tracksYouTube Music might finally fix its biggest playlist headache for a long time

By Jay Bonggolto Published

-

Piling on

Piling onWhy YouTube is not working for users of Opera GX with Ad blockers

By Nickolas Diaz Published

-

Piling on

Piling onYouTube's not working for users with ad blockers, at least for this one browser

By Nickolas Diaz Published

-

AI gets it wrong

AI gets it wrongYouTube's age verification system is back to calling adults kids

By Sanuj Bhatia Published

-

Old videos, new life

Old videos, new lifeYouTube will soon use AI to make low-resolution videos look sharper

By Sanuj Bhatia Published

-

A Pop of Fun

A Pop of FunYouTube's new 'Like' button animations bring a playful twist to your viewing experience

By Nickolas Diaz Published

-

More about Apps & Software

-

-

The $1 billion pivot

The $1 billion pivotDisney invests $1 billion in OpenAI to put Mickey Mouse inside your text prompts

By Jay Bonggolto Published

-

You're the captain, now

You're the captain, nowSpotify’s ‘Prompted Playlists’ lets you take more control of its algorithm

By Nickolas Diaz Published

-

Getting personal

Getting personalTrump's proposed travel rule demands social media history from tourists

By Nickolas Diaz Published

-