Exclusive: Meta's new smart glasses are great and everyone should be worried

Imagine the AR race is over. Meta won. Now, we're left with the 'Eye Glow' problem.

Enjoy our content? Make sure to set Android Central as a preferred source in Google Search, and find out why you should so that you can stay up-to-date on the latest news, reviews, features, and more.

This is an exclusive column featuring expert analysts from International Data Corporation (IDC), who provide insights into the latest products, news, and more.

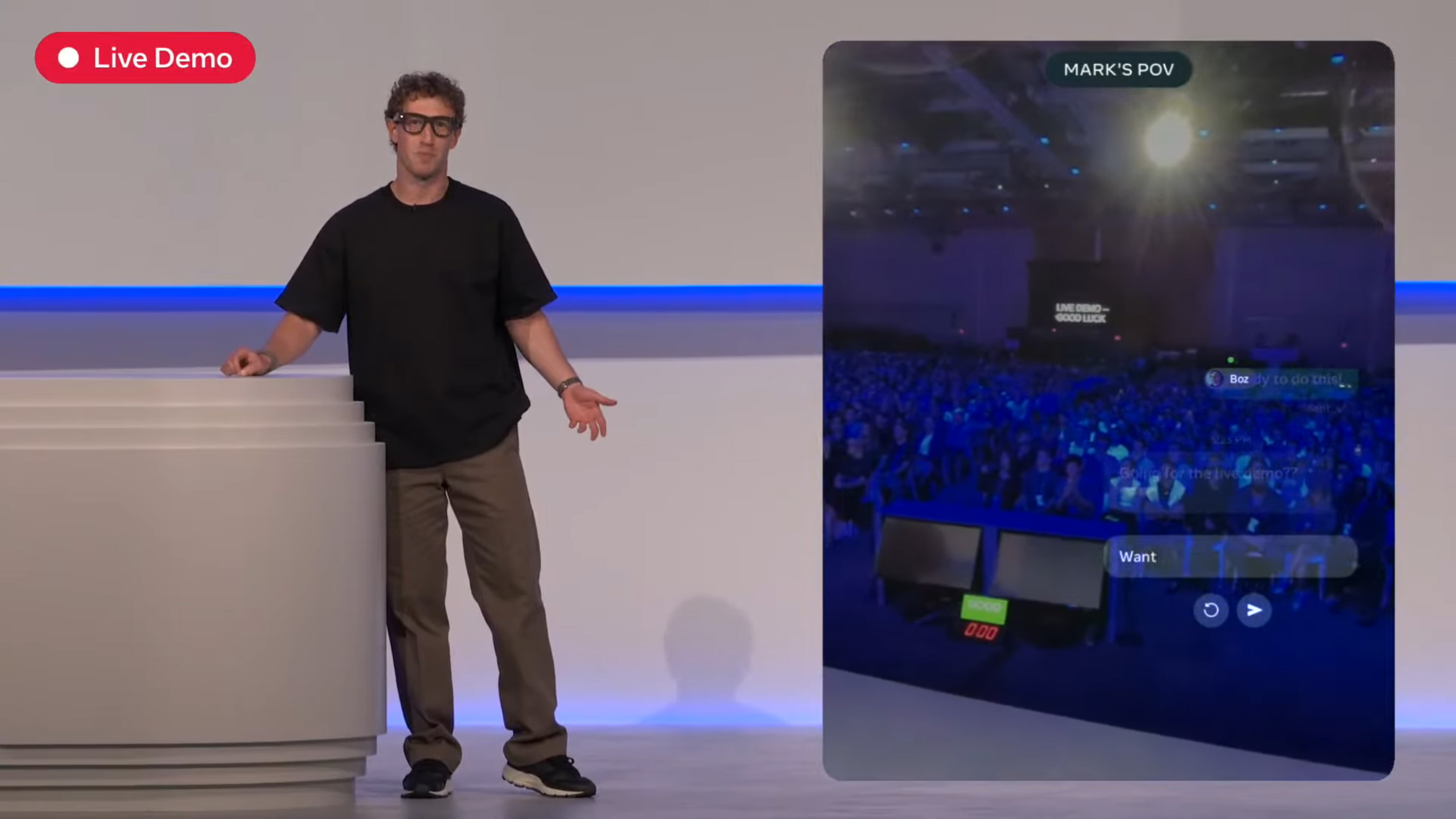

The smart glasses arms race is officially on, and Meta just fired a massive shot across the bow. With the launch of their latest lineup, including the updated Ray-Ban Meta (Gen 2), the new Oakley Meta Vanguard, and the groundbreaking Meta Ray-Ban Display, Meta isn't just releasing new hardware—they're cementing their lead in a market that's just starting to heat up.

Meta's hardware advantage and genius strategy

For anyone betting on the "wait and see" approach from Android XR or others, it's time to get real. The future of AR is here, and it's wearing Ray-Bans. But the implications aren't just for Meta's competitors; there are potential long-term risks for consumers too.

The Ray-Ban Meta (Gen 2) and Oakley Meta Vanguard are natural extensions of Meta's long-standing partnership with the eyewear giant EssilorLuxottica. While they may not have a display, they're critical to Meta's strategy. These aren't just minor upgrades; the inclusion of an improved camera is a welcome one, as photo and video capture remains the primary use case for these glasses.

But the real genius here isn't just the hardware. It's the strategy. The partnership with a luxury eyeglass maker provides these smart glasses with an extensive distribution network, including physical stores and e-commerce sites, that the competition simply does not have. Plus, with the addition of Oakley, Meta is tapping into the athletic and performance-driven crowd, broadening the appeal of its hardware beyond the tech-savvy crowd.

It doesn't just end with distribution or new designs. Meta's glasses have a huge installed base with over 3.5 million units of their previous Ray-Ban Meta glasses already shipped as of the second half of 2025, according to IDC estimates.

Think about that for a second. While Google and its partners are still in the R&D phase, figuring out how to get a display into their glasses, Meta has millions of users already capturing photos and videos, sharing their lives, and getting comfortable with the idea of tech-enabled eyewear. This isn't a small detail—it puts Android XR firmly on the back foot. They're not just competing on features; they're competing on adoption.

The price war and competitive threat

And now, for the main event: the Meta Ray-Ban Display. These are the first smart glasses from Meta to include a display, and on a technical level, they offer a unique AR experience that has been out of reach for consumers until now. The $799 price point is a bold choice. It strongly suggests that Meta is willing to heavily subsidize its hardware or at least offer it at a minimal markup.

Get the latest news from Android Central, your trusted companion in the world of Android

The price is high enough to limit appeal to early adopters, but it sets unrealistic expectations for consumers who expect future iterations and competing versions to be offered at a similar or lower price. While this is great news for consumers in the short term, it's a huge problem for the competition. Meta's willingness to subsidize its hardware—something they've done with their Quest headsets to great success—puts Google and its partners at a severe disadvantage.

Historically, Google hasn't been willing to play this game of hardware subsidies to the same extent, which means its partners will have a hard time competing on price. This strategy crowds out competing vendors and allows Meta to solidify its market position without worrying about rivals. For consumers, this is a double-edged sword. While it means access to advanced tech at a lower price now, a lack of competition in the long run could stifle innovation and lead to higher prices, along with a more restricted ecosystem down the road.

Android XR's technical and timeline disadvantage

Adding insult to injury, based on what I've heard from some folks in the industry, similar Android XR glasses with displays likely won't hit shelves until late 2026, and even that may be an ambitious timeline, so it likely won't happen until 2027. By the time they finally hit the market, Meta will have had close to a two-year head start.

Furthermore, the Android XR demos we've seen so far lag Meta in some critical areas. One issue is the lack of a discrete input method. While Meta's neural band introduces a novel and subtle interface, allowing users to navigate on-screen menus through subtle, intentional gestures, Android XR seems to be a step behind.

Another technical detail that highlights Meta's advantage is their choice of display technology. While Android XR demos have been seen using refractive waveguides, which often increase "eye glow" on the wearer's face—potentially creating social friction—Meta's use of geometric waveguides is a game-changer.

This technical choice results in a much more natural appearance and puts significant pressure on Android XR to find a solution that doesn't make users feel like they're walking around with a glowing screen on their face.

Meta's tricky limited rollout and consumer risk

Initially launching the Display glasses exclusively in the U.S. and with a limited, curated rollout in select physical retail locations, Meta is taking a cautious, hands-on approach. These stores will offer a tailored experience to ensure proper fit, screen alignment, and onboarding for new users. This isn't just about selling a product; it's about educating the market.

By focusing on familiar experiences such as messaging and social media—thanks to the deep integration with services like Instagram, WhatsApp, and Meta AI—the company is easing consumers into this new computing paradigm.

Viewing the product from this lens, the Meta Ray-Ban Display isn't just a consumer product; it's a public prototype. It's designed to gather feedback and evolve, serving as a precursor to Meta's more advanced Orion glasses that were displayed at the company's 2024 developer conference, which offered a full AR experience.

By the time Android XR finally enters the market in a meaningful way, Meta will have had years of real-world data, millions of users, and a deeply entrenched ecosystem. The Meta Ray-Ban Display allows the company to widen and deepen its moat in the smart glasses market, and with every new release, that moat gets harder for the competition to cross.

The message is clear: the future of smart glasses is here, and Meta is ready to own it. The question is, can Android XR catch up? More importantly, what happens to consumers when one company has a near monopoly on technology that is so personal and integrated into our daily lives?

Jitesh is a Research Manager for the Worldwide Mobile Device Trackers, including Wearables, Augmented Reality (AR), Virtual Reality (VR), tablets, and phones.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.