Google Wallet Card now available to order, ships in 10-12 days

One card can be used to access funds from a variety of other cards and accounts

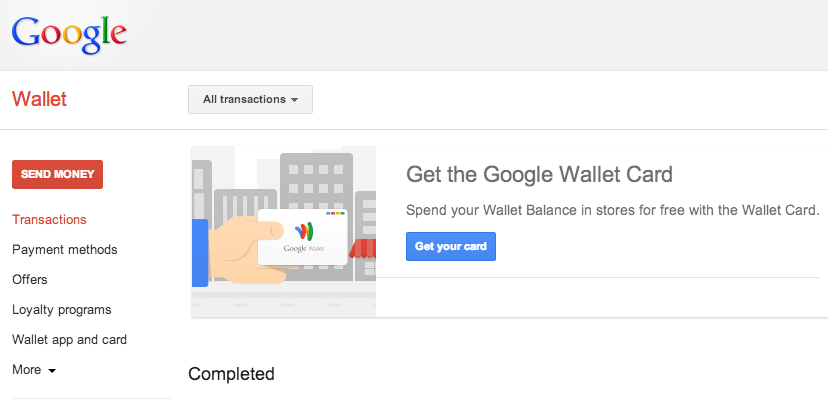

While the NFC-based Google Wallet payment system may not have taken off, Google is taking another swing at things with a physical Google Wallet Card. Yes, this is actually a physical credit card that basically fills the same role as the Google Wallet app tried to do previously, acting as a prepaid debit card that then pulls funds out of any connected account.

The Google Wallet Card is a physical prepaid debit card that allows you to access your Wallet Balance in the real world, at ATMs, banks, and wherever MasterCard® Debit is accepted.

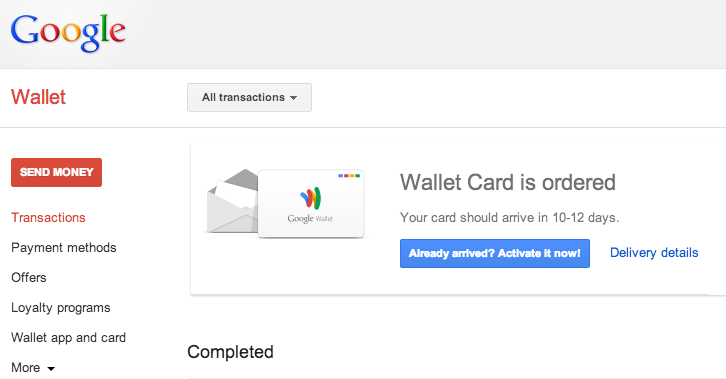

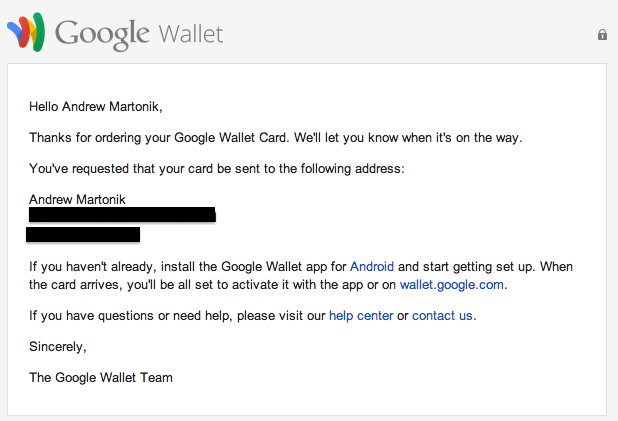

If you're in the U.S. and have the option to get a Google Wallet card, you'll be prompted in the Google Wallet app or on the Google Wallet website, where you'll then have to verify your identity and request the card. Verifying your identity is as simple as giving your name, address, birth date and social security number, but Google already had the necessary information from previous purchases for us to order with just two clicks.

The card will arrive in 10-12 days according to Google, and you'll be ready to activate it and set it up for payments thereafter. Presumably the experience will be much the same as the NFC system now, without the hassle of wondering if the retailers you visit most have the proper equipment — Google Wallet card will be accepted anywhere MasterCard already is.

More: Google; +Google Wallet; Google Commerce Blog

Get the latest news from Android Central, your trusted companion in the world of Android

Andrew was an Executive Editor, U.S. at Android Central between 2012 and 2020.