Samsung tops a declining smartphone market thanks to the Galaxy S22, A-series phones

Smartphone shipments are down worldwide, but Samsung is sitting pretty, thanks to the Galaxy S22.

What you need to know

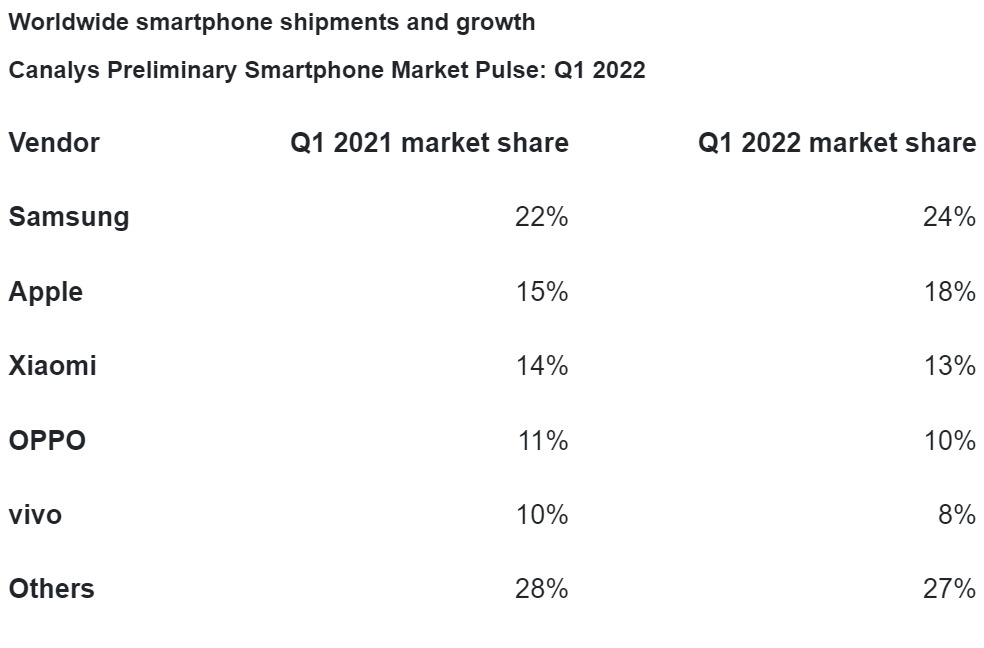

- Smartphone shipments were down 11% in the first quarter of 2022 when compared to Q4 2021.

- Samsung held the top spot with 24% market share, up from 22% the previous quarter.

- Apple's share also rose, while Chinese OEM fells in the first quarter.

The smartphone industry is feeling the effects of lower demand and economic strain as shipments fall by 11% in the first quarter of 2022, according to a preliminary report from Canalys.

The report lists the top brands by shipments for early 2022, with Samsung leading the pack with a 24% market share. That's notably up from 22% during the previous quarter, likely due to the launch of its mid-range smartphones and its flagship Galaxy S22 series.

Apple held onto second place and also saw shipments rise, bringing its market share up from 15% to 18%. That's fairly impressive as the company is in the middle of its flagship cycle after launching the iPhone 13 back in September. However, it seems the recent launch of the affordable, 5G-touting iPhone SE may have helped despite reports that it's seeing "lackluster" demand.

Canalys Analyst Sanyam Chaurasia says that Apple and Samsung were able to beat the odds by diversifying their product portfolio. "While the iPhone 13 series continues to capture consumer demand, the new iPhone SE launched in March is becoming an important mid-range volume driver for Apple. At a similar price point to its predecessor, it offers an upgraded chipset and improved battery performance and adds the 5G connectivity that operator channels are demanding."

"At the same time, Samsung ramped up production of its popular A series to compete aggressively in the mid-to-low-end segment while refreshing its 2022 portfolio, including its flagship Galaxy S22 series."

Curiously, Chinese vendors such as OPPO and Vivo saw their market share fall during the same period. Canalys VP of mobility, Nicole Peng, notes that there are several variables concurrently affecting the market. "The global smartphone market was held back by an unsettled business environment in Q1," Peng says in a statement on Wednesday. "Markets saw a spike in COVID-19 cases due to the Omicron variant, though minimal hospitalizations and high vaccination rates helped normalize consumer activity quickly."

"Vendors face major uncertainty due to the Russia-Ukraine war, China’s rolling lockdowns and the threat of inflation. All this added to traditionally slow seasonal demand. Vendors must equip themselves to respond quickly to emerging opportunities and risks while staying focused on their long-term strategic plans. The good news is that the painful component shortages might improve sooner than expected, which will certainly help relieve cost pressures."

Get the latest news from Android Central, your trusted companion in the world of Android

With inflation affecting prices everywhere, it may be more important than ever for companies to lean on their mid-range and lower-end products, which would be more palatable for consumers' wallets. For example, Google is expected to launch the Pixel 6a very soon as an affordable alternative to its latest flagship series. As it will likely be powered by the same Tensor chipset, the phone could see quite a bit of success as an Android alternative to the iPhone SE and thus become one of the best budget Android phones of the year.

Derrek is the managing editor of Android Central, helping to guide the site's editorial content and direction to reach and resonate with readers, old and new, who are just as passionate about tech as we are. He's been obsessed with mobile technology since he was 12, when he discovered the Nokia N90, and his love of flip phones and new form factors continues to this day. As a fitness enthusiast, he has always been curious about the intersection of tech and fitness. When he's not working, he's probably working out.