How to review all of your online subscriptions & save money

Chances are you spend a lot more on online subscriptions than you realize. It might sound like only $5 here and $10 there, but it really does add up when you sit down and actually take stock of everything together.

I recently went through to review my online subscriptions, and while I wasn't completely thrown for a loop at the final total, it was certainly more than even I had thought.

There are ways, however, you can save money by doing things like bundling subscriptions, getting rid of ones you don't use, and consolidating services where possible.

Go through your subscriptions, one-by-one

Your online subscriptions used to be reserved to just a cell phone, home Internet, and maybe cable or satellite TV. Now, it includes all of the above (or at least the first two) along with a streaming TV service subscription (probably more than one), streaming music, online storage, apps (games, news, and more), and video game online player subscriptions (like with the new PlayStation 5, for example, should you be one of the lucky few to have gotten your hands on one).

Then, there are those online subscription boxes you pay for every month (Dollar Shave Club or FabFitFun, anyone?), digital magazines, and home security monitoring. I'll bet anyone reading this has already had their "oh yah" moment when realizing that they had completely forgotten about a subscription or two.

How to audit your monthly subscriptions

Manual process

To make sure you catch everything and anything under the sun that you subscribe to, including those recurring monthly charges you always forget to count, take a deep dive into your credit card statements. Pull out the last three months' worth and scan them, line by line, for anything that's a recurring charge. When you find something, jot down the name, amount, and how often you're billed (monthly, quarterly? Every two weeks? Weekly?) Tally it all up when you're done. For subscriptions that might vary based on usage, take the average from your last three months to get a ballpark figure.

Get the latest news from Android Central, your trusted companion in the world of Android

If you want to get really organized, input the data into a spreadsheet, organizing subscriptions into categories like communications (smartphone, Internet), entertainment (streaming TV and music), business (cloud storage, security), and so on.

Then, see what you can budget based on your personal or household annual income, after factoring in all essential bills (mortgage/rent, utilities, groceries, gas, recurring payments for things like a car, miscellaneous expenses, like appliance repairs or gifts, and savings). Are you over or under? If you're over, which nine times out of 10 you probably will be, it's time to move on to the next step.

Automate the process

If you want to go automated, consider using an app into which you can plug in the numbers and it will calculate the data for you. Google's recently-revamped Google Pay app aims to help out with this, allowing you to link your bank account and credit cards so you can see exactly where money's coming and going. You'll also get reminders of any upcoming bills that Google detects, making it easy to catch a subscription that you may have otherwise forgotten about.

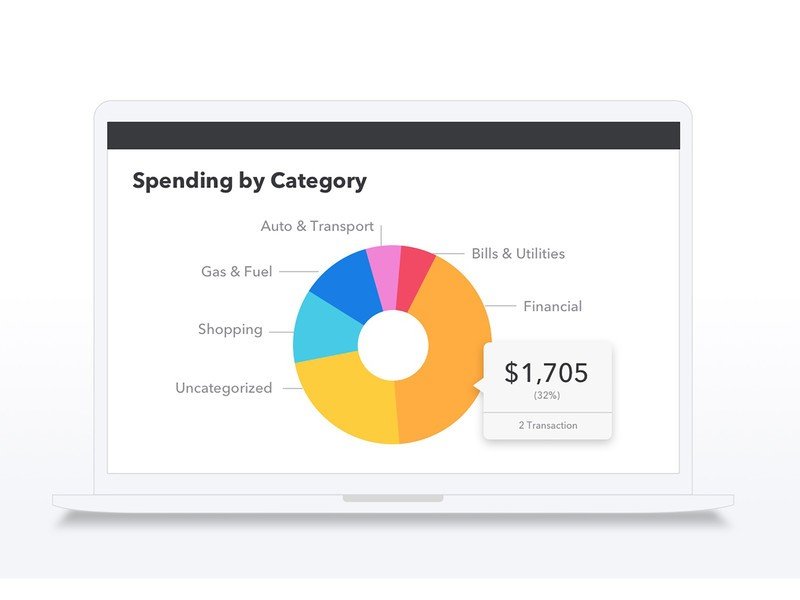

If you're looking for something that's been around a bit longer, check out long-time favorite Mint. Add bills to a dashboard, create and manage budgets, and get suggestions based on spending. After inputting all of your spending, the app will calculate the average per category to help you create a budget based on those spending patterns. But it will also provide a visual first so you can see exactly how much you're spending on what, and in which category, over the span of a month or even annually.

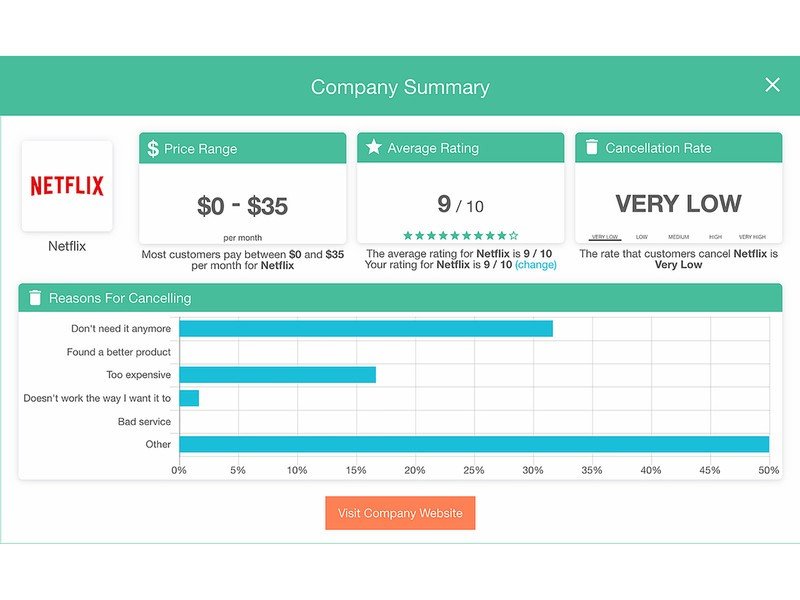

While Mint is more for managing overall spending, Truebill has some neat features specifically designed for managing subscriptions. After linking your bank account to the app, it can group together all recurring payments so you can see them in one spot. If you notice that you are still subscribing to SiriusXM radio in your car, for example, when you barely drive, you can make a decision to cancel it. The necessary contact information for services is included in the app to prevent you from procrastinating and "doing it later."

With the premium version of Truebill, you get automated cancellation, live chat support, and the ability to sync your account so you don't have to manually plug in figures. Sure, it's ironically another subscription to add to the list. But $3/mo. may end up saving you far more.

TrackMySubs is another interesting option. A Chrome extension, once downloaded, you have to manually add the details for each service you subscribe to. But once you've gone through this process, it's easy to manage everything. You can see in one easy-to-read dashboard, converted into colorful charts, exactly what you subscribe to, how much each one is, and when each subscription is due to renew (ideal for services for which you want to cancel before free trial periods end!)

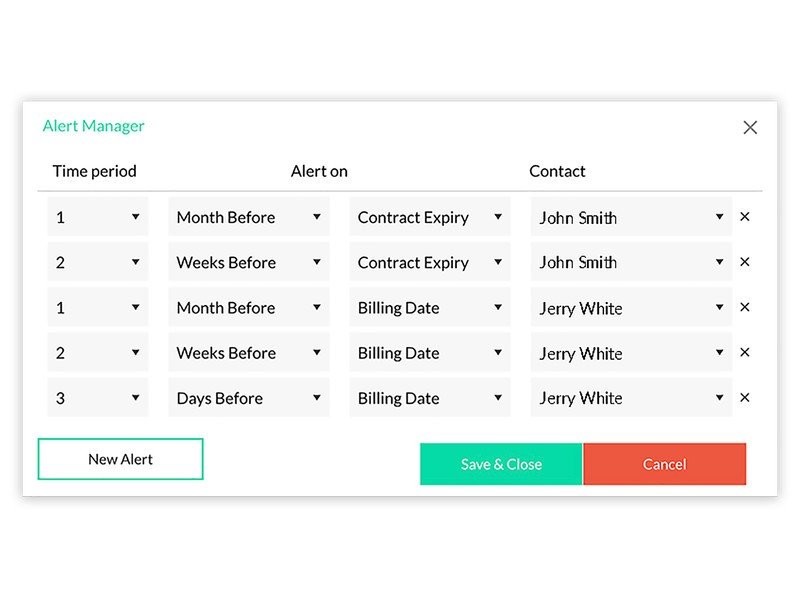

The app can send notifications when a payment is coming up and lets you see the payment history. You can only track up to 10 services and store up to 10MB of data with the free tier, but upgrade to the premium for $5/mo. to get even more, along with the alerts feature.

A single app for all things money

The new Google Pay isn't perfect, but it sure is powerful. Along with being able to send money to friends and earn cashback rewards on your purchases, you can also link your external accounts to see what's going on with your spending. You'll also get notifications about upcoming bills/subscriptions!

Keep track of your subscriptions

Once signed up, you can enter your bills then see exactly how much you spend and on what each month. Spending will be automatically put into categories so you can also see what you spend in each category. Focus on just subscriptions or use the app for auditing all of your personal finances.

Group subscriptions together

Once this handy extension is installed and synced to your bank account, it will group all recurring payments together so you can view your subscriptions in one place. It's easy to cancel any redundant ones as well thanks to contact information for each service displayed right in the app.

Easy-to-read dashboard

Store data for up to 10 subscriptions with the free tier, being able to manage not only spending but also renewal dates; and get important alerts. Upgraded packages start at $5/mo. for up to 20 subscriptions with unlimited alerts and 100 MBs of file storage, all the way up to $15 for unlimited features and up to 1GB of storage).

How to save money on your monthly subscriptions

Now that you have figured out what you are spending, it's time to figure out what you can cut in order to save money.

Look for duplicates

First, look for duplicates. Are you subscribed to several streaming music services, for example, when they all have a similar selection of songs and playlists you can stream on the devices you want? Consider keeping only one – either the one that's compatible with the most devices, the one that has your best curated playlists, or the one with the best quality audio. In some cases, it might make sense to just stick with a service like Amazon Prime Music since it comes with an Amazon Prime subscription, which means you're paying for it anyway.

Cancel until you really want it

For streaming video services, this is where it can get tricky. Every service has its own original content, and certain TV shows or movies are exclusive to certain services. So, you might be fine with just Netflix, but what happens when you want to watch The Handmaid's Tale? Or The Boys? It might be worth considering canceling the subscriptions for services that you only use to watch one or two shows and sign back up again when a new season comes out.

With most of these services, you can cancel at any time. Imagine if you had canceled Disney+ for the almost one-year period between seasons one and two of The Mandalorian and signed back up at the beginning of November once season two was out? You would have saved over $100! If you only sign up to watch that one show, cancel the subscription again come January 2021, and sign back up when season three is released.

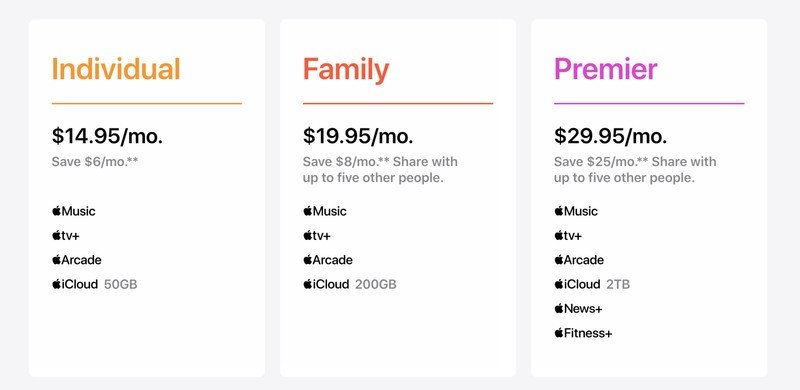

Bundling

Bundling is another way to save. Apple, for example, has its Apple One plan that lets you pick and choose up to six Apple services to bundle together in one subscription that can save you money. It ranges from Apple Music to Apple TV+, Apple Arcade, and other services.

Some apps and services offer coupons and other ways to save money on a per-subscription basis. Others offer bundles that can help you save money and are worth looking into. Did you know, for example, that you can get a Disney+, Hulu, and ESPN+ together for a single price of $12.99? The version of Hulu includes ads, but they make perfect pauses for bathroom and snack breaks. You can also get Hulu with HBO together for about $21/mo., after which you can add on other channels like Cinemax, Showtime, and Starz for additional fees. (And any cancel at any time).

There's also a Prime Video and HBO bundle, which will afford access to HBO content right from the Prime Video app, making not only billing convenient but also access.

Look for special offers

Keep an eye out for specials based on your age or status as well. Spotify, for example, has a deal specifically for higher education students that includes Spotify Premium, ad-supported Hulu, and Showtime for $4.99/mo.

Deals like this are always popping up so check in to see what's available to you from each of your favorite services.

Another "special offer" worth taking advantage of is the free trial. If there's only one show or movie you really want to watch, or you just want to be able to play music for your Christmas party without distracting ads, sign up for the free trial period – which can be anywhere from seven days to a month or even up to three - then cancel before the subscription renews and you have to start paying. You might very well discover you like the service better than another one you have and end up canceling something else instead. But if not, you have every right to cancel a service if you aren't interested anymore after the trial period ends.

Take advantage of cashback deals

If you use apps like Rakuten or Drop, you can take advantage of exclusive promotions and get cashback just for signing up for a new subscription. These are often reserved for new subscribers to services, so if you only need to use something like HBO Max for a month or two, you might as well sign up with one of these offers and get some money back.

The Google Pay app recently introduced cashback rewards as part of its design, so make sure you get those enabled and keep an eye out for any deals that catch your fancy.

Downgrade subscriptions

Look at downgrading subscriptions as well. Are you paying for 30GB of data on your smartphone, for example, when you barely use 1GB every month? It might have seemed like a great deal at the time, but if you aren't using it and can get a much better plan based on your typical usage, it's worth talking to your service provider.

Do you have the highest tier cloud storage subscription when half of the content you're backing up is blurry smartphone photos and throwaway videos? Take the time to go through your backups, delete things you don't need, then look at cheaper plans for less storage. Or consider getting a local hard drive to back up some content that you don't have to pay for monthly.

Cancel app subscriptions

You can easily manage all of your Google Play subscriptions by doing the following:

- Open Google Play

- Tap the Menu icon in the top, left corner

- Tap the "Subscriptions" tab

- Review the list of recurring purchases

- Edit payment options or cancel

For iOS users, the process is similar for services to which you subscribed from the App Store.

- Go to Settings

- Click on your name at the top (where it says "Apple ID, iCloud, Media & Purchases) underneath

- Click "Subscriptions" (if you don't have any, nothing will show up and you can move on!)

- Review the list of service subscriptions

- Edit options, like downgrading, choosing a family plan instead, or canceling a subscription altogether

Bringing it all together

It isn't a quick and easy task to manage and review online subscriptions, but an important one to take the time to do. It will open your eyes as to just how much you spend every month, sometimes on services and things you can live without or even don't use.

Once you have everything organized, sit down and figure out what can go and what can stay. The great thing about most online subscriptions is that you can cancel at any time without penalty and sign back up again at any time if you change your mind. It might take some digging to figure out how to cancel, but in most cases, it's simply a matter of calling customer service or going into the app, software, or website and finding a "cancel subscription" option.

In some cases, especially if you call by phone, the company might even offer an incentive to keep you onboard, including discounts or added features. Don't get sucked in unless it's really worth it. If it is, at least making the effort could end up saving you money and allowing you to keep a service you were reluctant to cancel.

Sit down and think about what services and subscriptions you actually use and when. Chances are a good chunk of the subscriptions you have can be eliminated, leaving extra funds to put towards more tangible goods, or maybe even a new subscription you would use.

Christine Persaud has been writing about tech since long before the smartphone was even a "thing." When she isn't writing, she's working on her latest fitness program, binging a new TV series, tinkering with tech gadgets she's reviewing, or spending time with family and friends. A self-professed TV nerd, lover of red wine, and passionate home cook, she's immersed in tech in every facet of her life. Follow her at @christineTechCA.