Google Wallet explained: Licenses, banks, new features, and the Google Pay shutdown

Google Wallet replaced Google Pay, which will shut down soon. Here's all the latest news and added features you need to know.

Get the latest news from Android Central, your trusted companion in the world of Android

You are now subscribed

Your newsletter sign-up was successful

Google Wallet is the default payment, ID, and transit pass app for most Android phones, supplanting Google Pay. The term "Google Pay" still exists for making contactless NFC payments in stores, but you use the Google Wallet app for those transactions.

Now that the Google Pay app is shutting down later this year, you're probably curious which Pay features will transfer over to Wallet. You may also have heard that Google Wallet supports features like driver's licenses, tickets, and medical info, and you may want to know how to access these.

Our in-depth Google Wallet guide will break down its history, list of key features, recent news and updates, and everything else you need to know!

Google Wallet, summarized

The original Google Wallet launched in 2011 as a Nexus phone exclusive for contactless credit card payments at specific locations. A lack of NFC-enabled phones, insufficient retail partnerships, and little consumer interest sunk the initiative.

Android Pay took Wallet's place in 2015 as a payment system with much more business support and infrastructure, while Wallet scaled down into a peer-to-peer payment system.

By 2018, both services had consolidated into the Google Pay brand, a single app for both tap-to-pay and sending money to friends, and Google Wallet ceased to be. Over time, Google Pay added boarding passes, event confirmations, transit balances, and other tools that weren't strictly "payments."

Google's love of renaming services for a marketing boost came full circle in July 2022, when it rebranded its payment service to Google Wallet once again. Google Pay persisted as a peer-to-peer payment app with its wallet-like features removed, but it will shut down on June 4, 2024.

Get the latest news from Android Central, your trusted companion in the world of Android

Google Wallet will continue to support "Google Pay" payments in stores worldwide. It won't enable P2P payments like the original Pay app, however, and your current Google Pay balance will only be transferrable through the website once the Pay mobile app shuts down.

Google Wallet supports a variety of banks and credit cards across over 80 countries. It also supports a variety of other passes, IDs, and stored information that we'll break down in the next section.

Generally speaking, Google Wallet pulls information from other Google apps on Android phones. So, for example, if you receive an email on Gmail with a delayed flight time, it'll notify you and change the stored boarding pass information.

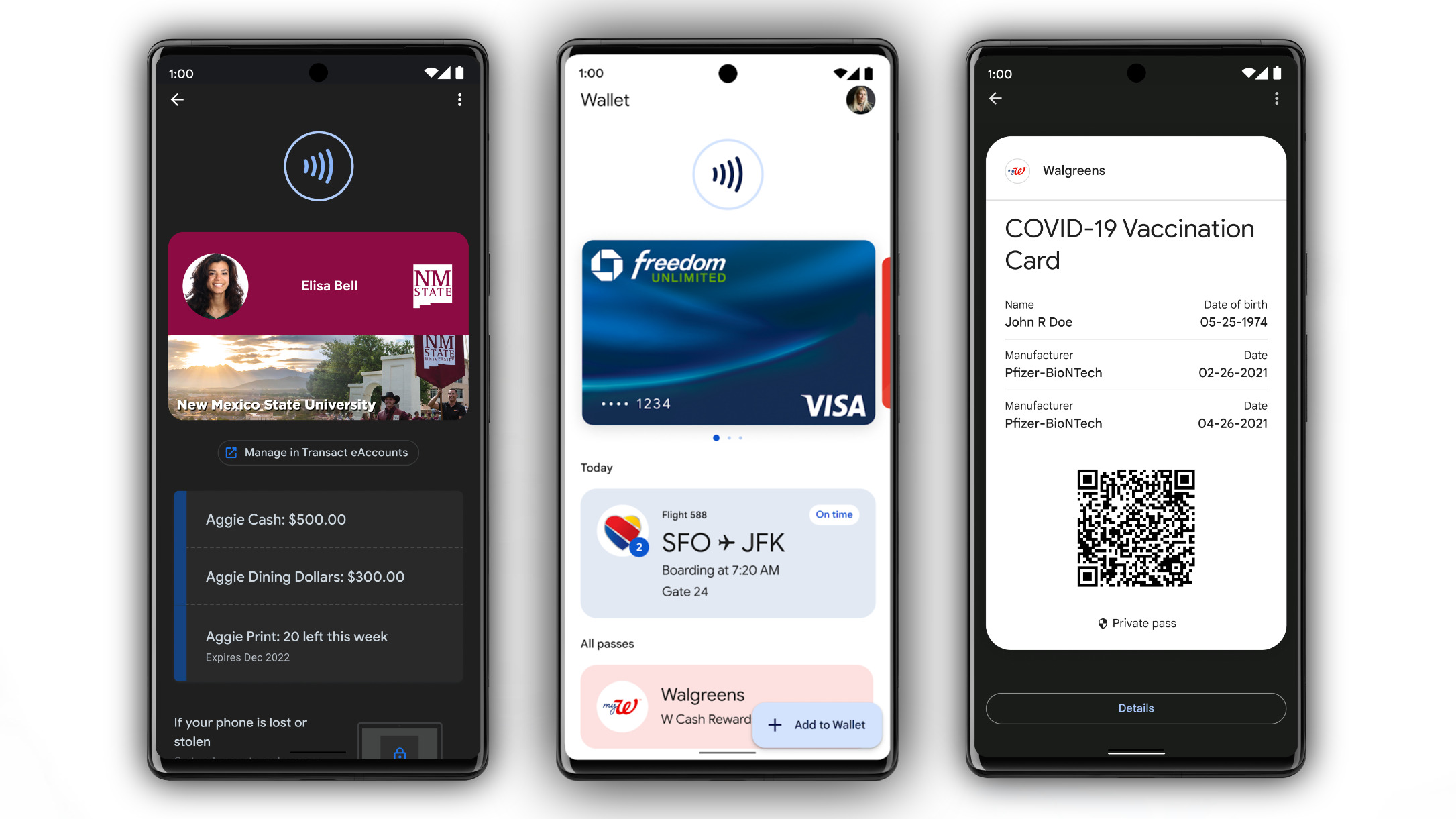

What can you store in Google Wallet?

First and foremost, you can deposit credit and debit cards in Google Wallet. Most banks and cards are compatible, and Google has added dozens of new banks in 2024 to fill out the list before Google Pay's shutdown. You can ensure your bank is included by checking the list of supported contactless payments sorted by country.

As a sidenote, we have a guide on how to lock down your Google Wallet cards if your phone is stolen, so that the thief can't use tap-to-pay with those stored cards.

You can add your loyalty or membership cards, then tap your phone or watch to apply discounts or balances, or even pay directly for items. Check if your loyalty card is eligible by tapping Add to Wallet > Loyalty card and entering the program name.

Plus, you can keep your boarding passes and event tickets in Google Wallet, so entering a plane or stadium is as simple as pulling them up and tapping your phone. In March 2024, Google updated Wallet so that Gmail confirmation emails automatically export passes to Wallet, saving you the trouble.

Google Wallet also hosts transit cards and parking passes, though once again, there is no guarantee that your local public transit or parking system will support Google Wallet without checking. Currently, San Francisco, Washington, D.C., and Toronto are the only cities to support Google Wallet transit passes or payments.

You may add COVID-19 vaccine passports or other medical info to Google Wallet as well.

Other Google Wallet functions include digital car keys, corporate office passes, and hotel keys. Digital car keys require a relatively recent phone running Android 12 or later, and not all cars will support them. As for corporate badges, only 10 countries support corporate passes today, and your employer must buy into the program.

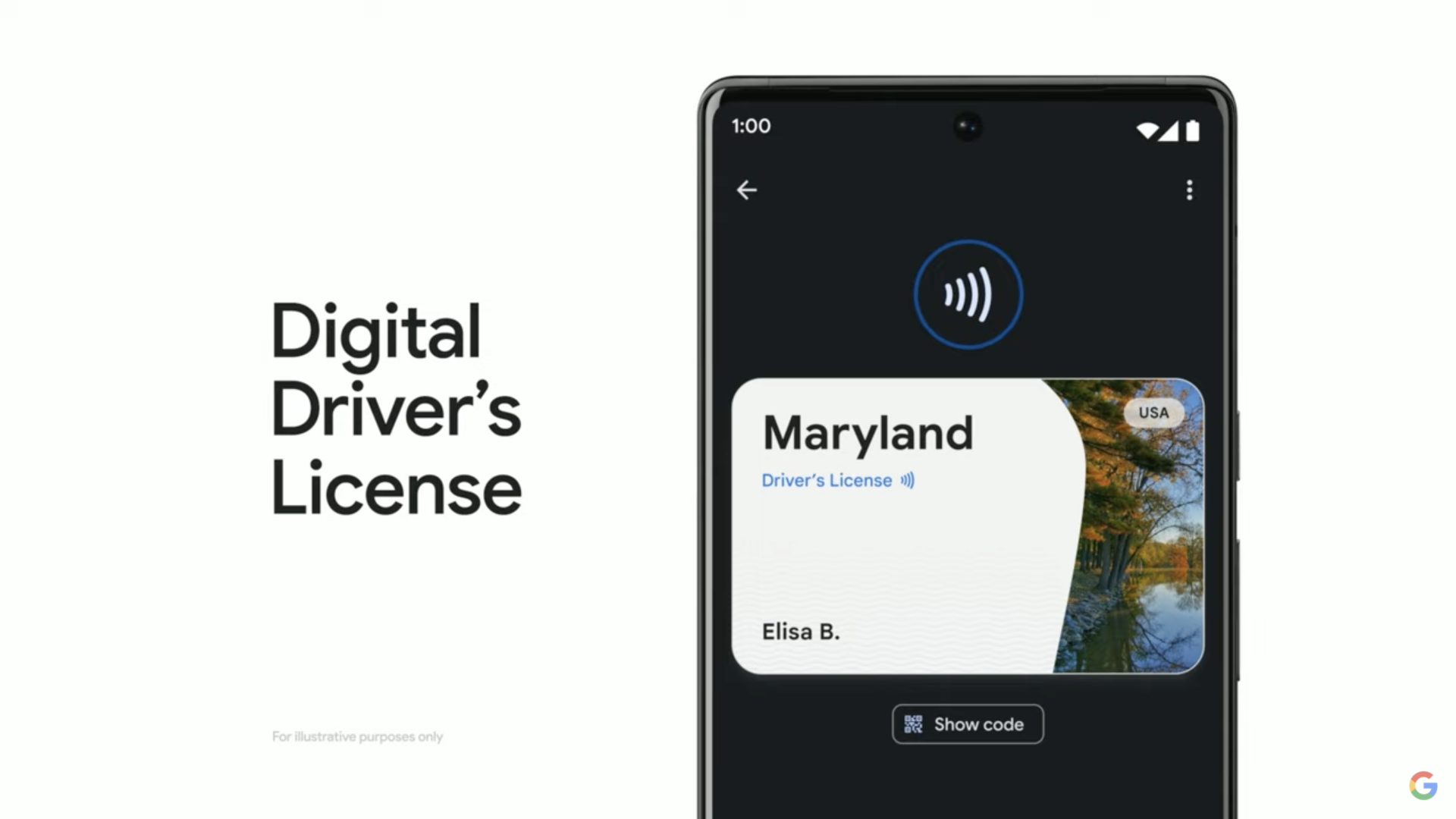

Google's biggest challenge, however, will be to enable digital driver's licenses or student IDs. Certain American states have begun to support digital IDs, but it's extremely limited at the moment.

Can I store my driver's license in Google Wallet?

During Google I/O 2022, VP of Product Management Sameer Samat announced on stage that "we're working with states here in the U.S. and governments around the world to bring digital IDs to wallet later this year, starting with driver's licenses."

That statement turned out to be a bit optimistic: The ID program did launch in Maryland by the end of 2022, but Google took until October 2023 to add digital ID support for Arizona, Colorado, and Georgia residents.

Dong Min Kim, Google's director of product management for Google Wallet, did promise in January that "Digital ID will be a cornerstone for us in the next year" and that more states' IDs will come to Wallet in the coming months. But we've yet to hear anything since, and there are regulatory hurdles to making this happen.

To add a driver's license to Google Wallet, you'll need an Android phone (version 8 or higher) with Bluetooth and Nearby Devices active and a screen lock protecting it.

With all of those prerequisites fulfilled, you can simply open the Wallet app and tap Add to Wallet > ID card. You'll then have to take photos of the front and back of your ID, then record a short video of yourself to submit for verification. At that point, you should be able to use your ID in lieu of a physical card at participating airports.

As for adding a student ID to Google Wallet, we have a guide for that as well, but it will once again depend on whether or not your school supports the feature.

Google Wallet: Banks

We can't possibly include the full list of Google Wallet banks here, so we'll link you to this Google Support page that has a dropdown menu linking to each country's list of banks.

Just for the United States alone, the list of "other participating banks" appears to have thousands of options. Once you've selected a bank in Google Wallet, you'll most likely need to log into the bank's website, or enter a PIN or authorization code.

You can also choose to make Paypal a payment method in Google Wallet, though only in the United States and Germany.

Which countries support Google Wallet?

Currently, Google Wallet has replaced Google Pay in the following 80 countries, listed below:

- Albania

- American Samoa

- Argentina

- Armenia

- Australia

- Austria

- Azerbaijan

- Belgium

- Bermuda

- Bosnia and Herzegovina

- Brazil

- Bulgaria

- Canada

- Cayman Islands

- Chile

- Columbia

- Costa Rica

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Dominican Republic

- Ecuador

- Estonia

- Faroe Islands

- Finland

- France

- Georgia

- Germany

- Greece

- Greenland

- Guam

- Guernsey

- Hong Kong

- Hungary

- Iceland

- Ireland

- Isle of Man

- Israel

- Italy

- Japan

- Kazakhstan

- Kyrgyzstan

- Kuwait

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malaysia

- Malta

- Mexico

- Moldova

- Monaco

- Montenegro

- Morocco

- Netherlands

- New Zealand

- North Macedonia

- Northern Mariana Islands

- Norway

- Peru

- Poland

- Portugal

- Puerto Rico

- Qatar

- Romania

- San Marino

- Serbia

- Singapore

- Slovakia

- Slovenia

- South Africa

- Spain

- Sweden

- Switzerland

- Taiwan

- Thailand

- Ukraine

- United Arab Emirates

- United Kingdom

- United States

- U.S. Virgin Islands

- Vietnam

Google Wallet vs. competing payment apps

Android users, specifically Samsung phone owners, have two main choices for their payment app: Google Wallet or Samsung Wallet. The latter launched around the same time as Google Wallet, combining Samsung Pay and Samsung Pass into one service. Sound familiar?

Like Google Wallet, Samsung Wallet collects your digital payment cards, boarding passes, vaccination cards, and digital car keys, with the eventual goal of adding IDs and licenses.

Unlike Google Wallet, Samsung Wallet stores passwords, a remnant of the feature on Samsung Pass. Plus, anyone invested in crypto can "monitor their digital asset portfolio by checking the value of their cryptocurrencies across various exchanges" within Wallet.

Samsung Wallet is available now, but only on Samsung phones via the Galaxy Store — whereas Google Wallet is available on all Android phones via the Play Store — and only 21 countries, well short of Google's list.

Looking beyond the Android phone ecosystem, we also have a general guide on how the five main payment systems — Google Pay, Samsung Pay, Apple Pay, Meta Pay, and Amazon Pay — compare to one another.

To briefly summarize, Google and Apple have the most robust features and widespread presence for both mobile and web payments. Amazon Pay is more limited but takes very little setup if you have a Prime account, while Meta Pay is most useful for frequent Facebook Marketplace users.

What's new with Google Wallet?

The biggest recent change to Google Wallet was a photo function, which lets you take a photo of a physical pass and have that data auto-transcribed into Wallet, rather than making you type it out yourself.

Google Wallet added support for Apple Wallet files in early 2024, though the rollout is still ongoing. People have noticed glitches, since ".pkpass" file expect you to be using an iPhone, but those glitches should be fixed over time.

Another controversy arose when Google Wallet began requiring you to verify your identity before making contactless payments in certain countries. While some countries already required this, others let you make payments indefinitely so long as they weren't above a certain threshold.

Google later created "Verification Settings" for Wallet, letting you decide in advance whether to require authentication before certain actions, such as using Wallet as a transit pass.

In late 2023, there was a Google Wallet vulnerability that exposed credit card information via a standard NFC reader. This glitch was eventually fixed.

Which smartwatches support Google Wallet?

The list of smartwatches that support Google Pay is exceedingly long. Basically, any Wear OS watch is going to support the feature, since it's a Google operating system. Even the latest Galaxy Watches let you choose between Google Pay and Samsung Pay, now that Google and Samsung have partnered for Wear OS 3.

In terms of the latest devices to add Google Wallet, both the Fitbit Sense 2 and Versa 4 have Wallet support thanks to Google's Fitbit acquisition. And of course, Google's own Pixel Watch will be the first to receive any new Wallet features and updates.

The best watch for Google apps

The Pixel Watch 2 is one of our favorite watches for Android phone owners. Its attractive soft-edge design and speedy UI make it stand out from other smartwatches, and you get all the latest Wear OS tech (like Google Wallet) before any other brand.

Michael is Android Central's resident expert on wearables and fitness. Before joining Android Central, he freelanced for years at Techradar, Wareable, Windows Central, and Digital Trends. Channeling his love of running, he established himself as an expert on fitness watches, testing and reviewing models from Garmin, Fitbit, Samsung, Apple, COROS, Polar, Amazfit, Suunto, and more.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.