All-new Affirm app aims to be an alternative to traditional credit cards

Credit cards are both awesome and terrible at the same time. They can be crazy helpful for big purchases that you need to make, but between hidden fees, outdated mobile apps, and plenty more, credit cards can often be a pain to use. PayPal co-founder Max Levchin launched Affirm in 2012 for handing out loans for online purchases, and today Affirm is launching its completely overhauled app with the goal of offering people a unique alternative for credit in the modern world.

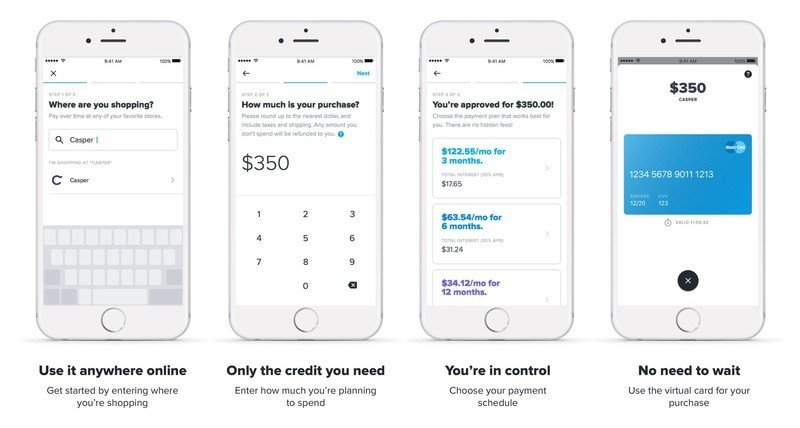

When you hop into the Affirm app, getting started with a line of credit is broken up into three easy steps. Simply type in the name of the site you'd like to shop at, the amount that your purchase will cost, and if you're approved, you'll get a few different options to choose from for how you'd like to pay off whatever item you're buying.

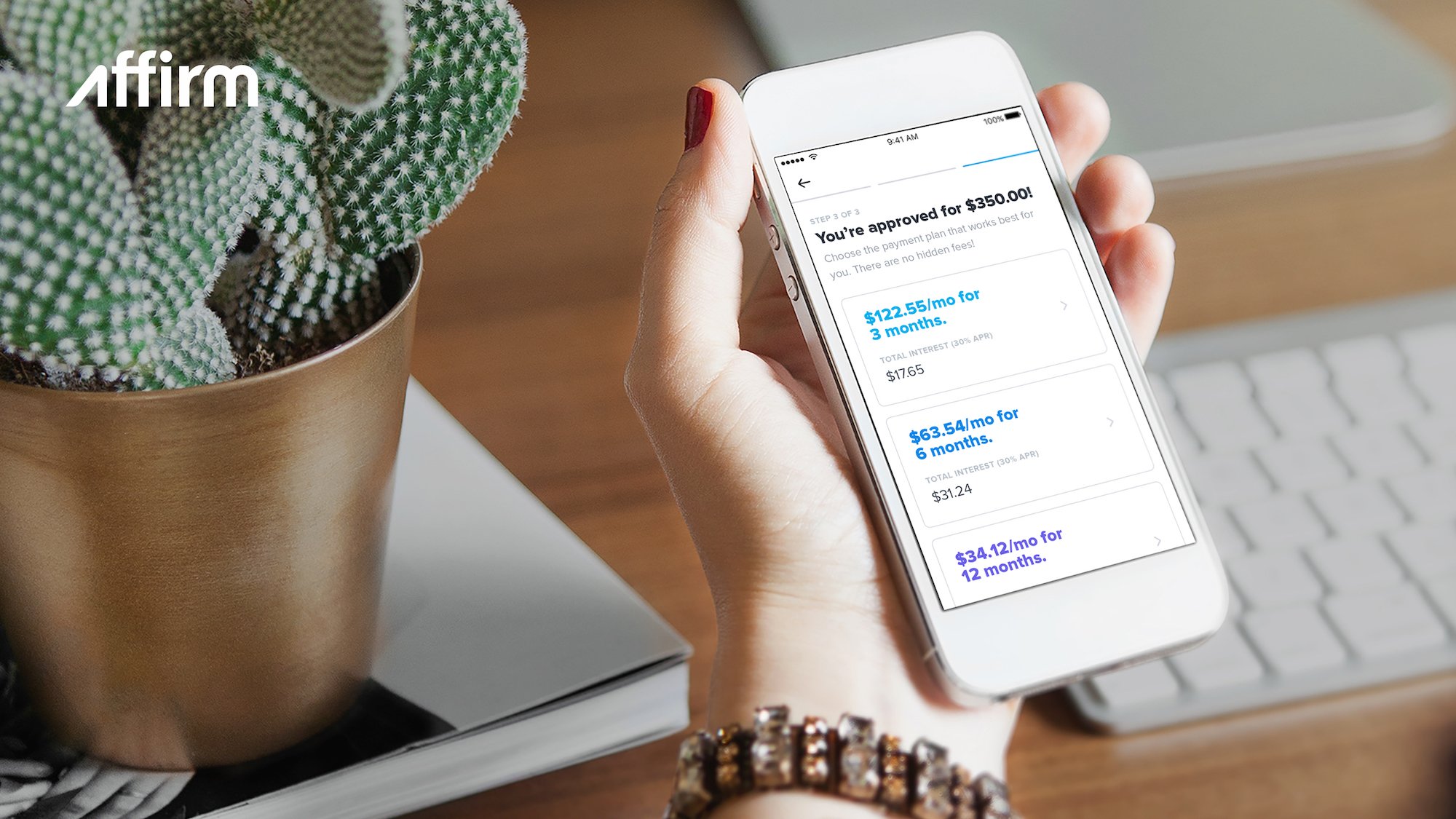

Affirm lets you pay off your purchase over the course of three, six, or twelve months, and once you select the plan that works for you, you'll be assigned a virtual, one-time credit card that's used for that purchase and that purchase only.

Interest rates with Affirm range between ten and thirty-percent, with the exact number depending on how much you need to pay for. Affirm needs to approve you for each individual purchase that's made with the app, and Affirm says that you'll be able to get credit loans for up to $10,000. Couple this with Affirm's partnership with over 1,000 different retailers/outlets and a sleek design for the mobile app, and you've got a really compelling alternative to credit cards that we've known for so many years.

If you want to give Affirm's new app a shot, you can download it now from the Google Play Store and App Store for Android and iOS respectively.

Android Pay now lets you pay with a PayPal account

Get the latest news from Android Central, your trusted companion in the world of Android

Joe Maring was a Senior Editor for Android Central between 2017 and 2021. You can reach him on Twitter at @JoeMaring1.