SMIC: Everything you need to know about China's answer to TSMC

Get the latest news from Android Central, your trusted companion in the world of Android

You are now subscribed

Your newsletter sign-up was successful

It's an interesting time in the semiconductor industry. Intel announced that it is pushing its 7nm plans to 2022 or 2023 (losing further ground to AMD), Qualcomm just posted massive profits for Q2 2020, and NVIDA may end up buying Arm, the company that designs the core instruction set that's used in every phone.

There's another thread playing out on the other side of the world. In just over a month's time, Huawei will lose access to TSMC, the largest semiconductor foundry in the world. That's a big deal, because without TSMC, Huawei will not be able to manufacture chipsets for its phones. The Chinese phone manufacturer is now turning to Semiconductor Manufacturing International Corporation (SMIC) — a Shanghai-based foundry — as an alternative to TSMC, so let's take a closer look at SMIC and see where it fits in.

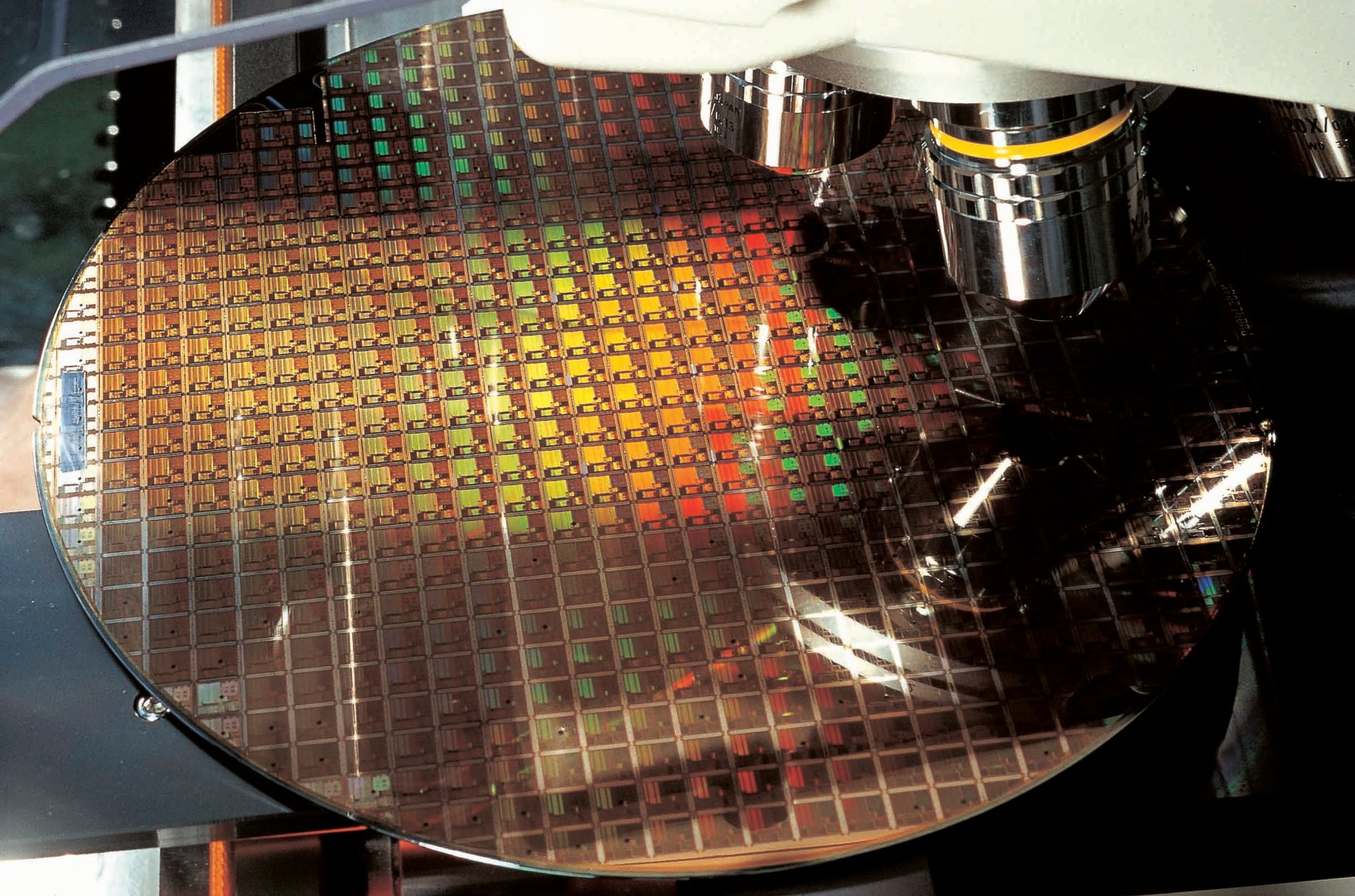

What exactly is a foundry anyway?

Before we get started, a primer on semiconductor foundries. Huawei uses its in-house HiSilicon semiconductor unit to design the Kirin chipsets that go into its phones. For instance, the P40 Pro uses a Kirin 990 5G chipset that's designed by HiSilicon.

HiSilicon is a fabless semiconductor, which means that while it designs its own chips, it does not have the manufacturing facilities to produce them. By contrast, Samsung has its own foundry, so the Exynos chipsets designed by Samsung LSI are manufactured at Samsung Foundry.

TSMC is where the latest Qualcomm, Apple, AMD, and NVIDIA chips are manufactured.

Building a foundry is a decades-long project that takes billions of dollars in investment, so most manufacturers these days rely on an external foundry to produce their chipsets. This is where Taiwan Semiconductor Manufacturing Company (TSMC) comes in. TSMC is a contract manufacturer; it doesn't sell its own products, instead working as a foundry for other vendors to produce chipsets.

TSMC is where the latest chips are made: everyone from Apple, AMD, NVIDIA, Qualcomm, Broadcom, Huawei, and Sony rely on the foundry to manufacture their latest designs. Even the chips featured in Lockheed Martin's F-35 Lightning II fighter jet are manufactured at TSMC.

There are just a handful of foundries in the world that can churn out phone chipsets, and right now, TSMC is as cutting-edge as it gets in the semiconductor industry. Remember the Kirin 990 5G from above? That's built on a 7nm node at TSMC, just like Qualcomm's latest Snapdragon 865 and 765 chipsets and AMD's Ryzen 3000 series.

Get the latest news from Android Central, your trusted companion in the world of Android

SMIC is China's best bet for semiconductor self-reliance

SMIC started out back in 2000, and is now the largest semiconductor foundry in China. The foundry just kicked off commercial production of its 14nm FinFET node, and was the foundry of choice for Qualcomm's Snapdragon 410 and 412 chipsets.

The main issue with SMIC is that the foundry is still on the 14nm manufacturing node. Unlike TSMC and Samsung Foundry, it is yet to make the switch to the 7nm process, putting it at a severe disadvantage. This isn't the first time either; the Chinese foundry was four years behind TSMC for the 65nm, 40nm, 28nm, and 14nm nodes.

SMIC is at least a generation behind TSMC, so it has a lot of ground to cover.

Of course, the node itself isn't everything, but in the context of phones, it makes a huge difference. Phones are thermally constrained by their size, so a more efficient node allows for better performance while consuming less power.

There is the question of scale as well; with Huawei now the world's largest smartphone manufacturer, it needs tens of millions of chipsets based on the 7nm node to be able to retain its edge in the high-end segment. At this point, SMIC lacks that scale.

But here's where things get interesting. SMIC is different from other foundries in that it attracts a lot of investment from the Chinese government, allowing it to scale faster. After it was announced that TSMC would cut off future orders from Huawei following pressure from the U.S. government, the Chinese government invested $2.2 billion into setting up a new fabrication plant.

In fact, were it not for the massive influx of funds put in by the Chinese government into SMIC every few years, the foundry would have shut down a long time ago. The Chinese government is effectively throwing money at the problem, and SMIC is set to kick off production on the 7nm node in Q4 2021. China needs a homegrown foundry now more than ever, and like we've seen several times in the past, the government will find a way to make that happen.

Huawei has already shifted a few mid-range Kirin designs that were being manufactured at TSMC over to SMIC's 14nm node. It remains to be seen if SMIC is able to kickstart volume production on the 7nm node over the next 15 months, but if it is able to do so, China will have a legitimate alternative to TSMC for high-end chip manufacturing.

The last Huawei flagship with Google services

A year after its launch, the P30 Pro still has a lot going for it. The hardware is still fast, the design is just as striking, and the camera at the back continues to take amazing photos. You also get all-day battery life and 40W fast charging with 15W wireless charging, the latest EMUI 10 update with Android 10, and global LTE bands for use on AT&T or T-Mobile.

Harish Jonnalagadda is Android Central's Senior Editor overseeing mobile coverage. In his current role, he leads the site's coverage of Chinese phone brands, networking products, and AV gear. He has been testing phones for over a decade, and has extensive experience in mobile hardware and the global semiconductor industry. Contact him on Twitter at @chunkynerd.