Losing access to TSMC would be catastrophic for Huawei

Get the latest news from Android Central, your trusted companion in the world of Android

You are now subscribed

Your newsletter sign-up was successful

Huawei hasn't had the best year, and it doesn't look like the manufacturer is going to weather the storm anytime soon. The U.S. extended the trade ban with the manufacturer for another year, preventing Huawei from doing business with most U.S. entities. Huawei was put on the U.S. Entity List a year ago, cutting off the Chinese manufacturer's access to U.S. businesses. A direct result of the ban was losing out on Google Mobile Services (GMS), including the Play Store.

But Huawei launched phones anyway over the course of 2019, with the Mate 30 series and more recently the P40 series offering an alternative to GMS in the form of AppGallery and Huawei Mobile Services. But a new development puts Huawei's phone business — not to mention its network infrastructure unit — in jeopardy. According to a new report, Taiwanese chipmaker Taiwan Semiconductor Manufacturing Company (TSMC) cut off access to Huawei and is no longer taking new orders.

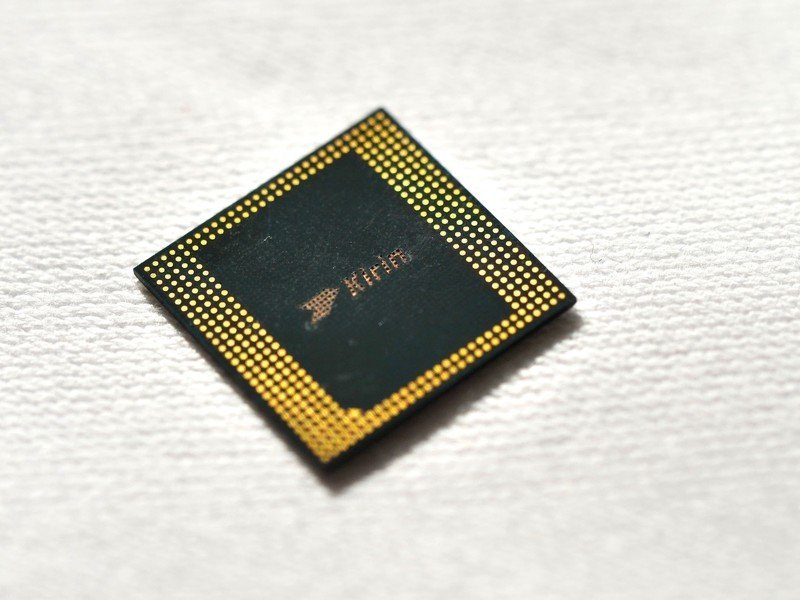

Without TSMC, Huawei just cannot manufacture Kirin chipsets — and that means no new phones.

That is a huge deal, because the move could prevent Huawei from releasing phones altogether. Huawei uses its in-house HiSilicon unit to manufacture Kirin chipsets for its phones. HiSilicon is a fabless semiconductor, which means that while it designs new chipsets, it does not have the facilities to physically manufacture them. That's why companies like Huawei rely on foundries like TSMC to manufacture chipsets. Without access to TSMC, Huawei just doesn't have the means to make new chipsets. And without the chipsets, there would be no phones.

I'll use a car analogy to break things down. Think of your phone as a car. Google Mobile Services would be the infotainment system; nice to have but not essential for a car to run. That's why even though Huawei lost access to GMS, it was still able to release phones. The Chinese manufacturer also had to look to non-U.S. entities for various components that go into its phones, and this would be like changing tires. If there's a blowout, you can always get a new one.

But a phone's chipset is like the engine of a car; without it, all you have is some bodywork and a few panes of glass. There's just no phone without a chipset. And Huawei relies solely on TSMC to manufacture these chipsets. What makes the situation dire is that unlike other parts shortages, it cannot just go to another manufacturer. The high-tech semiconductor business requires billions of dollars in investment and a profit outlook stretching to decades, and there are very few foundries that have the technical know-how required to make phone chipsets.

There's no other foundry for Huawei to fall back on for manufacturing 7nm chipsets.

TSMC is one such foundry, and that's what made it so attractive to phone manufacturers like Huawei. Let's look at the current situation with the semiconductor industry to give you some context of what's going on here. Most flagship phones released this year featured chipsets based on the 7nm manufacturing node — everything from Samsung's Exynos 990, Qualcomm's Snapdragon 865, and HiSilicon's Kirin 990 used the same manufacturing node. Using a smaller manufacturing node leads to a smaller chip, and it has an added side effect of being more energy-efficient.

The industry is moving to the 5nm node in the coming years, and the machines that make these 5nm chips often cost hundreds of millions of dollars. Foundries like TSMC invest in these machines years in advance, and because it takes so long to manufacture and integrate these machines into a foundry, this is not something a new fab will be able to achieve in a few years' time.

Get the latest news from Android Central, your trusted companion in the world of Android

ASML is a leading semiconductor equipment manufacturer, with its Twinscan NXE: 3400C EUV scanner now in use at fabs all around the world. A single machine weighs 180 tons and costs in excess of $120 million, and it is just one part of the fabrication process. That's why fabs invest billions of dollars when upgrading to a new node — there's a huge investment involved, and mass production on a new node usually takes the better part of a decade.

One of the reasons South Korea was able to kickstart its economy following the civil wars in the '60s was because of its focus on high-tech semiconductors. At the time, Samsung invested heavily in its semiconductor unit, believing that these chipsets would be integral to our modern lives. That bet paid off handsomely for Samsung — and South Korea — with the company now touting one of the largest foundries in the world.

China's SMIC could be an alternative, but the foundry does not possess the requisite technology yet.

Samsung SLSI is the only other alternative for mass production on the 7nm and 5nm nodes, and with the South Korean manufacturer heavily invested in the U.S. market for most of its products, it wouldn't risk running afoul of U.S. regulations. So for now, Samsung is not an option for Huawei.

One move for Huawei would be to bet on homegrown talent. The Chinese government recently poured $2.2 billion into building out the Shanghai-based Semiconductor Manufacturing International Corp (SMIC). While the move was undoubtedly targeted at bolstering local manufacturing, SMIC is several years behind TSMC and Samsung — it is just now commercializing the 14nm FinFET node. TSMC, meanwhile, is manufacturing 7nm chipsets and looking at 5nm.

While SMIC will be able to manufacture chipsets that can go into budget Huawei phones, it doesn't have the know-how to build 10nm or 7nm designs. Then there's the question of whether SMIC will even be able to make the switch to more efficient manufacturing nodes over the next few years. It relies heavily on U.S.-sourced parts and machines, and with Huawei as a customer, it may not be able to access the tools required to switch to the 7nm node.

Huawei's network infrastructure business is also going to suffer without TSMC. The manufacturer's 5G base stations use TSMC-made chipsets, and like its phone business, the Chinese manufacturer has no recourse in this area. The U.S. trade ban has thus far been limited to cutting off U.S. businesses from providing services to Huawei, but by blocking access to TSMC, the U.S. government has escalated the conflict. We'll now have to wait and see how China reacts.

Harish Jonnalagadda is Android Central's Senior Editor overseeing mobile coverage. In his current role, he leads the site's coverage of Chinese phone brands, networking products, and AV gear. He has been testing phones for over a decade, and has extensive experience in mobile hardware and the global semiconductor industry. Contact him on Twitter at @chunkynerd.