I used the new Google Pay for over two years — here's why it's amazing

Google overhauled Google Pay in the U.S. with a brand new design and exciting feature additions like cashback rewards and the ability to send and receive money from friends and family with ease. Oh, and because Google likes building messaging services so much, it baked one right into Google Pay so you can text your contacts from within the payments platform.

While these features are making their way to the U.S. for the first time, customers in India have had access to these features for a few years now. The redesigned Google Pay is based on a payments platform that Google introduced in India over three years ago, called Tez. Tez means fast in Hindi, and the service was built from the ground up for Indian users and works on the country's centralized Unified Payments Interface platform.

Google built the foundation of the current Google Pay over three years ago.

Tez started out as a service to transfer money to your contacts, and Google added rewards and offers to the platform shortly after launch. It then picked up the ability to pay and manage bills for phone service, power, heating, broadband, and others. And six months after launch, Google added a chat feature to Tez.

Tez immediately gained momentum in India, racking up 750 million transactions in the first 12 months. The lightweight service worked great on budget phones, and Google then folded Tez into Google Pay back in August 2018 to streamline its payments platform, and in doing so created the Google Pay that's now making its debut in the U.S.

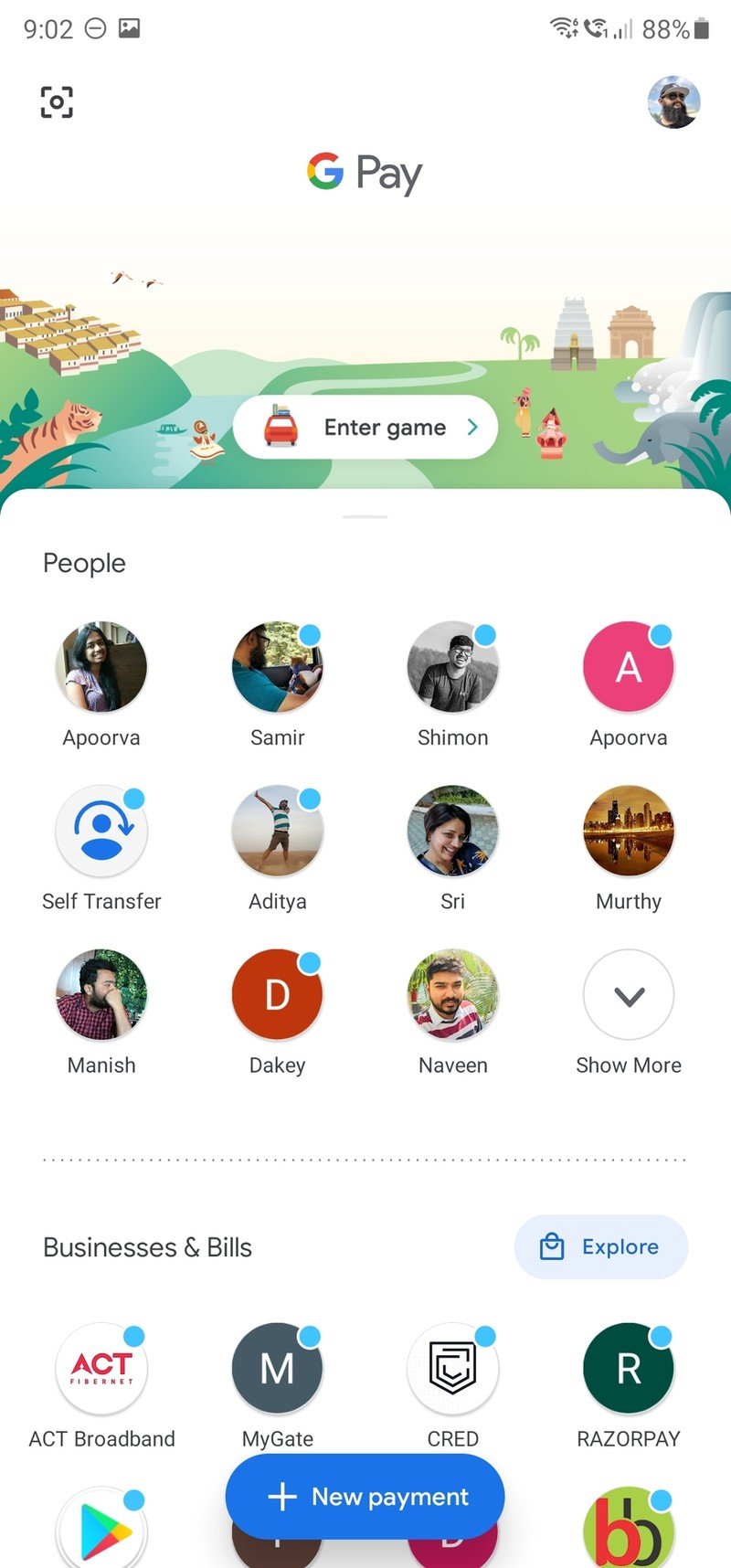

Now that you have a better understanding of Google Pay's journey, let's talk about what makes it a standout platform. I use the service regularly to transfer money to friends and family. Back when going out with friends was still a thing, Google Pay was the go-to option for divvying up the bills.

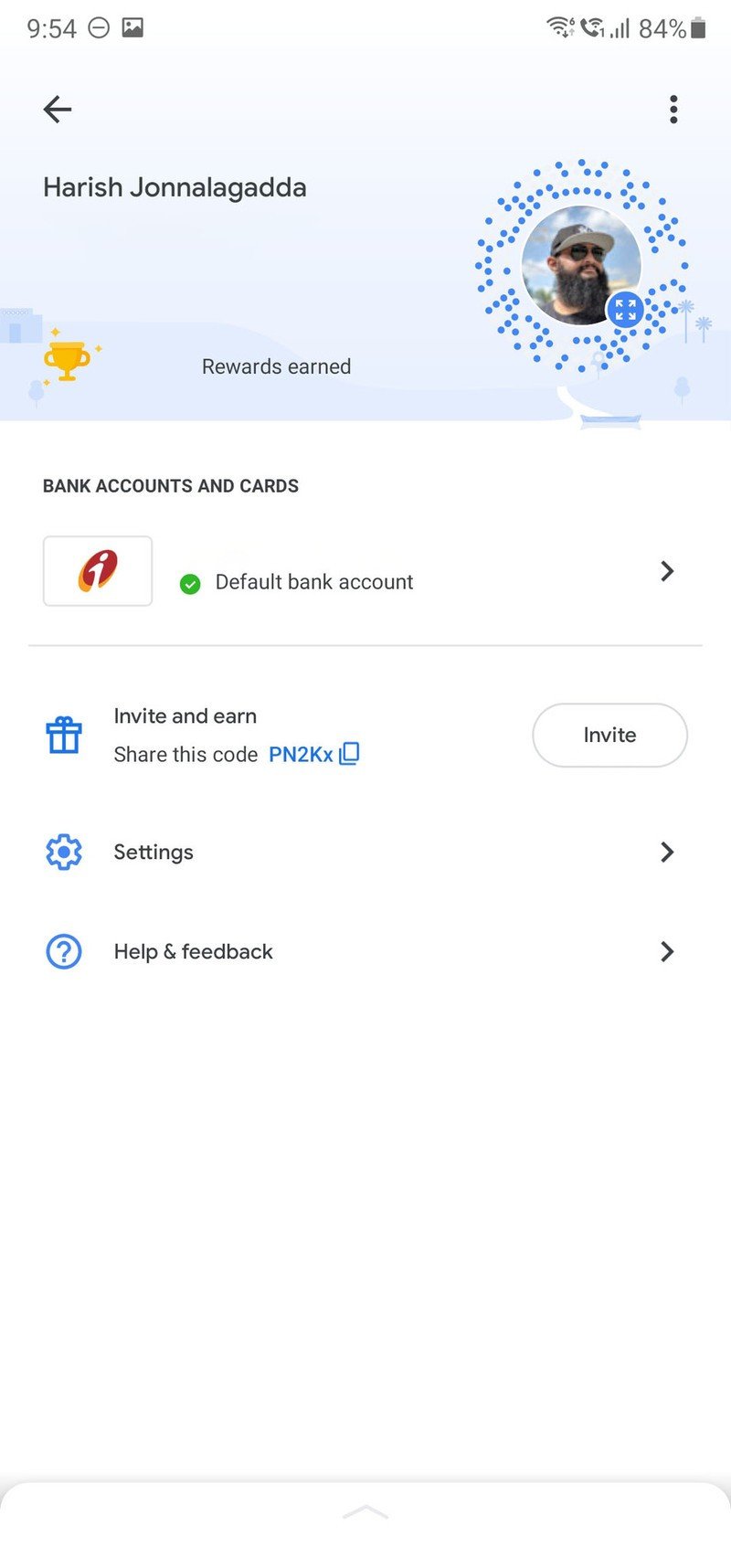

Source: Android Central

Google Pay is also a great way to manage all your bills in one location. I rely on Google Pay monthly to pay my phone, broadband, and credit card bills, and the fact that I don't have to go into individual apps to do this clinched the deal for me. Google also has a local businesses feature that's particularly handy for finding nearby stores, and in the U.S. you will be able to find the nearest gas station based on your location.

Get the latest news from Android Central, your trusted companion in the world of Android

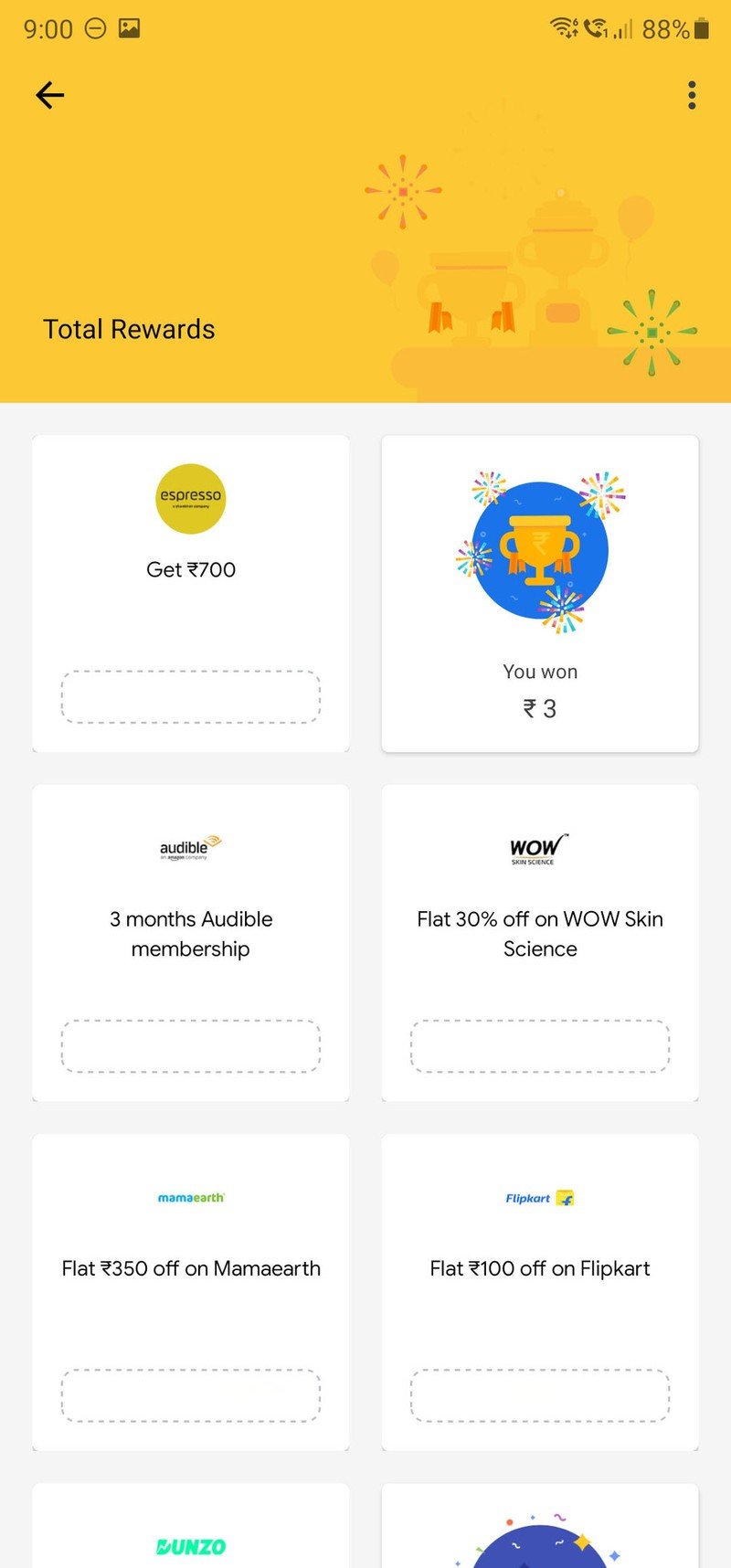

But the defining feature in Google Pay is the rewards and offers. Not only did I end up saving a decent amount of money via cashback offers by using Google Pay, but I also got free subscriptions to Audible, YouTube Premium, and other services.

Google incentivized Google Pay with attractive offers in India — it's now doing it in the U.S.

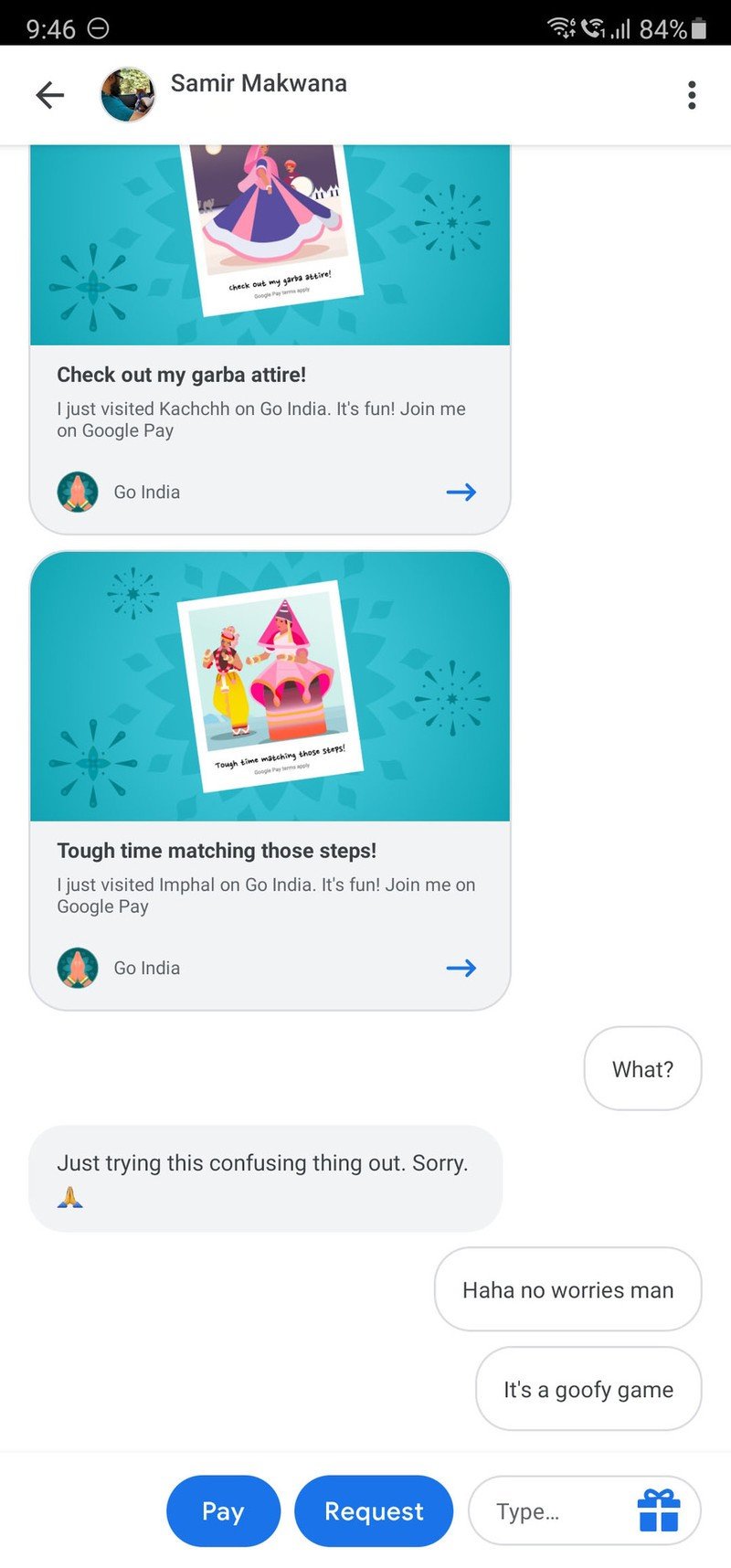

Google heavily incentivized Google Pay in India, and that allowed the service to gain significant momentum in the country. Google also does timed events to attract new users and is currently running a Go India mini-game within the service that rewards users with cash prizes for transacting on the platform.

The result of these efforts? Google Pay is now the dominant payments platform in India, touting 75 million transacting users a month and clearing over 500 million transactions every month.

Google is using a similar strategy in the U.S. where it is offering attractive cashback offers and rewards, and that should allow it to make headway in the country. As for that chat feature, I used it more than I thought it would. Turns out all Google needed to make Allo work was tack a payments platform to it.

After two years of usage, Google Pay has become one of my favorite Google services. It does everything I'm looking for in a payments platform; it offers a centralized location for paying bills, I can easily send money to friends and family, pay online and at retail stores, and the rewards are a nice bonus.

I set up my Google Pay account in the U.S. earlier this week, and the feature-set is identical to the Indian version of the service. Google is offering a financial monitoring service in the U.S. in addition to all the other features, and that should allow Google Pay to stand out just that little bit more.

It's exciting to see these features make their way to the U.S., and if you are interested in seeing what the new Google Pay has to offer, hit up the link below to install the app.

The only payments service you need

Google Pay now offers an easy way to send and receive money from friends and family, and lets you pay online and at retail stores. The best part about the service is that it now has attractive cashback offers, and you also get a dashboard to easily view your finances.

Harish Jonnalagadda is Android Central's Senior Editor overseeing mobile coverage. In his current role, he leads the site's coverage of Chinese phone brands, networking products, and AV gear. He has been testing phones for over a decade, and has extensive experience in mobile hardware and the global semiconductor industry. Contact him on Twitter at @chunkynerd.