deals

Latest deals

Prime Day Fire and Echo deals — up to 68% OFF Amazon's tablets, smart speakers, and more

By Patrick Farmer last updated

This is wild As part of Prime Day 2025, Amazon is dropping some serious discounts on its own Fire and Echo-branded tech, from smart home devices to tablets.

Best Buy's Black Friday in July sale is the ultimate anti-Prime Day, and here are the top Android deals that prove it

By Patrick Farmer published

Why wait? Best Buy just kicked off a weeklong Black Friday in July sale, slashing prices on a number of our favorite devices.

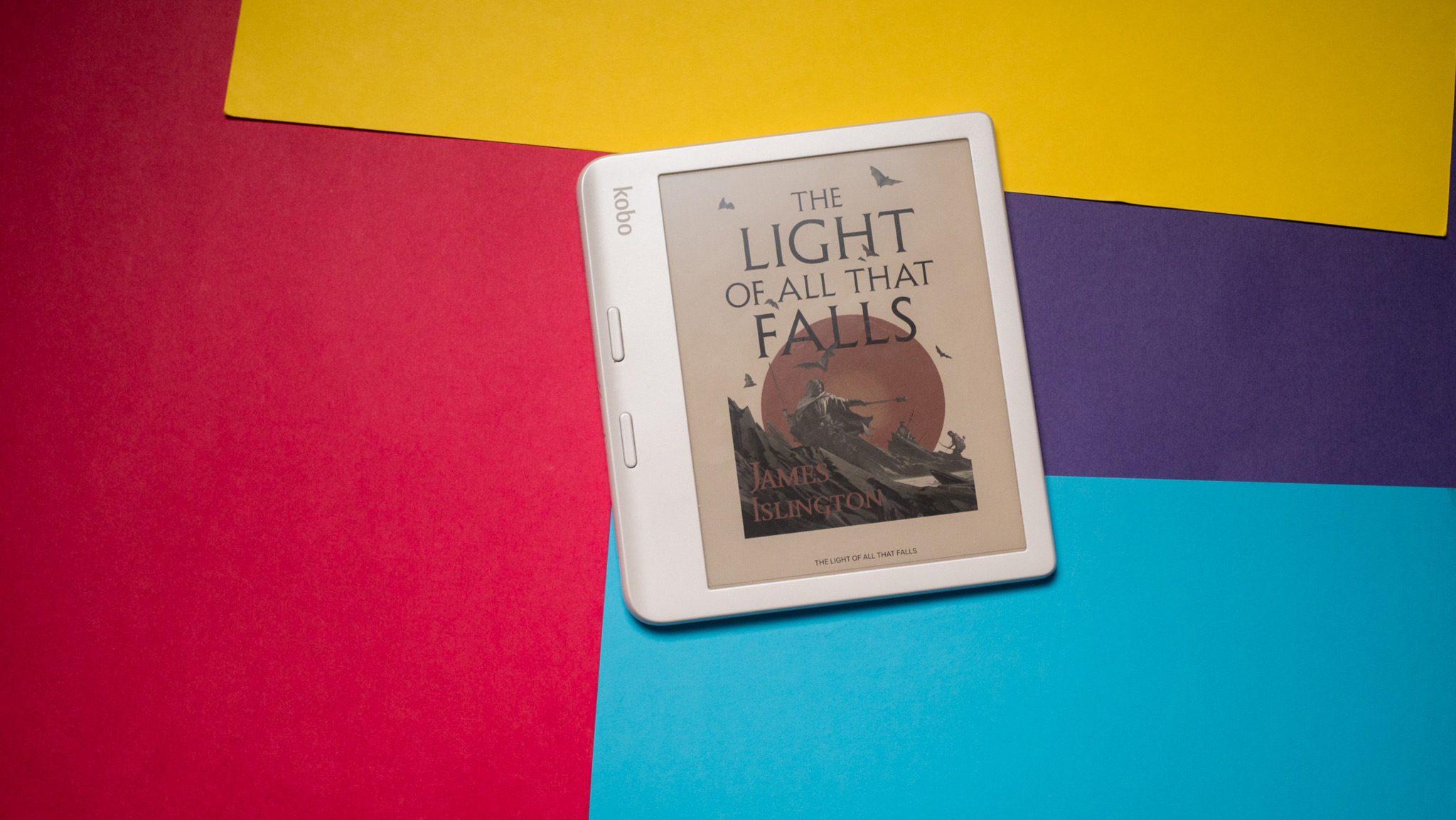

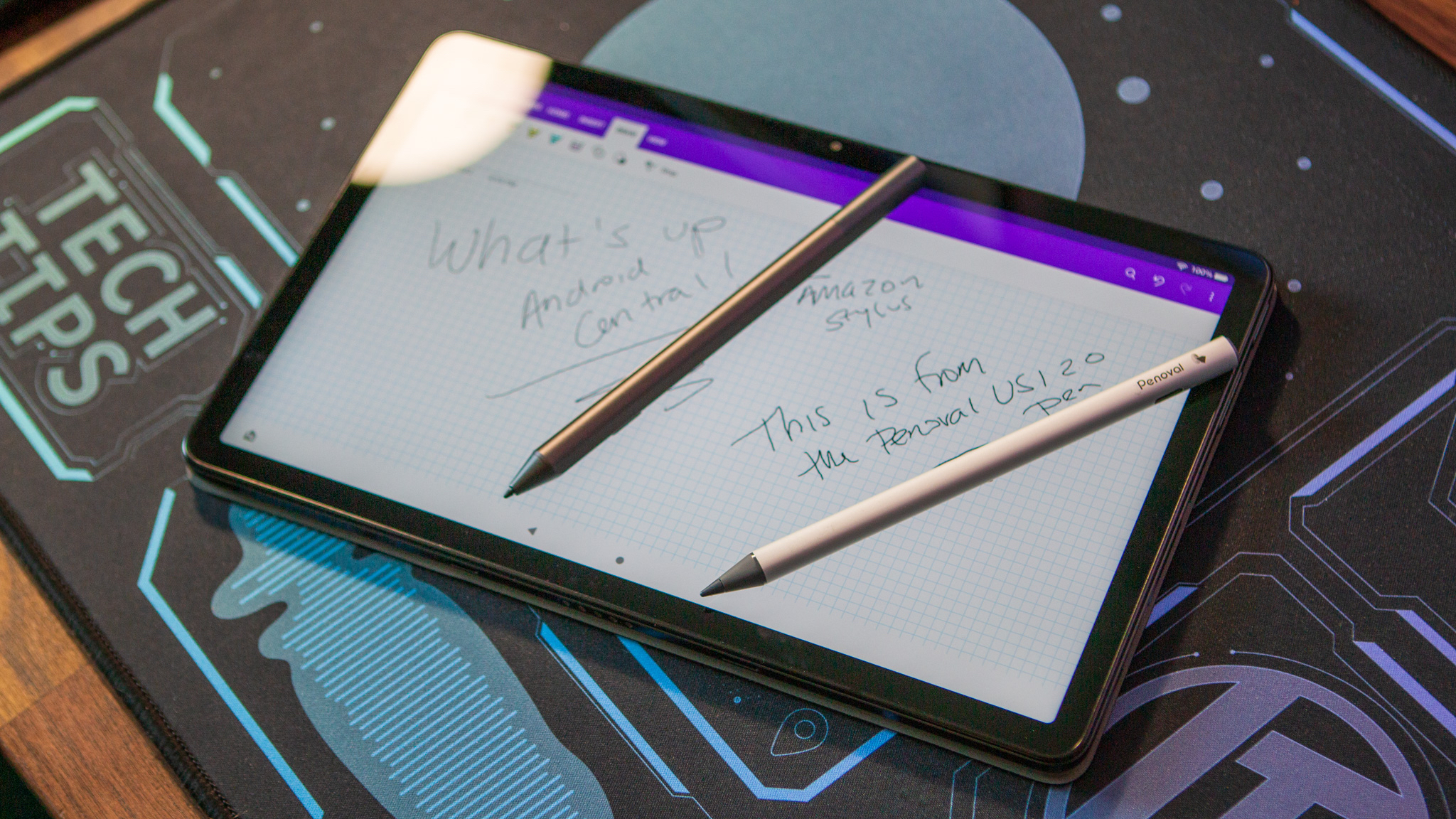

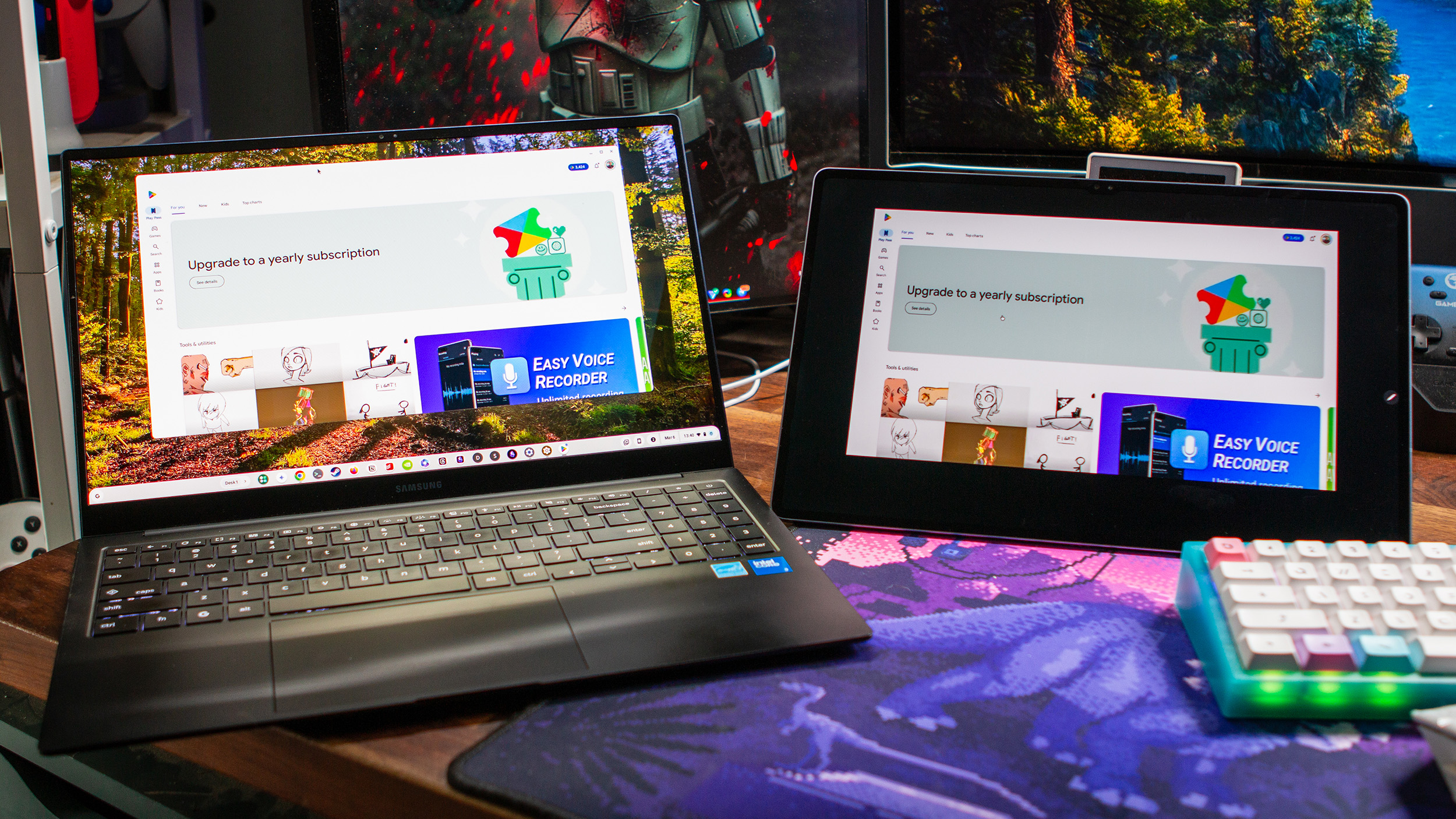

Prime Day Chromebook deals — how to buy the perfect cheap laptop during Amazon's sale

By Patrick Farmer last updated

For work and play Amazon's biggest sale of the year kicks off in just a few days, and I'm tracking down the best discounts on Chromebooks so you don't have to.

Prime Day Samsung Galaxy deals — active discounts and how to prepare for Amazon's big sale

By Patrick Farmer last updated

A Galaxy of savings Prime Day is here, and I'm using this guide to monitor all of the best Samsung Galaxy deals as they go live.

Amazon Prime Day returns tomorrow! See our FAQ and top Android deals available NOW

By Patrick Farmer last updated

Get ready Amazon's biggest sale of the year has been announced, and I'm gathering all of the info you need to prepare, plus some early deals!

This 100W USB-C cable is perfect for your Android phone, and it's just $9

By Harish Jonnalagadda published

Numero Uno UGREEN's Uno 100W USB-C to USB-C cable has a braided design, and a unique LED panel that cycles between various emoji.

Prime Day Google Pixel deals — early discounts and what to expect from Amazon's big sale

By Patrick Farmer last updated

Pixel magic Whether you want a premium foldable or a midrange masterpiece, these are the best Google Pixel deals of Prime Day 2025.

These external SSDs are delightfully different — and they're on sale

By Harish Jonnalagadda published

Believe it Aiffro isn't a brand you would've heard of, but it is making exciting external SSDs.

Get the latest news from Android Central, your trusted companion in the world of Android