You'll soon be able to use Android Pay in more apps and on the mobile web

Android Pay has only recently expanded to the UK, but Google has no intention of slowing down on its burgeoning contactless payment solution.

Starting today, the company will make its in-app payments API available to everyone, a considerable expansion compared to the small number of partners it began with when the feature launched last December. In addition to apps like Uber, Lyft, OpenTable, Wish, and Fancy, any app that has an e-commerce element will be able to tap into securely stored credits cards on compatible smartphones — in countries that support it.

Perhaps more interesting, though, is the expansion of Android Pay's in-app purchase workflow to the mobile web. Developed in conjunction with the Chrome team, a new experience will allow merchants to quickly integrate e-commerce solutions on mobile web pages that leverage the necessary hardware — in particular, fingerprint sensors — to complete transactions on web pages without having to manually enter credit card numbers, shipping and billing information, and more.

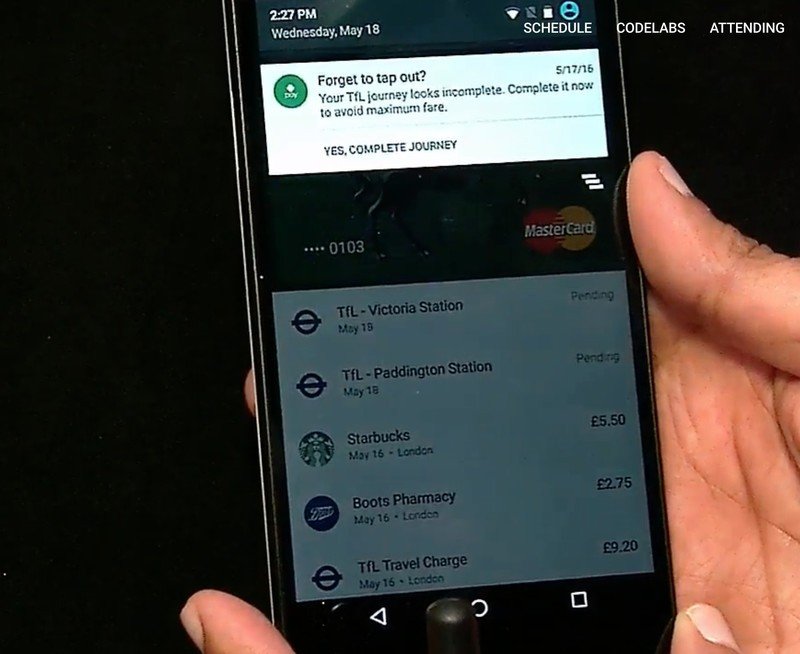

During a session at Google I/O, Pali Bhat, Senior Director of Product Management at Google, demoed the new feature, which optimizes payment experiences on a smartphone — app or no app — with the same workflow. While Android Pay was initially envisioned as a solution for contactless in-store payments utilizing popular standards such as tokenization and dynamic transport schemes, it has since expanded to be a full-scale payments platform, allowing anyone with a Visa, MasterCard, American Express or Discover card to potentially leave their plastic at home.

And while Google already announced loyalty integration with Android Pay, it has now gone one step further, working with popular drug store Walgreens to facilitate loyalty signup, in addition to collection and redemption. Walgreens can merely send an email or SMS, or use an NFC-based reader in-store, to quickly sign a customer to a points program and begin collecting.

Finally, Bhat demoed a new feature with Android Pay in the UK, working with Transport for London (TfL) to not only replace existing Oyster payment cards with a phone, but track when a rider has tapped on and off. If a customer forgets to tap off, he or she will receive a notification with a reminder to tap off or risk having to pay the maximum fare.

While none of the Android Pay announces are on their own particularly exciting, they represent a new phase for digital wallets where payments alone are no longer the crux of the experience. From loyalty to convenience, the ability to replace an increasing number of physical cards, payment or otherwise, with digital equivalents, reducing the number of total actions in the process, is the incentive people need to leave their wallets at home — for good.

Get the latest news from Android Central, your trusted companion in the world of Android

More: Google I/O 2016 coverage

Daniel Bader was a former Android Central Editor-in-Chief and Executive Editor for iMore and Windows Central.