AT&T 5G: Everything you need to know

Better mid-band spectrum coverage has improved AT&T's speed and competitiveness.

The AT&T 5G network has been steadily expanding over the last few years, and now its mid-band infrastructure covers more than 210 million people across the United States. AT&T's 5G network is one of the best in the business and is made up of three primary parts. There is nationwide network comprised of low-band and shared spectrum, mid-band spectrum including the C-band, and mmWave high-band for dense areas.

These three components come together to form one of the most competent mobile networks around, especially if you live in a rural area. Although AT&T's 5G expansion hasn't quite kept pace with that of competitors like T-Mobile and Verizon, the carrier is hard at work expanding its network's coverage and performance.

5G access with growing mid-band coverage

All of AT&T's unlimited plans give you 5G access via the carrier's nationwide, mid-band, and mmWave towers, and plenty of data to use the network infrastructure to its fullest. Where there are gaps in service, a robust LTE network fills them up.

- Carrier deals: Verizon | AT&T | T-Mobile | Mint Mobile | Visible

How is coverage improving?

AT&T's 5G network is comprised of three main parts. The first part involves low-band 5G deployment at 850MHz and uses some 'Dynamic Spectrum Sharing' with speeds similar to that of LTE. The second part is mid-band 5G primarily comprising spectrum around 3.7GHz, similar to Verizon's C-band. The third part is a high-band mmWave network that's capable of very fast speeds and high capacity, but with a more limited range.

Dynamic Spectrum Sharing, or DSS, is a technique that reuses some of the spectrum currently used for 4G, for providing access to both 4G and 5G as needs grow. Unlike refarming spectrum from LTE and simply moving capacity from one network to the other, DSS can keep both networks active and allocate portions of that spectrum as needed, to either 4G or 5G. This allows the network to adjust to higher 5G demands as people upgrade their phones.

While the major part AT&T 5G coverage is still made up of this slower network, the carrier has been making solid mid-band progress and even achieved its goal of 70 million much earlier than expected. Those in urban and suburban areas will see mid-band coverage sooner than rural customers since the higher frequencies don't reach as far as low-band frequencies.

One thing to keep in mind is that not all 5G is what it seems. AT&T began preparing its towers for 5G network, with LTE upgrades it calls 5GE. This essentially added the network capacity on the backend for 5G access, including upgraded fiber network connections. If you see 5GE on your older AT&T phone, note that it is not 5G and is actually 4G LTE with tower upgrades that make up the most of LTE technology.

AT&T's mmWave coverage

For the most part, you'll be using the larger low-band 5G coverage as AT&T builds out the places where it has access to the mid-band spectrum. However, if you have one of the phones that support AT&T's mmWave 5G+ network, you can still get some incredible speeds in several U.S. cities.

Be an expert in 5 minutes

Get the latest news from Android Central, your trusted companion in the world of Android

Over 50 major cities in the United States now have AT&T 5G+ coverage, alongside more than 80 other areas like large-scale venues and airports. Check out AT&T's coverage map for a full list of locations. Select markets include:

- Arizona

- Phoenix

- California

- Los Angeles, Oakland, San Diego, San Francisco, San Jose, West Hollywood

- Colorado

- Denver

- Florida

- Jacksonville, Miami, Orlando, Tampa

- Georgia

- Atlanta

- Indiana

- Indianapolis

- Illinois

- Chicago

- Kentucky

- Louisville

- Louisiana

- New Orleans

- Maryland

- Baltimore, Ocean City

- Massachusetts

- Boston

- Michigan

- Detroit

- Minnesota

- Minneapolis

- North Carolina

- Charlotte, Raleigh

- Nevada

- Las Vegas

- New York

- Brooklyn, New York City

- Ohio

- Cleveland

- Oklahoma

- Oklahoma City

- Pennsylvania

- King of Prussia, Philadelphia

- Tennessee

- Nashville

- Texas

- Austin, Dallas, Frisco, Houston, San Antonio, Waco

- Wisconsin

- Milwaukee

Which phones work with 5G?

Most of the new phones AT&T sells work with 5G access, including many of the best Android phones like the latest Galaxy S24 series and Google Pixel 8. Apple's 5G iPhones are also supported. If you're looking to update your AT&T phone, this is the right time to ensure it comes with 5G support.

AT&T's website lists each phone's 5G support. You should note that mid-band and mmWave 5G are associated with the 5G+ category, with band n260 for mmWave and n77 for mid-band. Nationwide 5G includes n2, n5, n30, and n66 bands, even though coverage will mainly depend on what's available in your area.

Having a phone that at least supports mid-band n77 is important if you care about getting the most from the network, as the majority of significant 5G expansion will be coming from the mid-band in the next few years.

Which plan do I need?

All of AT&T's current unlimited plans include 5G access. If you want to go for a data plan such as the basic 4GB plan, you won't get any access to 5G at all. Like most of the best 5G plans, AT&T treats its low-band nationwide 5G data the same as LTE, regarding hotspot and premium data.

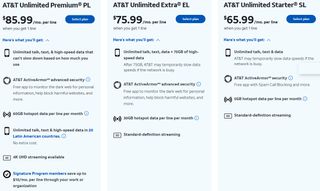

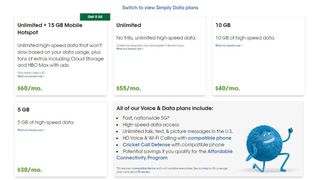

Currently available AT&T plans with 5G access include AT&T Unlimited Premium, AT&T Unlimited Extra, AT&T Unlimited Starter, and AT&T Value Plus. All three AT&T prepaid plans come with 5G access too. Keep in mind that only Unlimited Premium and Extra include priority data, so the other may experience slower speeds when the network is congested.

Cricket Wireless, the AT&T-owned prepaid carrier, now offers 5G access on all its plans. Combined with the recent removal of speed limits from its plans, the prepaid carrier is a great way to test out AT&T's 5G network and its coverage.

What tech is AT&T using for 5G?

AT&T initially started its 5G network with mmWave tech. This uses a high-frequency spectrum above 24GHz for coverage, and this spectrum is available in large chunks allowing for enormous speeds of over 2Gbps in ideal conditions. With a solid signal, mmWave can handle a large amount of traffic while staying fast enough to get just about anything done on your phone.

Next, AT&T launched a low-band sub-6 5G network at 850MHz. This is the network that most customers will be able to connect to, as it has much better coverage than mmWave. The coverage areas from a single tower will be much more like LTE, but so will speeds. This low-band 5G essentially fills in the gaps where deploying a denser coverage is not practical. AT&T is also sharing some spectrum for the LTE coverage wherever possible to balance the network for current load. This low-band spectrum reaches over 295 million people in over 24,500 cities across the United States.

Lastly, AT&T started deploying C-band spectrum in late January 2022. While its initial footprint was small, with just eight cities included at launch, AT&T has continued to expand and improve. As of today, this mid-band spectrum covers over 210 million people across the United States.

Is 5G worth it for most people?

In ideal conditions, 4G LTE is still fast enough for most users. However, one problem is that these good speeds lead to data usage constantly increasing as media quality improves and download sizes grow. As a result, there will be a hard ceiling on the amount of data one tower can deliver with LTE technology, and user experience will begin to suffer.

All of AT&T's Unlimited plans now have 5G access so if you're ready for a new phone, there's a good chance it will come with 5G support.

5G access with unlimited data

AT&T hasn't been sitting idle when it comes to 5G deployments, with steady expansion leading to better speeds and coverage in already-covered areas, and more being added to the coverage map. If you're covered, you'll need an unlimited plan to get the most out AT&T's 5G network.

- Carrier deals: Verizon | AT&T | T-Mobile | Mint Mobile | Visible

When Samuel is not writing about networking or 5G at Android Central, he spends most of his time researching computer components and obsessing over what CPU goes into the ultimate Windows 98 computer. It's the Pentium 3.

- Rajat SharmaContributor

- Patrick FarmereCommerce Editor