Samsung wins with the most smartphone shipments of Q1 2024 as market grows

On the heels of successful A-series launches, Samsung tops Apple in the most recent quarter.

What you need to know

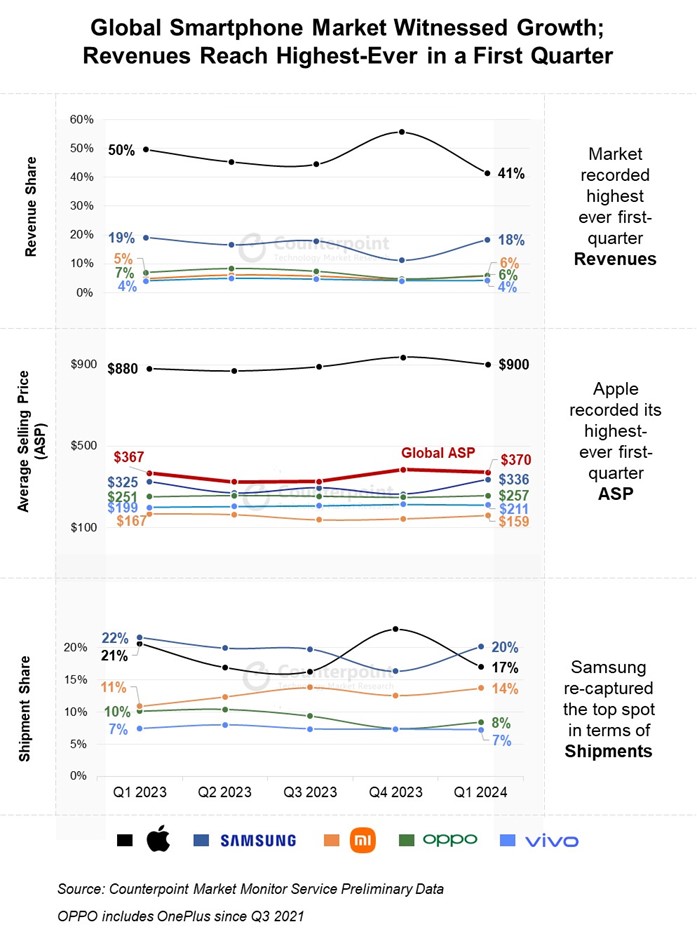

- According to a report from Counterpoint Research, the global smartphone market grew six percent in the first quarter of 2024 year-over-year.

- Apple had an interesting quarter, posting a 13% decline in Q1 2024 year-over-year despite recording its highest-ever average sale price (ASP).

- Samsung was the clear winner this quarter, reclaiming its spot as the top shipper of smartphones globally.

The global smartphone market appears to be rebounding, with Android phones especially finding success in the first quarter of 2024, according to a report from Counterpoint Research.

Overall, the market grew by six percent year-over-year despite Apple shipping far fewer iPhones last quarter than during Q1 2023. In part, that's due to the success of Samsung Galaxy phones. A strong launch of the company's Galaxy A-series smartphones appears to have vaulted Samsung above Apple as the global leader in shipments.

Samsung is typically the top smartphone manufacturer in terms of total number of shipments, but it lost that title to Apple in Q4 2023. However, as Apple posted a 13% decline in shipments year-over-year in Q1 2024, Samsung was able to recapture the leading position. Samsung devices represented 20% of the total smartphones shipped last quarter, while iPhones slipped to 17%.

As has been the case in past quarters, the premium smartphone market continues to grow. According to Counterpoint, the market segment, including phones priced above $800, was the fastest to grow in Q1 2024. Apple benefitted big from this trend last quarter because it has the highest average sale price (ASP) of any OEM at $900. This is presumably due to buyers picking the higher-priced iPhone 15 Pro and 15 Pro Max over the base models.

Additionally, Apple retained its spot as the smartphone revenue leader with a 43% share of the market. Still, that figure is down 11% year-over-year, and there are a few reasons why.

"Tough competition in China, record low upgrades in the US and a difficult compare from last year due to iPhone 14 Pro's supply shifting to Q1 2023 all weighed on iPhone performance," says Counterpoint Research Director Jeff Fieldhack. "An improved product mix with 15 Pro's performing better than its predecessors, and an increasing footprint in emerging markets, helped Apple in arresting some of the declines."

The overall growth can be partially attributed to select brands' success in regions outside of North America, including TECNO, Xiaomi, Honor, and Huawei. Of the top five OEMs, Xiaomi grew the most last quarter, improving shipments by 34% year-over-year.

Get the latest news from Android Central, your trusted companion in the world of Android

Looking ahead, the analysts at Counterpoint expect the premium smartphone market to continue growing. This is because of the expected release of new phones with generative AI functionality. Counterpoint predicts that 11% of smartphones shipped will feature generative AI this year. If Apple ends up including gen-AI features on the next iPhone series, joining the likes of Google and Samsung, this will likely end up being the case.

Brady is a tech journalist for Android Central, with a focus on news, phones, tablets, audio, wearables, and software. He has spent the last three years reporting and commenting on all things related to consumer technology for various publications. Brady graduated from St. John's University with a bachelor's degree in journalism. His work has been published in XDA, Android Police, Tech Advisor, iMore, Screen Rant, and Android Headlines. When he isn't experimenting with the latest tech, you can find Brady running or watching Big East basketball.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.