Samsung sees massive smartwatch growth in Q2 2019 while Wear OS barely holds on

What you need to know

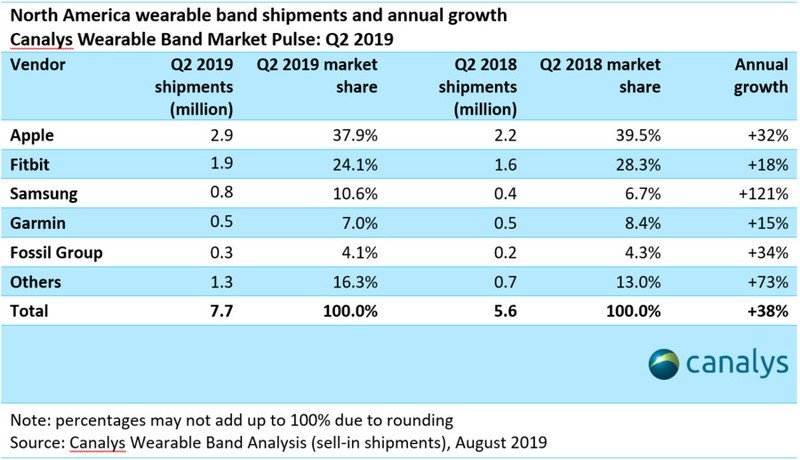

- The North American wearables market grew by 38% YoY in Q2 2019.

- Samsung saw a massive annual growth of 121% for a total market share of 10.6%.

- Wear OS is barely on the map, with Fossil Group having a 4.1% market share.

- Apple continues to dominate with 32% annual growth and 37.9% market share.

Research firm Canalys has released its numbers for the smart wearables market in North America, and as a whole, things are looking up. During Q2 2019, the wearables market reached a total value of $2.0 billion with 7.7 million shipments — an increase of 38% compared to Q2 last year.

To not much surprise, Apple is once again the market leader in this space. The company's Apple Watch dominates just about every other wearable out there, and this shows in the numbers. Apple now holds a market share of 37.9%, and while that is a decrease from the 39.5% it had in 2018, there was still a strong annual growth of 32%.

Fitbit takes the crown for 2nd place, finding itself with a respectable 24.1% market share and annual growth of 18%.

Although Samsung is trailing behind the fitness-focused brand in third place, it had an incredible past year of sales — specifically, Samsung's annual growth was 121%. Its market share is still relatively low at just 10.6%, but with numbers like that, it's certainly heading in the right direction.

Per Canalys:

Smartwatch vendors are increasingly getting nearer the bullseye — hitting the right price point in a way that spurs massive demand. With Samsung's new Galaxy Watch branding in place, and showing robust performance, the company has moved to cultivate a fitness-focused line-up with the Galaxy Watch Active series, with prices between US$200 and US$300.Packing features into a compact form factor that has an appealing design is challenging but rewarding. Samsung most recently showcased these capabilities with its latest Watch Active 2 series, though other vendors are close behind.

When it comes to Google's Wear OS platform, things aren't looking that good. Fossil Group is the only Wear OS brand that made it into the top five, and while it saw decent annual growth of 34%, it shipped just 0.3 million units in Q2 2019 and has a current market share of 4.1%.

To be fair, the "Others" group accounts for 16.3% of the market and likely includes other Wear OS brands such as Misfit, Mobvoi, and others. However, there's no telling how big those numbers are for other Wear OS vendors and further drives home the point that Wear OS has an identity crisis.

Get the latest news from Android Central, your trusted companion in the world of Android

Commenting on Fitbit's budget-focused Versa Lite smartwatch, that doesn't appear to have been the success Fitbit was hoping for.

There is certainly demand for affordable smartwatches with strong health and other intelligent features, but Fitbit's misstep with the Versa Lite shows that consumers will shun overly pared-down smartwatches if they are not appropriately targeted, and especially when it's obvious they are losing functionality.

Fitbit must have taken note of this, as we're expecting the company to launch one of its most powerful smartwatches at some point next month with the Fitbit Versa 2 — offering Alexa built-in, Fitbit Pay included by default, and 4+ day battery life.

Plenty of features at a price you'll love.

Considering how awesome the Galaxy Watch Active is, it's no wonder Samsung's numbers are as good as they are. The Watch Active has a simple design, good performance, a bevy of features, and offers all of this at an incredible price.