This new U.S. antitrust bill could be the end of Big Tech mergers as we know it

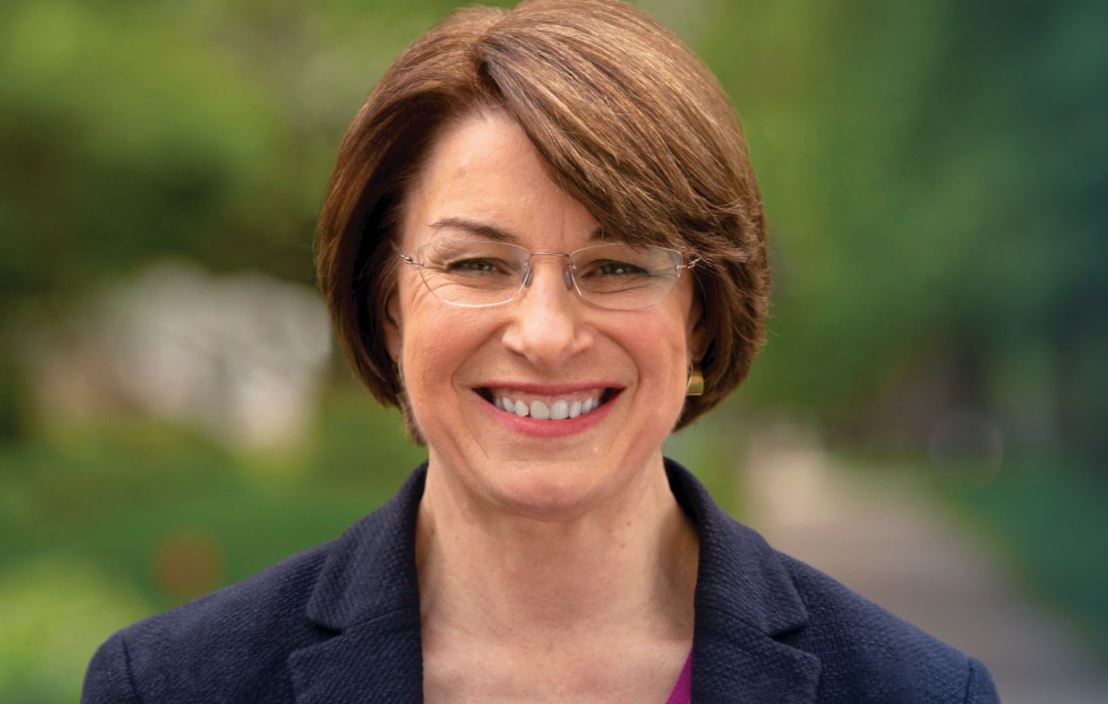

Senator Amy Klobuchar (D-Minnesota), the incoming head of the Senate antitrust subcommittee, has introduced a bill that would bring wide reforms to competition laws and antitrust enforcement that puts companies that sell the tech we love directly in its anti-competitive crosshairs.

The proposed Competition and Antitrust Law Enforcement Reform Act outlines the new administration's policies and attitude towards anti-competitive behavior in several key areas. One is the idea of projecting more of the investigation costs to the companies defending their practices; the other is a set of consumer protections like requiring companies that are given permission to merge or buy another one to show how they have kept their relevant industries competitive since initial the hearings.

It's important not to get attached to any of the proposed changes just yet though, as this is a bill that needs to be passed by Congress. Though with increased scrutiny by both parties towards recent moves from companies like Facebook and Google, there should be plenty of bipartisan support. Klobuchar is confident her bill will have the votes, and explains why we need these changes to the Wall Street Journal:

"We have an increasing monopoly problem, really headlined by what is happening with tech but also extending across the economy, Our laws have to be as sophisticated as those that are messing around with competition."

Still, Big Tech warns against any sort of sweeping reforms. Trade associations and lobby groups say that restricting bigger companies will ultimately penalize smaller ones and there will be plenty of pushback against any changes from companies whose products and services we use every day.

Should there be enough support for the Competition and Antitrust Law Enforcement Reform Act to pass, there are some important key points that would strengthen antitrust investigation and enforcement. A synopsis from CNBC:

- Raising the bar for dominant firms seeking to merge with other companies, including by shifting the burden of proof onto merging parties.

- Adding a prohibition on "exclusionary conduct" to the Clayton Act, which governs mergers, to make it harder for dominant firms to prove their mergers won't harm competition if they engage in such acts. Exclusionary conduct would include acts that disadvantage current or potential competitors or limit rivals' ability or incentive to compete.

- Authorizing $300 million increases to the annual budgets of the Department of Justice's Antitrust Division and the Federal Trade Commission, which enforce antitrust laws.

- Allowing antitrust enforcers to seek civil penalties for violations of monopoly law and the exclusionary conduct offense created by the bill, on top of other remedies they can already call for, like breakups and injunctions.

- Creating an independent Office of the Competition Advocate within the FTC that can conduct market analyses to inform enforcement and help elevate consumer complaints.

- Requiring merged companies to update agencies on the outcomes of their deals and for the agencies to study the impacts of past mergers.

- Extending whistleblower incentives to those flagging potential civil violations.

The last two bullet points here are exceptionally interesting and something big business and special interest lobby groups will fight against, tooth and nail. Imagine if Facebook were forced to offer an annual report about its acquisitions of WhatsApp and Instagram instead of finally being forced to answer tough questions by the U.S. House in 2020? Or if a Facebook employee would be protected against backlash if he or she decided to report the problems they were seeing. It's a safe bet to say similar skeletons are in every big tech company's closet so this sounds like bad news to the big players.

A government is in place to protect and serve people, not corporations. We need a watchdog with real teeth.

But governments aren't in place to protect the big players. They are placed to protect all of us, especially against adversaries with seemingly limitless resources at their disposal. The Competition and Antitrust Law Enforcement Reform Act probably won't pass as written, but we can hope it keeps enough of its teeth to be an effective counter to some very bad decisions from the FTC in the past.

Get the latest news from Android Central, your trusted companion in the world of Android

Big Tech doesn't have to be our enemy, and not so long ago it wasn't. We'll probably never go back to those days so we require an effective watchdog who has our best interests in mind.

Jerry is an amateur woodworker and struggling shade tree mechanic. There's nothing he can't take apart, but many things he can't reassemble. You'll find him writing and speaking his loud opinion on Android Central and occasionally on Threads.