LG

Latest about LG

This AI-powered 65" smart TV just crashed to $399 during Best Buy's Super Bowl TV sale

By Patrick Farmer published

Game on! Best Buy's Super Bowl TV sale is live, and one of the best deals we've found so far is this $200 discount on a great LG TV.

This three-year-old LG smartphone is getting Android 13

By Jay Bonggolto published

The LG V60 from 2020 is picking up the latest version of Android, marking its last software update.

Best Buy deal slashes $700 off the price of this 65-inch LG QNED smart TV

By Patrick Farmer published

Deal Best Buy has quietly slashed $700 off the price of the 65-inch LG Class 83 Series smart TV, but how long will it last?

LG Innotek is giving telephoto zoom cameras a big upgrade on next-gen phones

By Nickolas Diaz published

LG Innotek's 2023 CES reveal is all about its new optical telephoto zoom module for the next generation of smartphones.

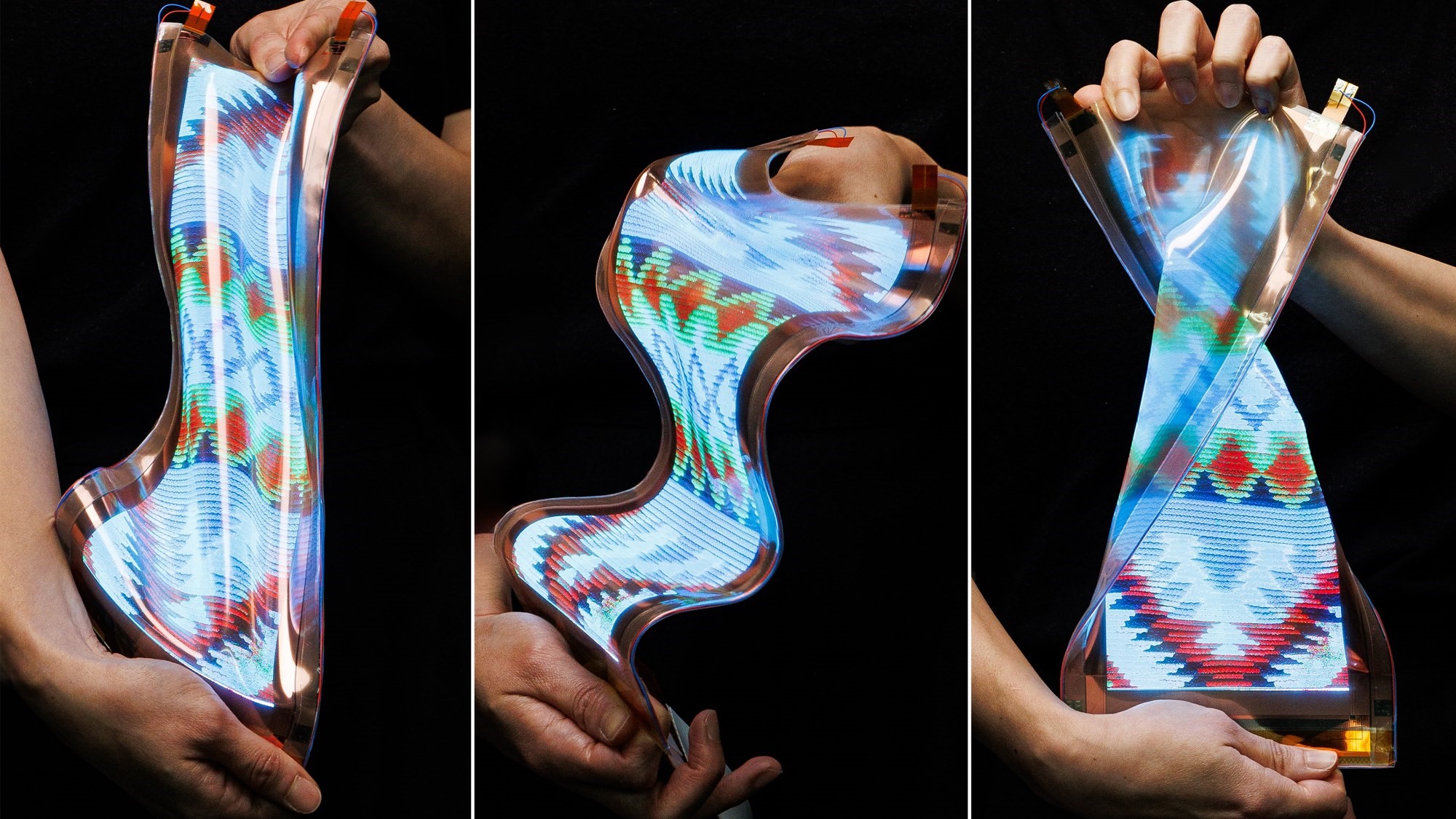

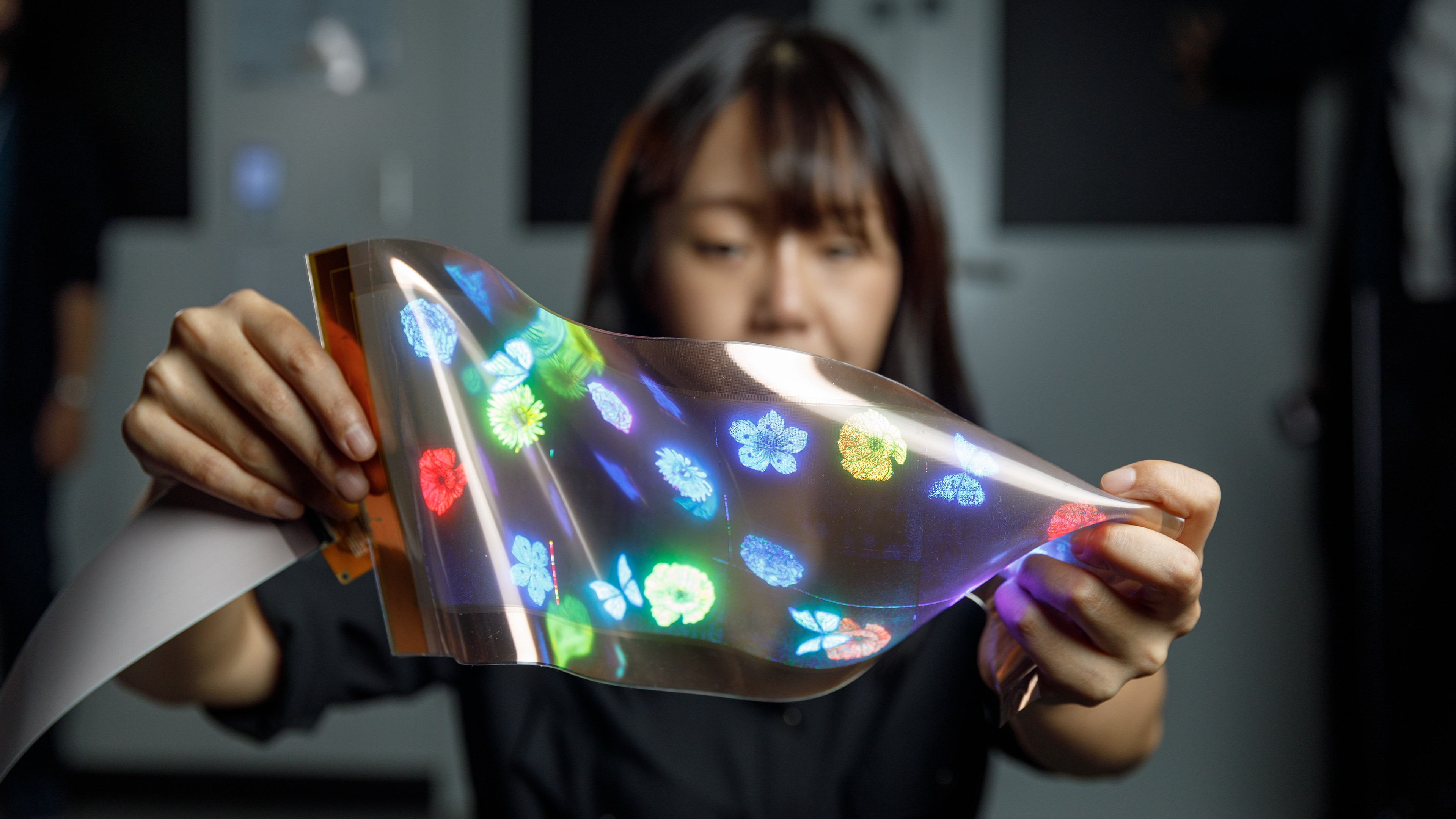

LG Display's stretchable high-resolution display is like something out of sci-fi

By Nickolas Diaz published

LG Display revealed the details surrounding its stretchable 12-inch display. With enough durability to withstand constant form changes, the stretchable screen can go from 12-inches to 14-inches.

LG gave up on Android phones but still has tablet ambitions with the new Ultra Tab

By Derrek Lee published

LG launched a new Android tablet with a 10-inch display and Wacom stylus pen support.

Top 8 things Android Central staff bought themselves on Prime Day 2022

By Derrek Lee last updated

Prime Day is coming to a close. Find out what items the Android Central staff purchased — they may surprise you.

Get the latest news from Android Central, your trusted companion in the world of Android