Android Pay still hasn't replaced my wallet

Get the latest news from Android Central, your trusted companion in the world of Android

You are now subscribed

Your newsletter sign-up was successful

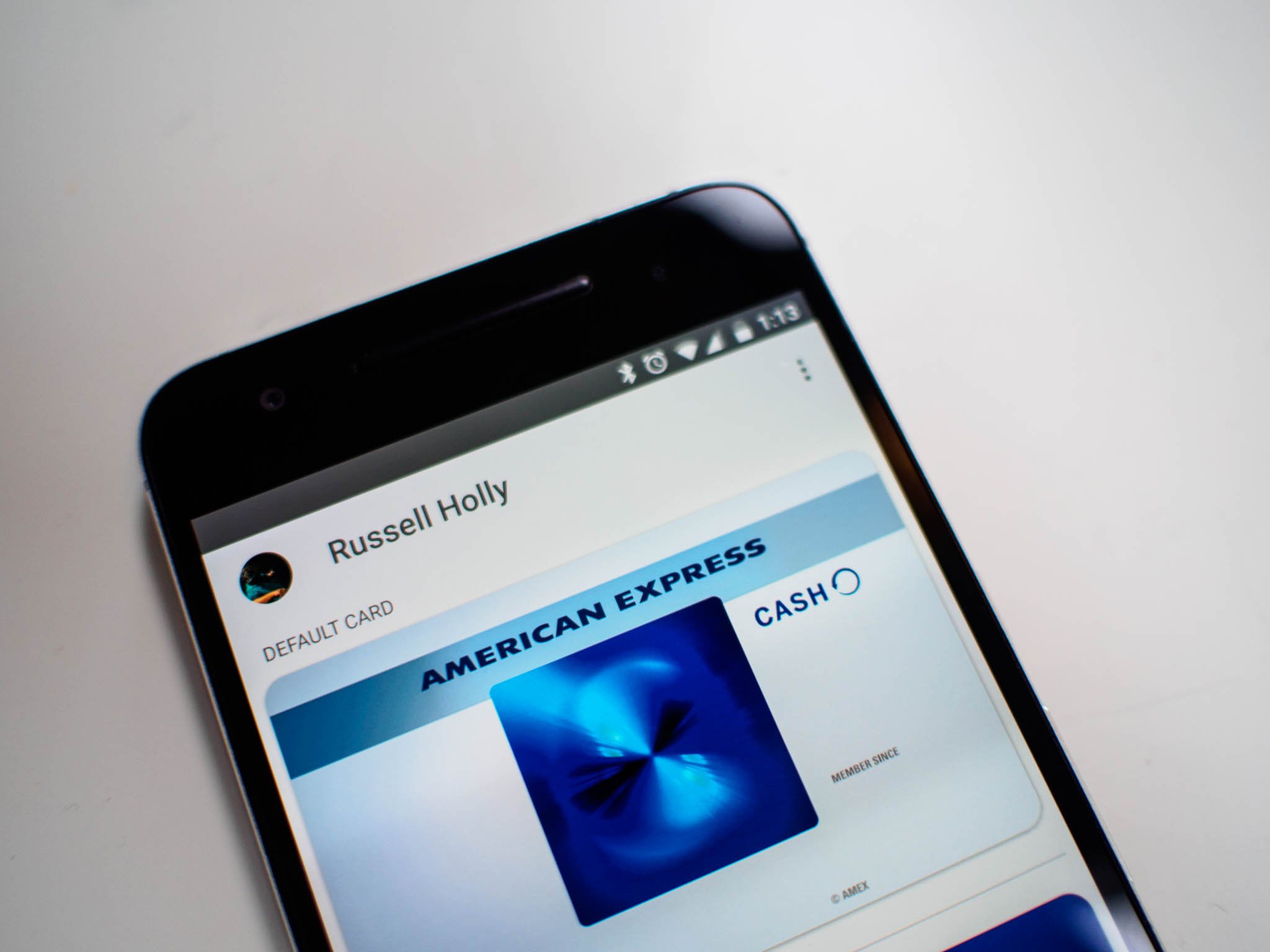

I've been on board with mobile payments for a long time now. I stared in excitement as Google handed folks Nexus S phones loaded with Google Wallet and showed them how easy it would be to pay for things in the not-so-distant future. A few weeks later a cab driver chased me down the street for what he thought was me trying to rip him off, and that still wasn't enough to deter me from the hope that everyone would one day get on this train. With Apple tossing their hat in the ring and Google re-branding and resurrecting Wallet as Android Pay, that excitement climbed all the way back to the top.

And then the kid behind the counter at Best Buy told me I had to use chip-and-signature for the card I was using, and that Android Pay wouldn't work for that particular card at that particular terminal. I almost wished I was back in that cab with the guy who thought I was a hacker.

Here's the thing: no one is doing enough to spread mobile payments in the U.S. right now. Apple's initial push was massive, but not enough. Google's initial response was cool, but somehow after years of experience doing this was less than Apple's efforts. Samsung is getting folks excited by leveraging current technology and making the whole idea more accessible, but there's no growth path from where they are right now. That magnetic-strip emulation system isn't going to start working at new places — in fact, as chip-and-PIN/signature becomes the norm it will be less useful — and when it comes to NFC-based transactions Samsung is even further behind Apple. We had a nice surge in attention for this system last year, but it was too little, and way too late.

The change from magnetic swipe to chip and signature here in the U.S. is causing both growth and failure at the same time. Lots of companies are starting the slow overhaul of their POS systems to include chip readers, and many of those chip reader terminals also support NFC transactions. It's still not a complete thought at every establishment, as I discovered at Best Buy when I had to use the chip in the card no matter what, and neither the cashier nor the card company is educating users on this. The phone fails, the card works, and everyone just sort of shrugs their shoulders and moves on. If the phone isn't reliable, it doesn't get used, and that's all that matters from the user's perspective.

To Google's credit, there are a lot of things Android Pay does incredibly well. I love that I never have to carry a membership card ever again. My loyalty cards pop up as soon as I get near one of these establishments, and all I need to do is hold the phone up to be scanned. When the payment system works with the loyalty system, it's an incredibly smooth setup. The way the app has everything ready when you're using a phone with a fingerprint scanner, no need to load anything up or punch in a code, is fantastic.

All we need now is for the rest of the system to work as smoothly, and unfortunately I think it's going to be a while before that happens in as many places as it probably should.

Get the latest news from Android Central, your trusted companion in the world of Android