6 reasons you should switch to this tech-forward renters insurance solution

Insurance is a fact of life. And while giving away your hard-earned money to something intangible that you may not even get to take advantage of is hard, the process of buying insurance is an even more arduous task. You have to deal with commission-hungry brokers and stacks of documents inundated with legalese. And when it comes to actually making a claim? Forget it. Expect layers upon layers of red tape.

Not with Lemonade, though. A tech-forward insurance company with a refreshingly different way of doing things, Lemonade aims to provide home and renters insurance to anyone who needs it, without the emotional and financial hassle that traditional insurers impose. It leverages state-of-the-art technology to deliver impeccable service, making insurance less of a headache; plus, policies start at just $5 for renters insurance and $25 for homeowners. Here are six (more) reasons you should switch to Lemonade:

1. It delivers AI-generated personalized policies.

With Lemonade, you don't have to wait on the phone to engage with an agent or wonder when the seemingly endless paperwork will finally go through. Simply answer a few questions from their charming AI bot, Maya, and you can get tailor-made insurance that works for you in as little as 90 seconds. You also have the option to customize and adjust your coverage at your will, and you pay right then and there.

2. Lemonade disrupts the traditional insurance model.

Unlike traditional insurers, Lemonade takes a flat fee and all the rest goes towards paying your claims. So, there's never a conflict of interest between you, the policyholder, and your insurer. It's that simple.

3. You only need to pay a flat fee.

Given the coverage that Lemonade offers to customers (insurance to rented or owned properties, with the option to add extra for high-ticket items), it's astounding how affordable their rates are. Renters insurance starts from $5 a month, while homeowners insurance starts from $25 a month. Your final rate will still depend on how much coverage you need, but you won't find a better deal than Lemonade.

4. Lemonade pays claims instantly.

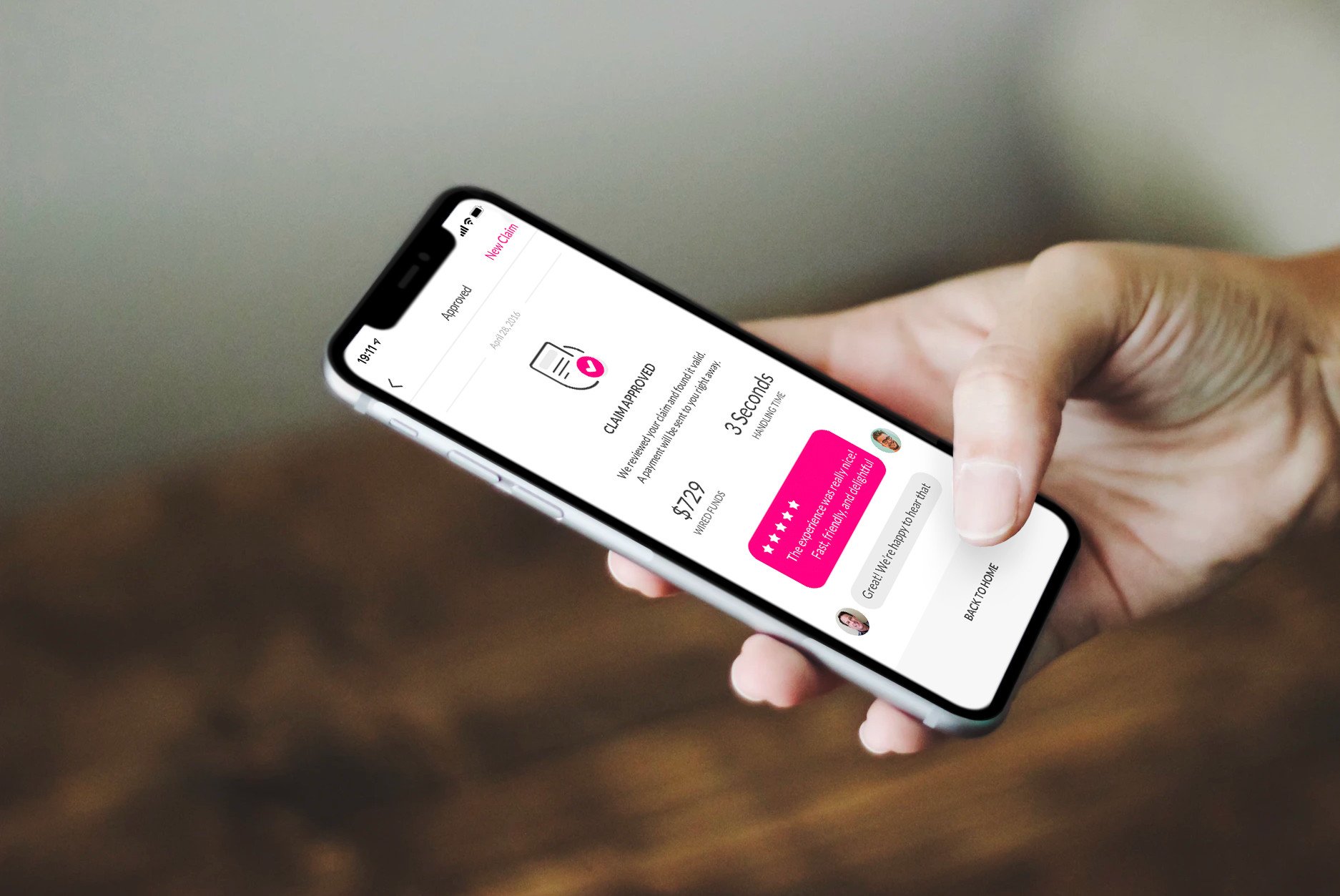

Lemonade does away with confusing forms. Should you need to file a claim, you would only have to answer a few questions from their AI bot, Jim. You'll be asked to speak to a camera and tell Jim what items were damaged or stolen. The system will then process the information and get back to you with a result. If instantly approved, you will get your payout in as few as three seconds. Compared to traditional insurance companies, Lemonade is a breeze to work with.

5. It gives you the opportunity to give back to causes you care about.

At its core, Lemonade is all about making a change, and that includes taking care of what truly matters. At the end of every year, if there is leftover, unclaimed money, it will go directly to your charity of choice, allowing you to give back to causes you value the most.

6. It has fantastic reviews on the Google Play Store.

Android users who've made the switch to Lemonade give the service and its app high marks (see it in action here). Lemonade has an average rating of 4.7 stars from close to 6,000 reviews. Combine that with positive accolades from the App Store, Supermoney, Clearsurance, as well as others and you're left with what has to be one of the top rated insurance companies in the U.S.

Ready to give Lemonade a squeeze? Get a free quote.

Get the latest news from Android Central, your trusted companion in the world of Android