Guilt: how bad do you feel about your spending?

It's pretty easy to keep track of purchases based on when they occur and their price, but what if you categorized everything you bought by how guilty it made you feel? Guilt is an interesting new app that hopes to help you keep tabs on your regular purchases and not only how much they cost but also on a level of how guilty you feel after purchasing them. The hope is to give a new perspective on your finances to help keep things in order from month to month.

Read long with us after the break to see if Guilt could help keep your personal finances in order.

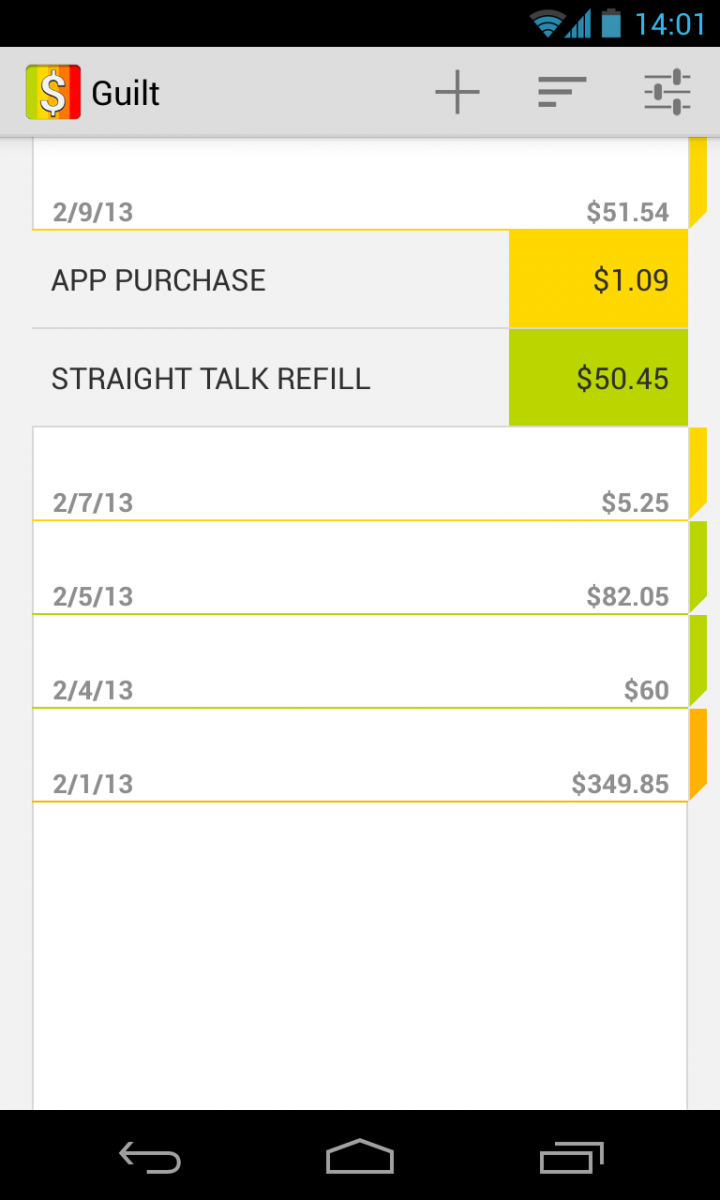

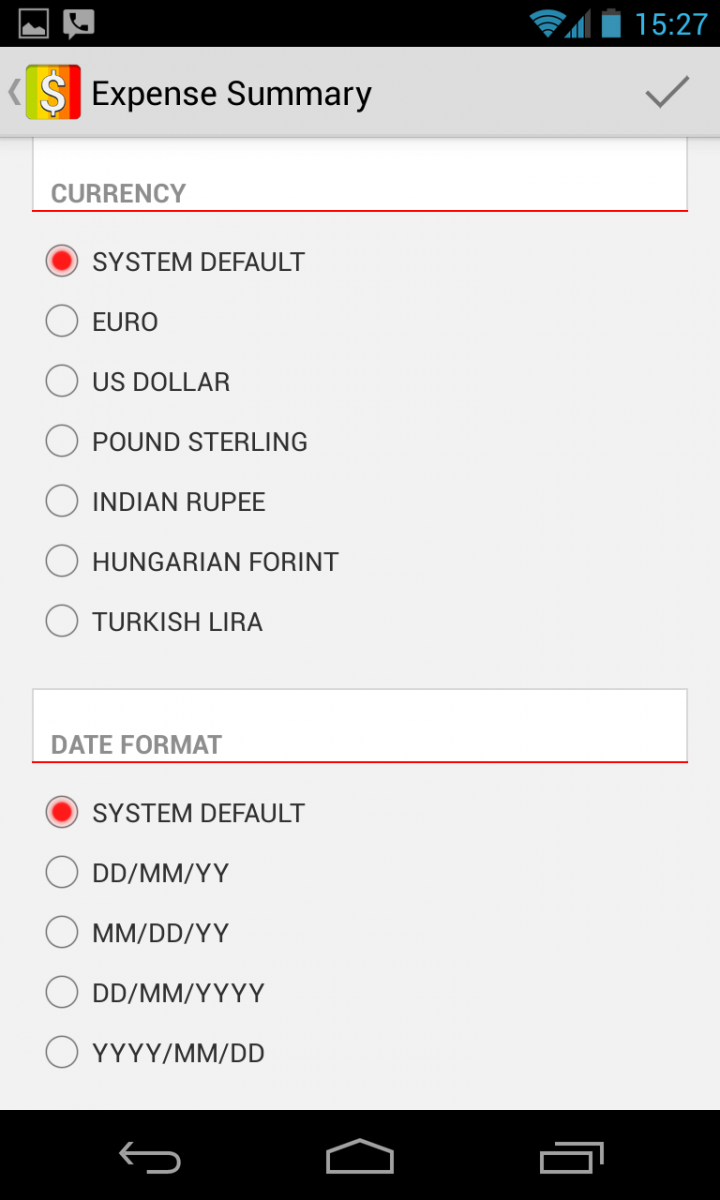

There isn't a whole lot of visual flare to Guilt, but I think that's a good thing. Upon opening the app, you're greeted with an easy to use and navigate holo interface, in a basic gray/white background with the green, yellow, orange and red colors mixing things up. The first screen of the app is a reverse chronological listing of previous day's spending, with the current day's purchases expanded to show each individual purchase. There are just three quick options at the top of the screen.

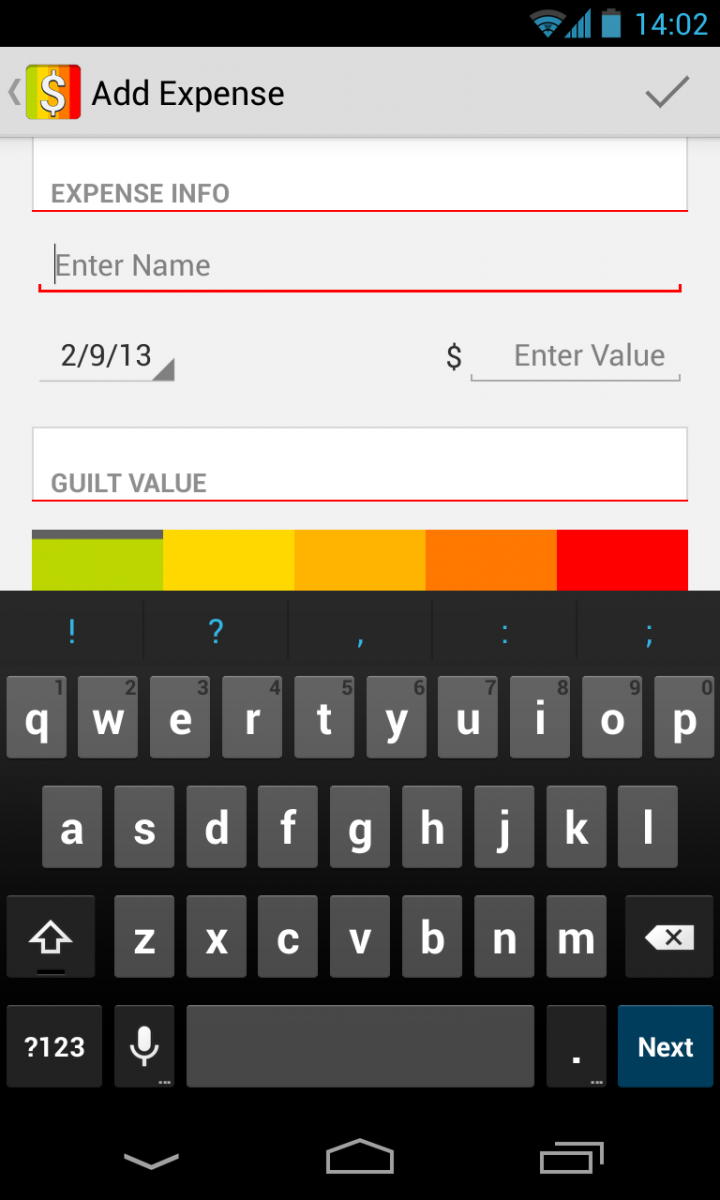

Those options are used to add a new purchase, view a day/month/year summary and change the settings. Adding a new purchase couldn't be easier -- simply tap the "plus" button at the top of the screen, enter the name, date and price and select the "Guilt Value" of the item. This is where the app gets its name. For every purchase you make, you put a self-assessed Guilt Value on the item -- no guilt, low, medium, high and "guilty as hell" -- to say how critical of the purchase you should feel. For example you may not feel bad about paying your monthly power bill, but maybe buying a $350 Nexus 4 in the middle of the month was an uncharacteristic splurge purchase.

It takes some self-control to get into the mood of critically assessing what things you purchase and how necessary they are, but so does every personal finance app. You'll get the most benefit out of Guilt by spending a few weeks (or a few months) honestly assessing your purchases and going back to review it later.

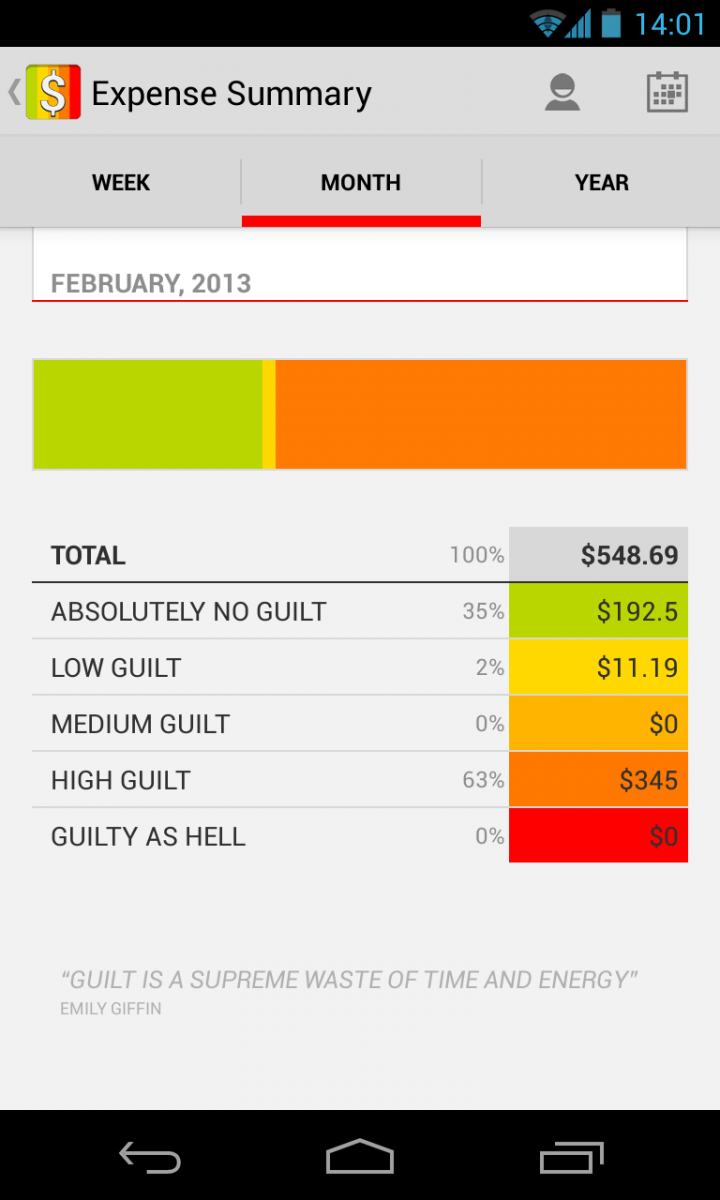

Speaking of reviewing weeks and months of your purchases, Guilt does a pretty good job at breaking down the data to more manageable listings. The full version of Guilt -- which is just $1.99 -- gives weekly, monthly and yearly breakdowns of purchases. You get a tabbed interface to select between the three, and the chart and table below repopulate with the proper data. You get a horizontal bar chart (which reminded me of a hard drive storage graph) to visually express the proportion of spending each guilt level occupies, and a table that breaks it down more granularly by spending amount. The table shows a grand total, and a total for each guilt level with the percentage of spending that landed in that level.

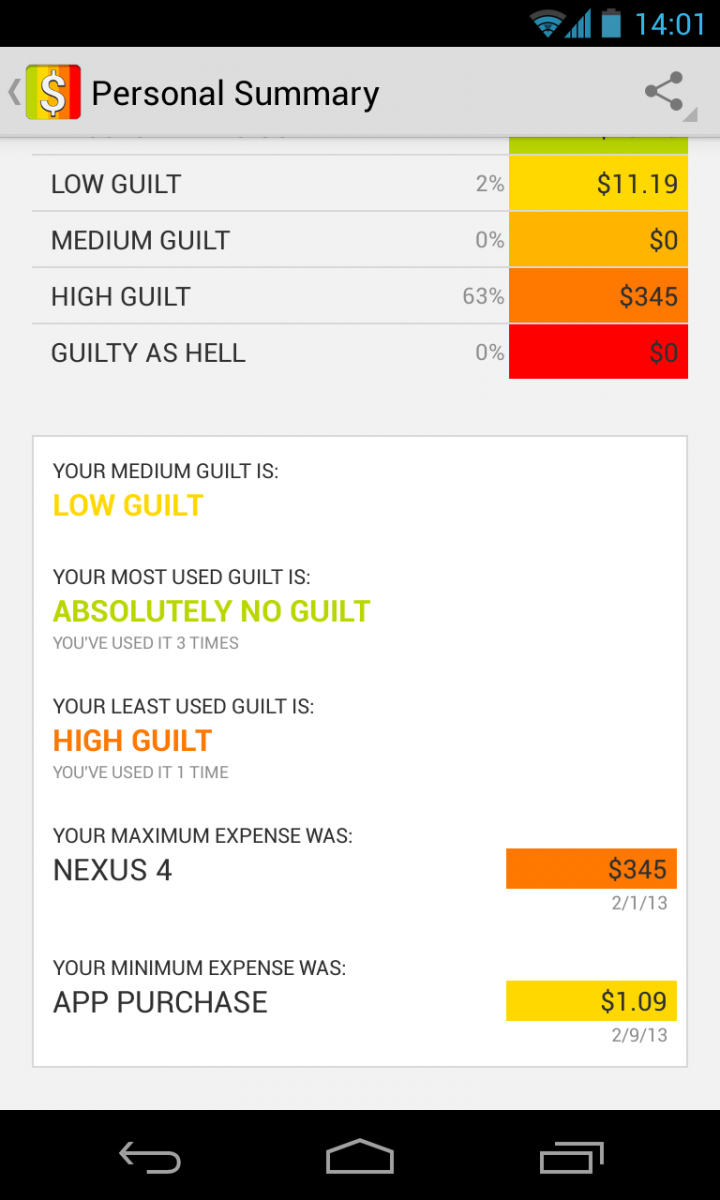

If you tap on the "person" icon (which is seemingly the stock Jelly Bean icon for People) you'll get a personal summary of what your overall statistics are, such as your highest and lowest expense for the period. From here, if you feel like bragging to your friends about how well you did this week or month you can share directly to any app in the sharing menu.

Get the latest news from Android Central, your trusted companion in the world of Android

If you'd prefer just to keep things in sync between your devices, the paid version of Guilt also offers Dropbox sync between them. It's a nice feature if you have a phone and tablet -- Guilt fully supports 7-inch tablets -- you'd like to keep in sync with purchases, and it also means that you know exactly where this potentially sensitive data is going.

Guilt will definitely fill a need for people that just want a basic way to track purchases and give another perspective on where the money is headed every month. For the power user, there are better options out there that will pull in data directly from your bank accounts (such as Mint) and give you granular monthly financial statements. As far as a simple smartphone app for personal finance goes, Guilt does just what the vast majority of people will want it to do.

If this sounds like something you could benefit from, go ahead and give Guilt a try. It's free in the Play Store with slightly limited functionality, but there's a great full-featured and ad-free version as well for just $1.99. That's a small price to pay for some simple financial insight.

Andrew was an Executive Editor, U.S. at Android Central between 2012 and 2020.